Lexmark 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report

Lexmark International, Inc.

Table of contents

-

Page 1

2010 Annual Report Lexmark International, Inc. -

Page 2

-

Page 3

... The formation of ISS and the acquisition of Perceptive Software support Lexmark's strategy of helping businesses of all sizes by offering them products, solutions and services that enable them to save time and money. We continued the successful execution of our strategy Our strong 2010 results were... -

Page 4

... good growth in both our color laser and laser MFP units. Our managed print service business grew rapidly as we continued to help our enterprise customers optimize their output environment and improve their paper-based workï¬,ows. In 2010 Lexmark once again gained market share in our target segment... -

Page 5

... were no shares outstanding of the registrant's Class B Common Stock, par value $0.01. Documents Incorporated by Reference Certain information in the Company's definitive Proxy Statement for the 2011 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission... -

Page 6

... DISCLOSURE ...Item 9A. CONTROLS AND PROCEDURES ...Item 9B. OTHER INFORMATION ...Item 10. Item 11. Item 12. Item 13. Item 14. Item 15. PART III DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE . EXECUTIVE COMPENSATION...SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED... -

Page 7

... and document-process automation software solutions markets. In the fourth quarter of 2010, Lexmark combined its laser and inkjet printing divisions into a single organization in order to enable the Company to more easily execute its strategy of targeting and capturing higher usage business segments... -

Page 8

... printer-based product and solution vendors like Lexmark to displace copier-based products in the marketplace. The Company's management believes that the integration of print/copy/fax/scan capabilities enables Lexmark to leverage strengths in network printing and related document workflow solutions... -

Page 9

...office home office ("SOHO") and other businesses. Customers are increasingly seeking productivity-related features that are found in inkjet multifunction products designed for office use such as wireless and ethernet connectivity, automatic document feeders and duplex capabilities, as well as access... -

Page 10

... engine of the business model. Supplies profit helps fund new technology investments in products, solutions, services and software. As Lexmark continues to increase its mix of managed print services and content and document management solutions, management anticipates that the Company's annuity mix... -

Page 11

...- ISS • Products - ISS ISS offers a broad portfolio of monochrome and color laser printers, laser MFPs and inkjet AIOs along with innovative software solutions and managed services to help businesses efficiently manage and share information. ISS' laser and inkjet products are core building blocks... -

Page 12

...to build robustly designed and feature-rich inkjet AIOs to meet the demands of SOHO and business users. Lexmark's Professional and Home Office series of Inkjet AIO products include highly desirable office features such as automatic two-sided printing and excellent document and photo print quality at... -

Page 13

...printer models for customers who print multi-part forms. Supplies ISS designs, manufactures and distributes a variety of cartridges and other supplies for use in its installed base of laser, inkjet and dot matrix printers. ISS' revenue and profit growth from its supplies business is directly linked... -

Page 14

...of ISS' laser supplies products sold commercially in 2010 were sold through the ISS network of Lexmark-authorized supplies distributors and resellers, who sell directly to end-users or to independent office supply dealers with inkjet supplies primarily distributed through large discount store chains... -

Page 15

... in inconsistent quality and reliability. As the installed base of laser and inkjet products matures, the Company expects competitive supplies activity to increase. • Manufacturing and Materials - ISS ISS operates manufacturing control centers in Lexington, Kentucky; Shenzhen, China; and Geneva... -

Page 16

... documents and information, protect data integrity throughout its lifecycle and access precise content in the context of the users' everyday business processes. These components are developed and maintained by Perceptive Software. In 2010, Perceptive Software released Retention Policy Manager... -

Page 17

...secure data center. The SaaS option enables customers to maintain focus on their business and customers, not ECM software support and infrastructure. Finally, customers may also subscribe to Perceptive Software product and solution licenses on a recurring basis (quarterly or annually) with customers... -

Page 18

...; Shawnee, Kansas; Cebu City, Philippines; and Kolkata, India. Lexmark's engineering efforts focus on technologies associated with laser, inkjet, connectivity, document management, ECM software, and other customer facing solutions. Lexmark also develops related applications and tools to enable it to... -

Page 19

... Chief Executive Officer of Perceptive Software Vice President of Asia Pacific and Latin America Vice President of Human Resources Vice President, General Counsel and Secretary Vice President, ISS and Corporate Finance 20 20 6 12 1 7 20 10 20 Dr. Curlander has been a Director of the Company since... -

Page 20

... and cross-licensing agreements with a number of third parties. Certain of Lexmark's material license agreements, including those that permit the Company to manufacture some of its current products, terminate as to specific products upon certain "changes of control" of the Company. The Company has... -

