Kraft 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

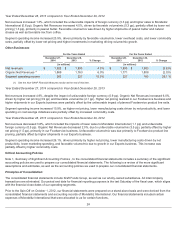

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As we operate primarily in North America but source our commodities from global markets and periodically enter into financing or

other arrangements abroad, we use financial instruments to manage our primary market risk exposures, which are commodity

price, foreign currency exchange rate, and interest rate risks. We monitor and manage these exposures as part of our overall risk

management program. Our risk management program focuses on the unpredictability of financial markets and seeks to reduce the

potentially adverse effects that the volatility of these markets may have on our operating results. We maintain commodity price,

foreign currency, and interest rate risk management policies that principally use derivative instruments to reduce significant,

unanticipated earnings fluctuations that may arise from volatility in commodity prices, foreign currency exchange rates, and interest

rates. We also sell commodity futures to unprice future purchase commitments, and we occasionally use related futures to cross-

hedge a commodity exposure. We are not a party to leveraged derivatives and, by policy, do not use financial instruments for

speculative purposes. Refer to Note 1, Summary of Significant Accounting Policies, and Note 10, Financial Instruments , to the

consolidated financial statements for further details of our commodity price, foreign currency, and interest rate risk management

policies and the types of derivative instruments we use to hedge those exposures.

Value at Risk:

We use a value at risk (“VAR”) computation to estimate: (1) the potential one-day loss in pre-tax earnings of our commodity price

and foreign currency-sensitive derivative financial instruments; and (2) the potential one-day loss in the fair value of our interest

rate-sensitive financial instruments. We included our debt, commodity futures, forwards and options, foreign currency forwards, and

interest rate swaps in our VAR computation. Excluded from the computation were anticipated transactions and foreign currency

trade payables and receivables which the financial instruments are intended to hedge.

We made the VAR estimates assuming normal market conditions, using a 95% confidence interval. We used a “variance / co-

variance” model to determine the observed interrelationships between movements in interest rates and various currencies. These

interrelationships were determined by observing interest rate and forward currency

31

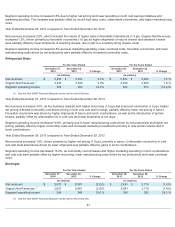

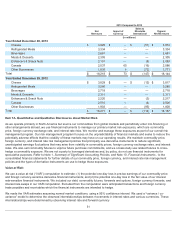

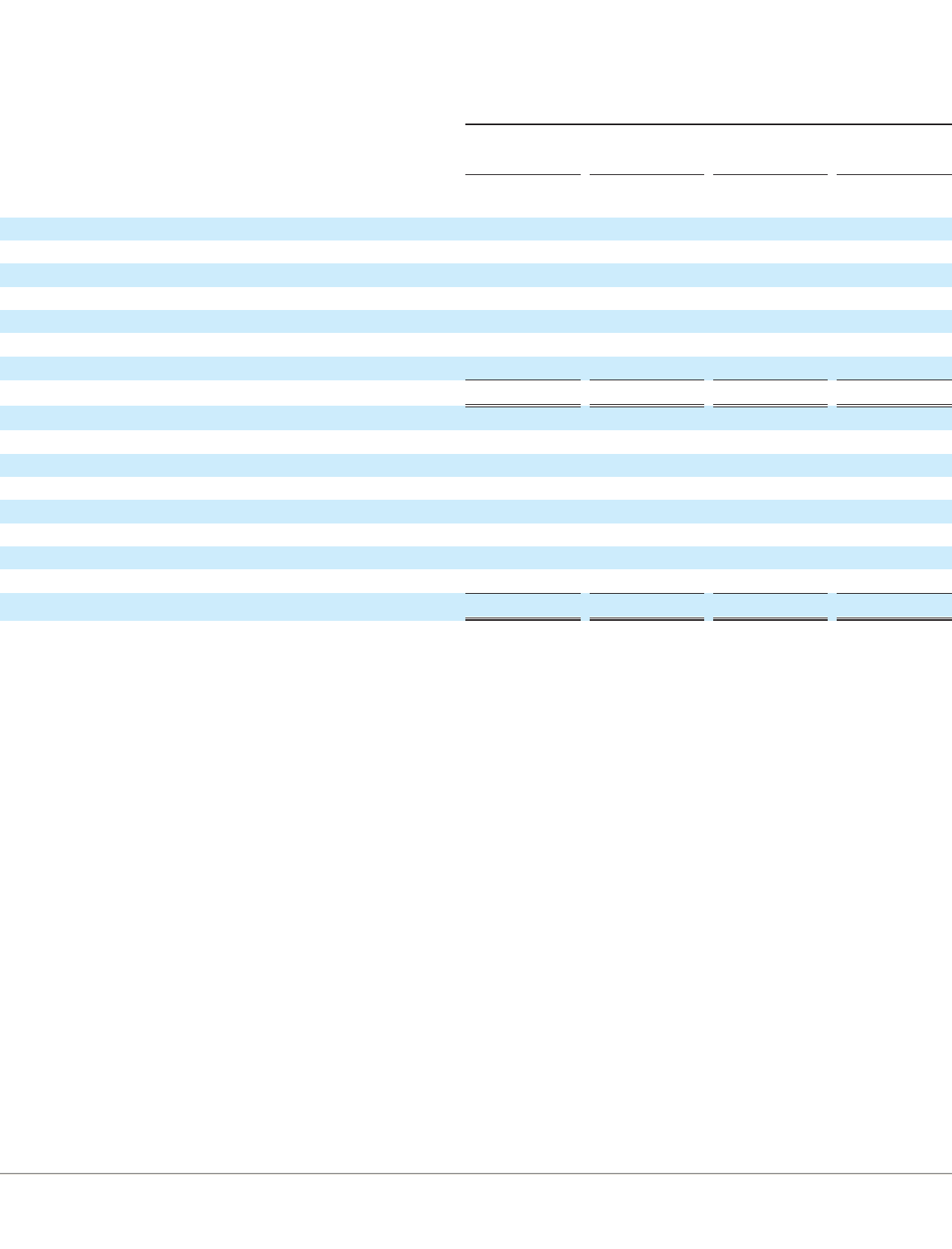

2013 Compared to 2012

Net

Revenues

Impact of

Currency

Sales to

MondelƝz

International

Organic

Net Revenues

(in millions)

Year Ended December 28, 2013

Cheese $3,925 $ — $(51 ) $3,874

Refrigerated Meals 3,334 — — 3,334

Beverages 2,681 — — 2,681

Meals & Desserts 2,305 — — 2,305

Enhancers & Snack Nuts 2,101 — (8 ) 2,093

Canada 2,037

65 (16 ) 2,086

Other Businesses 1,835 8 (72 ) 1,771

Total $ 18,218 $73

$ (147 ) $ 18,144

Year Ended December 29, 2012

Cheese $ 3,829

$—

$(12 ) $ 3,817

Refrigerated Meals 3,280 — — 3,280

Beverages 2,718 — — 2,718

Meals & Desserts 2,311 — — 2,311

Enhancers & Snack Nuts 2,220 — (3 ) 2,217

Canada 2,010 — (4 ) 2,006

Other Businesses 1,903 — (95 ) 1,808

Total $18,271 $ — $(114 ) $18,157