Kraft 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

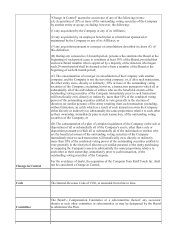

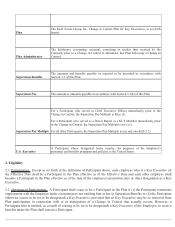

The Company and its Affiliates shall bear no responsibility for any Excise Tax payable on any Reduced Amoun

t

p

ursuant to a subsequent claim by the Internal Revenue Service or otherwise. For purposes of determining the

Reduced Amount under this Section 3.4(a), amounts otherwise payable to the Participant under the Plan shall be

reduced, to the extent necessary, in the following order: first, Separation Pay under Section 3.3(b), then Accrue

d

Obligations payable under Section 3.3(a), other than Annual Base Salary through the Date of Termination,

followed by outplacement services payable under Section 3.3(d), welfare benefits payable under Section 3.3(c),

and, finally, perquisites payable under Section 3.3(e). In the event that such reductions are not sufficient to reduce

the aggregate Payments to the Participant to the Reduced Amount, then Payments due the Participant under any

other plan shall be reduced in the order determined by the Plan Administrator in its sole discretion.

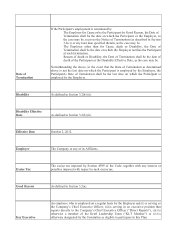

3.5. Payment Obligations Absolute. Upon a Change in Control and termination of employment under the circumstances

described in Section 3.2(a), the obligations of the Company and its Affiliates to pay or provide the Separation Benefits

described in Section 3.3 shall be absolute and unconditional and shall not be affected by any circumstances, including,

without limitation, any set-off, counterclaim, recoupment, defense or other right which the Company or any of the

Affiliates may have against any Participant. In no event shall a Participant be obligated to seek other employment or take

any other action by way of mitigation of the amounts payable to a Participant under any of the provisions of this Plan,

nor shall the amount of any payment or value of any benefits hereunder be reduced by any compensation or benefits

earned by a Participant as a result of employment by another employer, except as specifically provided under Section

3.3.

3.6. Non-Competition and Non-Solicitation. Upon a Change in Control and termination of employment under the

circumstances described in Section 3.2(a), the obligations of the Company and its Affiliates to pay or provide the

Separation Benefits described in Section 3.3 are contingent on the Participant’ s adhering to the Non-Competition

Agreement and the Non-Solicitation Agreement. Should the Participant violate the Non-Competition Agreement or Non-

Solicitation Agreement, the Participant will be obligated to pay back to the Employer all payments received pursuant to

this Plan and the Employer will have no further obligation to pay the Participant any payments that may be remaining

due under this Plan.

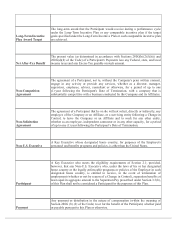

3.7.

Non-Disparagement. Upon a Change in Control and termination of employment under the circumstances

described in Section 3.2(a), the obligations of the Company and its Affiliates to pay or provide the Separation Benefits

described in Section 3.3 are contingent on the Participant's adhering to certain non-disparagement provisions. The

Participant agrees that, in discussing their relationship with the Employer, such Participant will not disparage, discredi

t

or otherwise treat in a detrimental manner the Employer, its affiliated and parent companies or their officers, directors

and employees. The Employer agrees that, in

(ii)

An amount (the “Reduced Amount”) that is one dollar less than the smallest amount that would give rise

to any Excise Tax.

(b)

All determinations required to be made under this Section 3.4, including whether a Reduced Amount or a Ne

t

After-Tax Benefit is payable, and the assumptions to be utilized in arriving at such determinations, shall be made

b

y the Company's independent auditors or such other nationally recognized certified public accounting firm as

may be designated by the Company and approved by the Participant (the “Accounting Firm”), which shall provide

detailed supporting calculations both to the Company and the Participant within 15 business days of the receipt o

f

notice from the Participant that there has been a Payment, or such earlier time as is requested by the Company. All

fees and expenses of the Accounting Firm shall be borne solely by the Company. Any determination by the

Accounting Firm shall be binding upon the Company, its Affiliates and the Participant.