Page 21

...committed to maintaining compliance with all environmental laws applicable to its operations, products and services. Lexmark is also required to have permits from a number of governmental agencies in order to conduct various aspects of its business. Compliance with these laws and regulations has not... -

Page 22

... to medium-sized business, as well as develop and manufacture additional products, designed for the geographic and customer and product segments of the inkjet market that support higher usage of supplies. The Company's failure to manage inventory levels or production capacity may negatively impact... -

Page 23

... purchases of existing products in anticipation of new product introductions by the Company or its competitors and market acceptance of new products and pricing programs, any disruption in the supply of new or existing products as well as the costs of any product recall or increased warranty, repair... -

Page 24

...of facilities, operations functions and manufacturing capacity, and the centralization of support functions to regional and global shared service centers. In particular, the Company's manufacturing and support functions are becoming more heavily concentrated in China and the Philippines. The Company... -

Page 25

... finance functions and order-to-cash functions from various countries to shared service centers. The Company is also continuing the process of reducing, consolidating and moving various parts of its general and administrative resource, supply chain resource and marketing and sales support structure... -

Page 26

... of additional competitors that are focused on printing solutions could further intensify competition in the inkjet and laser printer markets and could have a material adverse impact on the Company's strategy and financial results. • The Company acquired Perceptive Software in 2010 to strengthen... -

Page 27

... be intense. To help attract, retain, and motivate qualified employees, the Company must offer a competitive compensation package, including cash, cash-based incentive awards and share-based incentive awards, such as restricted stock units. Because the cash-based and share-based incentive awards are... -

Page 28

...Lexmark's corporate headquarters and principal development facilities are located on a 374 acre campus in Lexington, Kentucky. At December 31, 2010, the Company owned or leased 6.3 million square feet of administrative, sales, service, research and development, warehouse and manufacturing facilities... -

Page 29

... agreements, business conditions, tax laws, certain corporate law requirements and various other factors. Issuer Purchases of Equity Securities Total Number of Shares Purchased - - - - Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs - - - - Approximate Dollar Value... -

Page 30

... total stockholder return on the Company's Class A Common Stock with a broad performance indicator, the S&P Composite 500 Stock Index, and an industry index, the S&P 500 Information Technology Index, for the period from December 30, 2005, to December 31, 2010. The graph assumes that the value... -

Page 31

...Based Plan limits the number of shares subject to full-value awards (e.g., restricted stock units and performance awards) to 50,000 shares. On February 24, 2011, the Company's Board of Directors terminated the Broad-Based Plan and cancelled the remaining available shares that had been authorized for... -

Page 32

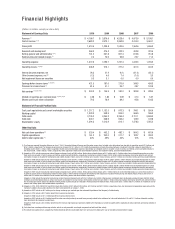

... information refer to the Company's Consolidated Financial Statements and Notes thereto presented under Part II, Item 8 of this Form 10-K. (Dollars in Millions, Except per Share Data) Statement of Earnings Data: Revenue (1) ...Cost of revenue (1)(2) ...Gross profit ...Research and development... -

Page 33

... the office imaging and ECM markets. Lexmark's products include laser printers, inkjet printers, multifunction devices, dot matrix printers and associated supplies, solutions and services and ECM software solutions and services. The Company is primarily managed along two segments: ISS and Perceptive... -

Page 34

...laser line, laser MFPs and business inkjets. To allow Lexmark to participate in the growing market to manage unstructured data and processes, and to build upon and strengthen the current industry-focused document workflow solutions and managed print services, the Company acquired Perceptive Software... -

Page 35

... products designed for office use such as wireless and ethernet connectivity, automatic document feeders and duplex capabilities, as well as access to web-based applications to automate print and document related work functions. This trend represents an opportunity for the Company to pursue revenue... -

Page 36

... the Company's cartridges are available and compete with the Company's supplies business. As the installed base of laser and inkjet products matures, the Company expects competitive supplies activity to increase. • Historically, the Company has not experienced significant supplies pricing pressure... -

Page 37

... printing; inkjet, monochrome laser and color laser. • Lexmark, through the addition of Perceptive Software, provides ECM software and workflow management products and industry tailored solutions to help companies manage business processes and unstructured information including documents... -

Page 38

... the Company's policy for revenue recognition. For customer programs and incentives, Lexmark records estimated reductions to revenue at the time of sale for customer programs and incentive offerings including special pricing agreements, promotions and other volume-based incentives. Estimated... -

