Lexmark 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

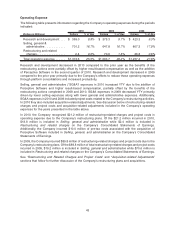

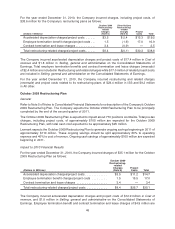

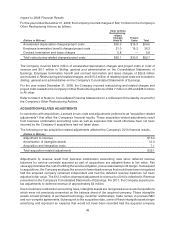

remained independent. During 2010, the Company incurred $9.1 million and $2.9 million in Cost of

revenue and Selling, general and administrative, respectively, on the Company’s Consolidated Statements

of Earnings for amortization of intangible assets. For 2011, the Company expects pre-tax charges for the

amortization of intangible assets to be approximately $20 million.

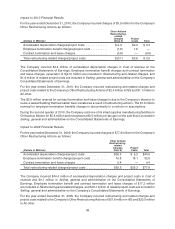

In connection with its acquisitions, the Company incurs acquisition and integration expenses that would not

have been incurred otherwise. The acquisition costs include items such as investment banking fees, legal

and accounting fees, and costs of retention bonus programs for the senior management of the acquired

company. Integration costs may consist of information technology expenses, consulting costs and travel

expenses. The costs are expensed as incurred. During 2010, the Company incurred $7.1 million in Selling,

general and administrative on the Company’s Consolidated Statements of Earnings for acquisition and

integration costs. For 2011, the Company expects charges for acquisition and integration expenses of

approximately $3 million.

Acquisition-related adjustments were recognized in the Perceptive Software reportable segment with the

exception of acquisition and integration costs of $7.1 million recognized in All other.

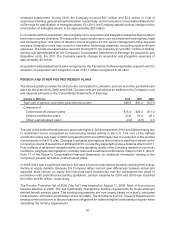

PENSION AND OTHER POSTRETIREMENT PLANS

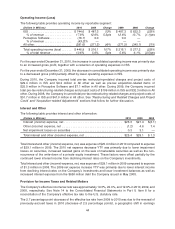

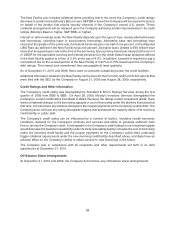

The following table provides the total pre-tax cost related to Lexmark’s pension and other postretirement

plans for the years 2010, 2009, and 2008. Cost amounts are included as an addition to the Company’s cost

and expense amounts in the Consolidated Statements of Earnings.

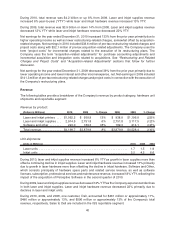

(Dollars in Millions) 2010 2009 2008

Total cost of pension and other postretirement plans . . . . . . . . . . . . . . . . . $38.8 $41.2 $37.0

Comprised of:

Defined benefit pension plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $15.4 $20.3 $11.4

Defined contribution plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.6 21.4 25.1

Other postretirement plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2) (0.5) 0.5

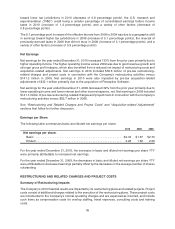

The cost of the defined benefit pension plans was higher in 2009 compared to 2010 and 2008 primarily due

to curtailment losses recognized on restructuring related activity in the U.S. The cost of the defined

contribution plans was lower in 2009 compared to 2010 and 2008 mainly due to a reduction in the number

of participants in the U.S. plan. Changes in actuarial assumptions did not have a significant impact on the

Company’s results of operations in 2009 and 2010, nor are they expected to have a material effect in 2011.

Future effects of retirement-related benefits on the operating results of the Company depend on economic

conditions, employee demographics, mortality rates and investment performance. Refer to Part II, Item 8,

Note 17 of the Notes to Consolidated Financial Statements for additional information relating to the

Company’s pension and other postretirement plans.

In 2008, there was a significant decline in the value of pension plan assets primarily resulting from a large

decline in equity markets. Because the Company defers current year differences between actual and

expected asset returns on equity and high-yield bond investments over the subsequent five years in

accordance with prescribed accounting guidelines, pension expense for 2010 and 2009 was impacted

$4 million and $5 million, respectively.

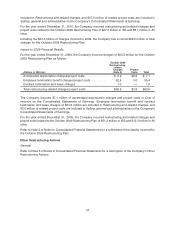

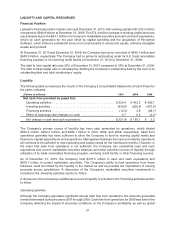

The Pension Protection Act of 2006 (“the Act”) was enacted on August 17, 2006. Most of its provisions

became effective in 2008. The Act significantly changed the funding requirements for single-employer

defined benefit pension plans. The funding requirements are now largely based on a plan’s calculated

funded status, with faster amortization of any shortfalls. The Act directs the U.S. Treasury Department to

develop a new yield curve to discount pension obligations for determining the funded status of a plan when

calculating the funding requirements.

50