Page 39

... company-specific intentions. Warranty Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The amounts accrued for product warranties are based on the quantity of units sold under warranty, estimated product failure rates, and material usage and service... -

Page 40

... is no longer applicable to the U.S. pension plan due to the benefit accrual freeze in connection with the Company's 2006 restructuring actions. In addition, some of the non-U.S. pension plans are also frozen. Plan assets are invested in equity securities, government and agency securities, mortgage... -

Page 41

... several areas including marketable securities, pension plan assets and derivatives. The Company uses fair value in measuring certain nonrecurring items as well, as instructed under existing authoritative accounting guidance. The Company utilizes observable market data, when available, to determine... -

Page 42

...a 250 basis point liquidity premium added to the applicable discount rate. Valuation of these securities can be very subjective and estimates and assumptions could be revised in the future depending on market conditions and changes in the economy. Fair values of certain corporate debt securities and... -

Page 43

...million allocated to the Company's ISS reporting units. The fair values of these reporting units were substantially in excess of their carrying values on this date. Key assumptions to the valuation of Perceptive Software include its ability to expand internationally and the revenue growth that would... -

Page 44

... in technology, hardware and software products and solutions to secure: (a) high value hardware installations and capture profitable supplies, software maintenance and service annuities in document-intensive industries and business processes in distributed office environments; and (b) high value ECM... -

Page 45

... lasers, laser MFPs, and business inkjets. To allow Lexmark to participate in the growing market to manage unstructured data and processes, and to build upon and strengthen the current industry-focused document workflow solutions and managed print services, the Company acquired Perceptive Software... -

Page 46

... of the Company's revenue by product category, hardware unit shipments and reportable segment: Revenue by product: (Dollars in Millions) 2010 2009 % Change 2009 2008 % Change Laser and inkjet printers ...Laser and inkjet supplies ...Software and other ...Total revenue ... $1,062.2 2,914... -

Page 47

... and away from low-end devices. The supplies revenue grew 6% year on year, primarily driven by a strong unit growth in laser supplies, somewhat offset by a decline in inkjet supplies as a result of the decrease in the installed base of inkjet hardware devices. During 2009, ISS revenue declined $648... -

Page 48

... geography: The following table provides a breakdown of the Company's revenue by geography: (Dollars in Millions) United States ...EMEA (Europe, the Middle East & Africa) ...Other International ...Total revenue ...2010 $1,790.9 1,510.2 898.6 $4,199.7 % of Total 43% 36% 21% 100% 2009 $1,672.1 1,453... -

Page 49

...-based compensation as well as the addition of Perceptive Software in the second quarter of 2010. Research and development decreased in 2009 compared to the prior year primarily due to the Company's efforts to reduce these operating expenses through platform consolidations and increased productivity... -

Page 50

... on securities, increased realized gains on the sale of marketable securities as well as the nonrecurrence of the write-down of a private equity investment. These factors were offset partially by the continued lower interest income from declining interest rates on the Company's investments. Total... -

Page 51

... charges and project costs in connection with the Company's restructuring activities versus $141.3 million in 2009. Net earnings in 2010 were also impacted by pre-tax acquisition-related adjustments of $32.1 million primarily due to the acquisition of Perceptive Software. Net earnings for the year... -

Page 52

... 31, 2010, the Company incurred charges of $35.1 million for the October 2009 Restructuring Plan as follows: October 2009 Restructuringrelated Charges (Note 5) (Dollars in Millions) Project Costs Total Accelerated depreciation charges/project costs ...Employee termination benefit charges/project... -

Page 53

... 31, 2009, the Company incurred charges of $63.5 million for the October 2009 Restructuring Plan as follows: October 2009 Restructuringrelated Charges (Note 5) (Dollars in Millions) Project Costs Total Accelerated depreciation charges/project costs ...Employee termination benefit charges/project... -

Page 54

... building that had earlier been vacated as a result of restructuring actions. The $1.6 million reversal for employee termination benefits charges is due primarily to a revision in assumptions. During the second quarter of 2010, the Company sold one of its inkjet supplies manufacturing facilities... -

Page 55

... business combination accounting rules when deferred revenue balances for service contracts assumed as part of acquisitions are adjusted down to fair value. Fair value approximates the cost of fulfilling the service obligation, plus a reasonable profit margin. Subsequent to acquisitions, the Company... -

Page 56

... requirements for single-employer defined benefit pension plans. The funding requirements are now largely based on a plan's calculated funded status, with faster amortization of any shortfalls. The Act directs the U.S. Treasury Department to develop a new yield curve to discount pension obligations... -

Page 57

... and total stockholders' equity. Liquidity The following table summarizes the results of the Company's Consolidated Statements of Cash Flows for the years indicated: (Dollars in millions) 2010 2009 2008 Net cash flow provided by (used for): Operating activities ...Investing activities ...Financing... -

Page 58

... negatively impacted the Company at that time. See discussion of prior year cash flows from operating activities for additional information. Trade receivables balances increased $28.5 million in 2010 (excluding receivables recognized on the date of acquisition of Perceptive Software) and decreased... -

Page 59

... the number of days that elapse between the day the Company pays for materials and the day it collects cash from its customers. Cash conversion days are equal to the days of sales outstanding plus days of inventory less days of payables. The days of sales outstanding are calculated using the... -

Page 60

... increase in capital spending. The Company's business acquisitions, marketable securities and capital expenditures are discussed below. Business acquisitions The YTY increase in cash flows used to acquire businesses was driven by the acquisition of Perceptive Software in the second quarter of 2010... -

Page 61

...observable market data is lacking, fair values are determined using valuations techniques consistent with the income approach whereby future cash flows are converted to a single discounted amount. The Company uses multiple third parties to report the fair values of the securities in which Lexmark is... -

Page 62

... of remaining share repurchase authority from the Board of Directors. This repurchase authority allows the Company, at management's discretion, to selectively repurchase its stock from time to time in the open market or in privately negotiated transactions depending upon market price and other... -

Page 63

... the term of the facility to September 30, 2011 and increasing the maximum capital availability under the trade receivables facility from $100 million to $125 million. A new financial institution was also added to the agreement in October 2010. There were no secured borrowings outstanding under the... -

Page 64

... downgrade triggers that accelerate the maturity dates of its revolving credit facility or public debt. The Company's credit rating can be influenced by a number of factors, including overall economic conditions, demand for the Company's products and services and ability to generate sufficient cash... -

Page 65

...and long-term amounts reported separately in the Less than 1 Year and 1-3 Years columns, respectively. These payments will relate mainly to employee termination benefits and contract termination and lease charges. The Company's funding policy for its pension and other postretirement plans is to fund... -

Page 66

... Capital expenditures totaled $161.2 million, $242.0 million, and $217.7 million in 2010, 2009 and 2008, respectively. The capital expenditures for 2010 principally related to infrastructure support (including internal-use software expenditures), new product development and capacity expansion. The... -

Page 67

...foreign currency exchange rates. Interest Rates At December 31, 2010, the fair value of the Company's senior notes was estimated at $693.8 million based on the prices the bonds have recently traded in the market as well as the overall market conditions on the date of valuation. The fair value of the... -

Page 68

... AND SUPPLEMENTARY DATA Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS For the years ended December 31, 2010, 2009 and 2008 (In Millions, Except Per Share Amounts) 2010 2009 2008 Revenue ...Cost of revenue ...Gross profit ...Research and development ...Selling... -

Page 69

...debt ...Other liabilities ...Total liabilities ...Commitments and contingencies Stockholders' equity: Preferred stock, $.01 par value, 1.6 shares authorized; no shares issued and outstanding ...Common stock, $.01 par value: Class A, 900.0 shares authorized; 78.6 and 78.1 outstanding in 2010 and 2009... -

Page 70

... ...Increase in short-term debt ...Decrease in short-term debt ...Repayment of assumed long-term debt ...Issuance of treasury stock ...Purchase of treasury stock ...Proceeds from employee stock plans ...Other ...Net cash flows (used for) provided by financing activities . . Effect of exchange rate... -

Page 71

...marketable securities ...Other comprehensive earnings (loss) ...Comprehensive earnings, net of taxes ...Shares issued under deferred stock plan compensation ...Shares issued upon exercise of options ...Shares issued under employee stock purchase plan ...Tax benefit (shortfall) related to stock plans... -

Page 72

...laser printers, inkjet printers, multifunction devices, dot matrix printers, and associated supplies, services and solutions as well as ECM and document process software, solutions and services. The customers for Lexmark's products are large enterprises, small and medium businesses and small offices... -

Page 73

... market data is lacking, the Company uses valuation techniques consistent with the income approach whereby future cash flows are converted to a single discounted amount. The Company uses multiple sources of pricing as well as trading and other market data in its process of reporting fair values... -

Page 74

...cost of inventory and the estimated market value. The Company estimates the difference between the cost of obsolete or unmarketable inventory and its market value based upon product demand requirements, product life cycle, product pricing and quality issues. Also, Lexmark records an adverse purchase... -

Page 75

... disposed of or otherwise retired. Internal-Use Software Costs: Lexmark capitalizes direct costs incurred during the application development and implementation stages for developing, purchasing, or otherwise acquiring software for internal use. These software costs are included in Property, plant... -

Page 76

... Perceptive Software. ISS offers a broad portfolio of monochrome and color laser printers, laser multifunction products and inkjet all-in-one devices as well as a wide range of supplies and services covering its printing products and technology solutions. Perceptive Software offers a complete suite... -

Page 77

..., the Company provides for the estimated cost of post-sales support, principally product warranty, and reduces revenue for estimated product returns. Lexmark records estimated reductions to revenue at the time of sale for customer programs and incentive offerings including special pricing agreements... -

Page 78

... Costs: Lexmark engages in the design and development of new products and enhancements to its existing products. The Company's research and development activity is focused on laser and inkjet devices and associated supplies, features and related technologies as well as software. The Company expenses... -

Page 79

... agreements, business conditions, tax laws, certain corporate law requirements and various other factors. The fair value of each restricted stock unit award and deferred stock unit award was calculated using the closing price of the Company's stock on the date of grant. Restructuring: Lexmark... -

Page 80

...stockholders' equity, net of tax. Lexmark's Accumulated other comprehensive (loss) earnings is composed of deferred gains and losses related to pension or other postretirement benefits, foreign currency exchange rate adjustments, and net unrealized gains and losses on marketable securities including... -

Page 81

... follow its policy for determining when transfers between levels are recognized. The new guidance also requires separate presentation of purchases, sales, issuances, and settlements rather than net presentation in the Level 3 reconciliation. ASU 2010-06 also requires that the fair values of... -

Page 82

... performed to date. The Company has developed a process that uses stand alone sales data or a cost plus methodology in order to determine best estimate of selling price for deliverables in which neither VSOE nor TPE is available. Lexmark also believes that the changes to software revenue guidance... -

Page 83

... issued ASU No. 2010-13, Compensation - Stock Compensation (Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades ("ASU 2010-13"). ASU 2010-13 clarifies that employee share-based awards with... -

Page 84

... with the Company's accounting policy regarding cash equivalents. The fair value of these instruments is readily determinable using the methods described below for marketable securities or, in the case of money market funds, based on the fair value per share (unit) determined and published as the... -

Page 85

... Active Observable Unobservable Markets Dec. 31, Inputs Inputs 2009 (Level 1) (Level 2) (Level 3) Assets measured at fair value on a recurring basis: Government & agency debt securities ...$271.9 Corporate debt securities ...301.2 Asset-backed and mortgage-backed securities ...100.1 Total available... -

Page 86

... in 2010 include sales of Lehman Brothers debt securities in the third quarter, which resulted in no additional losses. The Company's remaining investment in Lehman Brothers debt securities is valued at $0.5 million. For purposes of comparison, the following tables present additional information... -

Page 87

... a single discounted amount. The Company uses multiple third parties to report the fair values of its marketable securities, though the responsibility of valuation remains with the Company's management. Most of the securities' fair values are based upon a consensus price method, whereby prices from... -

Page 88

...a low number of pricing sources, or the Company is otherwise unable to gather supporting information to conclude that the price can be transacted upon in the market at the reporting date. During 2009, the Company valued a small number of asset-backed and mortgage-backed securities using a discounted... -

Page 89

... caused by volatility in currency exchange rates. Fair values for the Company's derivative financial instruments are based on pricing models or formulas using current market data. Variables used in the calculations include forward points and spot rates at the time of valuation. Because of the very... -

Page 90

...prices in the secondary market after considering the highest and best use of the asset from the perspective of market participants in the most advantageous market. 4. BUSINESS COMBINATIONS Acquisition of Perceptive Software, Inc. On June 7, 2010, the Company acquired all issued and outstanding stock... -

Page 91

... on a straightline basis over their estimated useful lives as follows. Fair Value Recognized Weighted-Average Useful Life Intangible assets subject to amortization: Customer relationships ...Non-compete agreements ...Purchased technology...Total ...Intangible assets not subject to amortization... -

Page 92

...20 for Perceptive Software segment data. Perceptive Software - Determinations of Fair Value The total amount recognized for the acquired identifiable net assets was driven by the fair values of intangible assets. Valuation techniques and key inputs and assumptions used to value the most significant... -

Page 93

...fair value the hypothetical royalty payments a market participant would be willing to pay to enjoy the benefits of the asset. A royalty rate of 2% was used in the valuation which took into account data regarding third party license agreements as well as certain characteristics of Perceptive Software... -

Page 94

...million in ISS and $11.7 million in All other. Liability Rollforward The following table represents a rollforward of the liability incurred for employee termination benefits and contract termination and lease charges in connection with the October 2009 Restructuring Plan. Of the total $25.3 million... -

Page 95

... the closure of inkjet supplies manufacturing facilities in Mexico as well as impacting positions in the Company's general and administrative functions, supply chain and sales support, marketing and sales management, and consolidation of the Company's research and development programs. The Other... -

Page 96

...6. STOCK-BASED COMPENSATION Lexmark has various stock incentive plans to encourage employees and nonemployee directors to remain with the Company and to more closely align their interests with those of the Company's stockholders. As of December 31, 2010, awards under the programs consisted of stock... -

Page 97

....18, $6.18 and $11.23, respectively. The fair value of each option award on the grant date was estimated using the Black-Scholes option-pricing model with the following assumptions: 2010 2009 2008 Expected dividend yield...Expected stock price volatility ...Weighted average risk-free interest rate... -

Page 98

...market value of the shares at the date of grant, is charged to compensation expense ratably over the vesting period of the award. During 2010 a certain number of senior managers of the Company...level of achievement was return on net assets minus cash and marketable securities. The performance period ... -

Page 99

... securities, corporate debt securities, preferred and municipal debt securities, government and agency debt securities, and auction rate securities. The fair values of the Company's available-for-sale marketable securities are based on quoted market prices or other observable market data, discount... -

Page 100

... of the Company's available-for-sale marketable securities were $215.0 million and $679.7 million, respectively. The Company uses the specific identification method when accounting for the costs of its available-for-sale marketable securities sold. For the year ended December 31, 2010, the Company... -

Page 101

...403.1 $(2.4) (0.6) (0.4) (0.2) $(3.6) Total ... The following table provides information, at December 31, 2010, about the Company's marketable securities with gross unrealized losses for which other-than-temporary impairment has been incurred, and the length of time that individual securities have... -

Page 102

... illiquid and that the security's interest rate will continue to be set at the maximum applicable rate, and that the security will not be redeemed until its mandatory redemption date. The methodology for determining the appropriate discount rate uses market-based yield indicators and the underlying... -

Page 103

... price. In October 2010, the agreement was amended by extending the term of the facility to September 30, 2011 and increasing the maximum capital availability under the trade receivables facility from $100 million to $125 million. As of December 31, 2010 and December 31, 2009, there were no secured... -

Page 104

..., $209.1 million, and $203.2 million in 2010, 2009 and 2008, respectively. Leased products refers to hardware leased by Lexmark to certain customers as part of the Company's ISS operations. The cost of the hardware is amortized over the life of the contracts, which have been classified as operating... -

Page 105

... value adjustments recorded in 2010 related to the site held for sale. Related to the 2008 restructuring plan, the Company received in the second quarter of 2010 final payment for the sale of its inkjet supplies manufacturing facility in Chihuahua, Mexico in accordance with the sale agreement signed... -

Page 106

... the changes in the carrying amount of goodwill for each reportable segment and in total during 2010. For the twelve months ended December 31, 2010 ISS Perceptive Software Total Beginning balance ...Goodwill acquired during the period ...Foreign currency translation ...Ending balance... $23... -

Page 107

...18.3 $121.1 Total ... In-process technology refers to research and development efforts that were in process on the date the Company acquired Perceptive Software. Under the accounting guidance for intangible assets, in-process research and development acquired in a business combination is considered... -

Page 108

... .. (83.3) $ 52.2 $ 50.9 84.1 4.4 (92.8) $ 46.6 Balance at December 31... Deferred service revenue: 2010 2009 Balance at January 1 ...$ 195.9 Revenue deferred for new extended warranty contracts...90.2 Revenue recognized ...(100.4) Balance at December 31 ...Current portion ...Non-current portion... -

Page 109

...Company exercised its option to increase the maximum amount available under the New Facility to $300 million. As of December 31, 2010 and 2009, there were no amounts outstanding under the facility. Lexmark's New Facility contains usual and customary default provisions, leverage and interest coverage... -

Page 110

... is required to pay a commitment fee on the unused portion of the New Facility of 0.40% to 0.75% based upon the Company's debt ratings. The interest and commitment fees are payable at least quarterly. Short-term Debt Lexmark's Brazilian operation has a short-term, uncommitted line of credit. The... -

Page 111

... taxes using the U.S. statutory rate and the Company's effective tax rate was as follows: 2010 Amount % Amount 2009 % Amount 2008 % Provision for income taxes at statutory rate ...State and local income taxes, net of federal tax benefit ...Foreign tax differential...Research and development credit... -

Page 112

......Inventories ...Restructuring ...Pension ...Warranty ...Postretirement benefits...Equity compensation ...Other compensation ...Foreign exchange ...... range from 7 to 10 years. The Company believes that, for any tax loss carryforward where a valuation allowance has not been provided, the associated ... -

Page 113

... years 2008 and after are subject to examination. The Internal Revenue Service ("IRS") is currently auditing tax years 2008 and 2009. In France, tax years 2008 and after are subject to examination. The French Tax Administration has informed the Company that they will begin an audit of tax years 2008... -

Page 114

...Class B Common Stock at December 31, 2010. These shares are available for a variety of general corporate purposes, including future public offerings to raise additional capital and for facilitating acquisitions. In 1998, the Company's Board of Directors adopted a stockholder rights plan (the "Rights... -

Page 115

... on the average of the daily volume weighted average price of the Company's common stock over the agreement's trading period, a discount, and the initial number of shares delivered. Under the terms of the ASR, the Company would either receive additional shares from the counterparty or be required... -

Page 116

... net EPS calculations for the years ended December 31: 2010 2009 2008 Numerator: Net earnings...Denominator: Weighted average shares used to compute basic EPS ...Effect of dilutive securities - employee stock plans ...Weighted average shares used to compute diluted EPS ...Basic net EPS ...Diluted... -

Page 117

... POSTRETIREMENT PLANS Lexmark and its subsidiaries have defined benefit and defined contribution pension plans that cover certain of its regular employees, and a supplemental plan that covers certain executives. Medical, dental and life insurance plans for retirees are provided by the Company and... -

Page 118

... the Benefit Obligation and Plan Assets were related to the implementation of the Company's new disclosure policy on immaterial plans. For 2010 and 2009, the Settlement, curtailment or special termination (gain) loss in the table above were primarily due to restructuring related activities in France... -

Page 119

...plan assets and benefit obligations recognized in accumulated other comprehensive income ("AOCI") (pre-tax) for the year ended December 31, 2010: Pension Benefits Other Postretirement Benefits New prior service cost ...Net loss (gain) arising during the period ...Effect of foreign currency exchange... -

Page 120

...Benefit Cost for Years Ended December 31: Discount rate ...Expected long-term return on plan assets ...Rate of compensation increase ... 5.6% 6.2% 6.2% 5.4% 6.4% 6.0% 7.5% 7.4% 7.6% - - - 2.7% 2.8% 3.5% 4.0% 4.0% 4.0% Plan assets: Plan assets are invested in equity securities, government and agency... -

Page 121

Corporate bonds and debentures: Valued at quoted prices in markets that are not active, broker dealer quotations, or other methods by which all significant inputs are observable, either directly or indirectly. U.S. equity securities: Valued at the closing price reported on the active market on which... -

Page 122

... benefits. Related to Lexmark's acquisition of the Information Products Corporation from IBM in 1991, IBM agreed to pay for its pro rata share (currently estimated at $20.8 million) of future postretirement benefits for all the Company's U.S. employees based on pro rated years of service with IBM... -

Page 123

... Position at their fair value. Fair values for Lexmark's derivative financial instruments are based on pricing models or formulas using current market data, or where applicable, quoted market prices. On the date the derivative contract is entered into, the Company designates the derivative as... -

Page 124

... circumstances. In addition, the Company uses credit insurance for specific obligors to limit the impact of nonperformance. Lexmark sells a large portion of its products through third-party distributors and resellers and original equipment manufacturer ("OEM") customers. If the financial condition... -

Page 125

... relationships to better ensure more consistent quality, cost and delivery. The Company also sources some printer engines and finished products from OEMs. Typically, these preferred suppliers maintain alternate processes and/or facilities to ensure continuity of supply. Although Lexmark plans in... -

Page 126

... discovery phase. Sagem Communications v. Lexmark Sagem Communications (formerly Sagem, S.A.) filed suit against the Company, in the Court of First Instance, Geneva, Switzerland on May 15, 2007. The suit alleges the Company failed to timely develop a series of private label fax machines for Sagem... -

Page 127

... DATA During 2010, the Company executed two strategic actions. First, in the second quarter of 2010, the Company acquired Perceptive Software in order to build upon and strengthen Lexmark's industry workflow solutions and allow the Company to compete in the faster growing ECM and document-process... -

Page 128

... and inkjet printing divisions into a single organization in order to enable the Company to more easily execute its strategy of targeting and capturing higher usage business segments of the output marketplace and to further unify its sales, marketing, and research and development of new products and... -

Page 129

... location of customers. Other International revenue includes exports from the U.S. and Europe. The following is long-lived asset information by geographic area as of December 31: 2010 2009 2008 Long-lived assets: United States...EMEA (Europe, the Middle East & Africa) ...Other International...Total... -

Page 130

... ... The Company acquired Perceptive Software on June 7, 2010. The consolidated financial results include those of Perceptive Software subsequent to the acquisition. Refer to Note 20 for financial information regarding Perceptive Software. The sum of the quarterly data may not equal annual amounts... -

Page 131

...statement schedule, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to... -

Page 132

..., internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies... -

Page 133

... communicated to the Company's management, including its principal executive and principal financial officers or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Management's Report on Internal Control over Financial Reporting The Company... -

Page 134

...or by management override. • The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there ... Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or ... -

Page 135

... Board of Directors, is available on the Corporate Governance section of the Company's Investor Relations website at http://investor.lexmark.com. The Company also intends to disclose on the Corporate Governance section of its Investor Relations website any amendments to the Code of Business Conduct... -

Page 136

..." and "Equity Compensation Plan Information." Item 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE Information required by Part III, Item 13 of this Form 10-K is incorporated by reference from the Company's definitive Proxy Statement for its 2011 Annual Meeting of... -

Page 137

... In Form 10-K Report of Independent Registered Public Accounting Firm included in Part II, Item 8 ...For the years ended December 31, 2008, 2009 and 2010: Schedule II - Valuation and Qualifying Accounts ... 125 132 All other schedules are omitted as the required information is inapplicable or the... -

Page 138

LEXMARK INTERNATIONAL, INC. AND SUBSIDIARIES SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS For the Years Ended December 31, 2008, 2009 and 2010 (In Millions) (A) (B) Balance at Beginning of Period (C) Additions Charged to Charged to Costs and Other Accounts Expenses (D) (E) Balance at End of ... -

Page 139

...thereunto duly authorized in the City of Lexington, Commonwealth of Kentucky, on February 28, 2011. LEXMARK INTERNATIONAL, INC. By /s/ Paul A. Rooke Name: Paul A. Rooke Title: President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has... -

Page 140

... Exhibit Number Period Ending Filing Date Filed Herewith Exhibit Description Form Exhibit 2 3.1 3.2 3.3 3.4 4.1 4.2 4.3 4.4 4.5 10.1 10.2 10.3 10.4 10.5 Agreement and Plan of Merger, dated as of February 29, 2000, by and between Lexmark International, Inc. (the "Company") and Lexmark... -

Page 141

...-Mitsubishi, Ltd., New York Branch ("BTM"), as the Banks; Citicorp North America, Inc. ("CNAI") and BTM, as the Investor Agents; CNAI, as Program Agent for the Investors and Banks; and the Company, as Collection Agent and Originator. Amendment No. 1 to Receivables Purchase Agreement, dated as of... -

Page 142

... 2, 2009, by and among LRC, as Seller; Gotham, as an Investor; BTMUFJ, as Program Agent, an Investor Agent and a Bank; and the Company, as Collection Agent and Originator. Amendment No. 7 to Receivables Purchase Agreement, dated as of October 1, 2010, by and among LRC, as Seller; Gotham, as an... -

Page 143

... to the Company's Stock Incentive Plan.+ Form of Performance-Based Restricted Stock Unit Agreement pursuant to the Company's Stock Incentive Plan.+ Form of 2008-2010 Long-Term Incentive Plan Agreement pursuant to the Company's Stock Incentive Plan.+ Company Nonemployee Director Stock Plan, Amended... -

Page 144

... Director Stock Plan.+ Form of Annual Restricted Stock Unit Agreement pursuant to the Company's 2005 Nonemployee Director Stock Plan.+ Company Senior Executive Incentive Compensation Plan, as Amended and Restated, effective January 1, 2009.+ Form of Employment Agreement for Executive Officers... -

Page 145

... previously granted by the Securities and Exchange Commission. + Indicates management contract or compensatory plan, contract or arrangement. § Pursuant to Rule 406Tof Regulation S-T, the Interactive Data Files on Exhibit 101 hereto are deemed not filed or part of a registration statement or... -

Page 146

-

Page 147

www.lexmark.com One Lexmark Centre Drive Lexington, KY 40550 USA 859.232.2000