Kraft 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

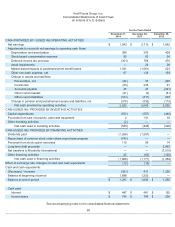

Dividends:

We paid dividends of $1,266 million in 2014 and $1,207 million in 2013. No dividends were paid in 2012. On December 16, 2014,

our Board of Directors declared a cash dividend of $0.55 per share of common stock, which was paid on January 16, 2015 to

shareholders of record on December 26, 2014. In connection with this dividend, we recorded $324 million of dividends payable as

of December 27, 2014. The present annualized dividend rate is $2.20 per share of common stock. The declaration of dividends is

subject to the discretion of our Board of Directors and depends on various factors, including our net earnings, financial condition,

cash requirements, future prospects, and other factors that our Board of Directors deems relevant to its analysis and decision

making.

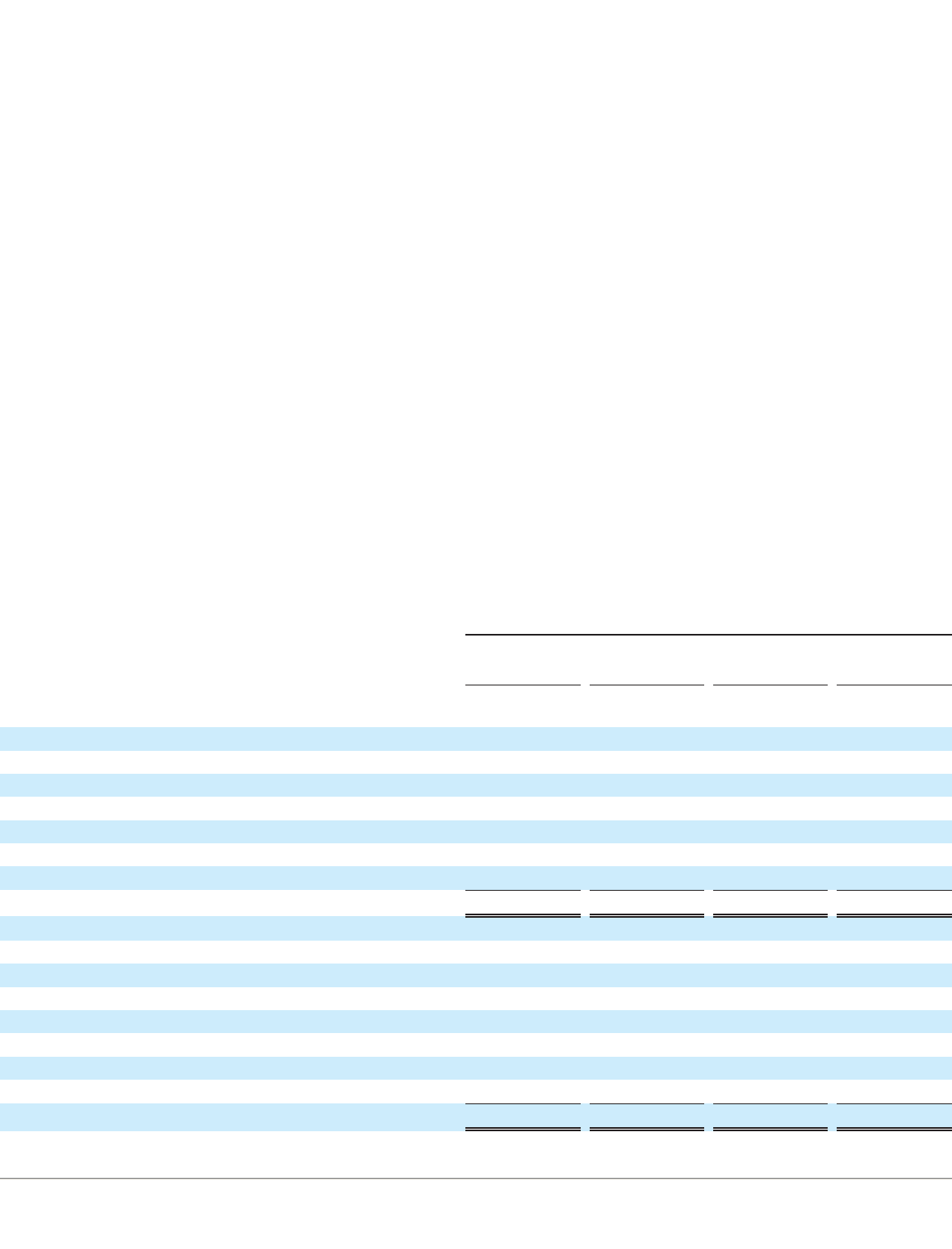

Non-GAAP Financial Measures

To supplement our financial statements presented in accordance with U.S. GAAP, we present Organic Net Revenues, which is

considered a non-GAAP financial measure. We define Organic Net Revenues as net revenues excluding the impact of transactions

with MondelƝz International, acquisitions, divestitures (including the termination of a full line of business due to the loss of a

licensing or distribution arrangement, and the complete exit of business out of a foreign country), currency and the 53

rd

week of

shipments when it occurs. We calculate the impact of currency on net revenues by holding exchange rates constant at the previous

year's exchange rate. We believe that presenting Organic Net Revenues is useful because it (1) provides both management and

investors meaningful supplemental information regarding financial performance by excluding certain items, (2) permits investors to

view our performance using the same tools that management uses to budget, make operating and strategic decisions, and evaluate

our historical performance, and (3) otherwise provides supplemental information that may be useful to investors in evaluating us.

We believe that the presentation of Organic Net Revenues, when considered together with the corresponding U.S. GAAP financial

measure and the reconciliation to that measure, provides investors with additional understanding of the factors and trends affecting

our business than could be obtained absent these disclosures. Non-GAAP financial measures should be viewed in addition to, and

not as an alternative for, our results prepared in accordance with U.S. GAAP. In addition, the non-GAAP measures we use may

differ from non-GAAP measures used by other companies, and other companies may not define the non-GAAP measures we use

in the same way. A reconciliation of Organic Net Revenues to net revenues is set forth below.

30

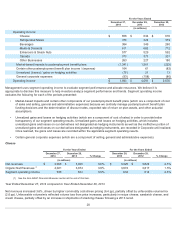

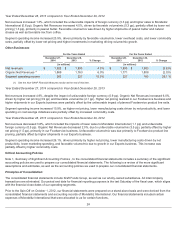

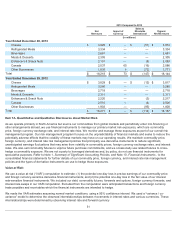

2014 Compared to 2013

Net

Revenues

Impact of

Currency

Sales to

MondelƝz

International

Organic

Net Revenues

(in millions)

Year Ended December 27, 2014

Cheese $4,066 $ — $(45 ) $4,021

Refrigerated Meals 3,433 — — 3,433

Beverages 2,627 — — 2,627

Meals & Desserts 2,155 — — 2,155

Enhancers & Snack Nuts 2,062 — — 2,062

Canada 1,937 139 (16 ) 2,060

Other Businesses 1,925 17 (73 ) 1,869

Total $ 18,205 $ 156 $ (134 ) $ 18,227

Year Ended December 28, 2013

Cheese $ 3,925 $— $(51 ) $ 3,874

Refrigerated Meals 3,334 — — 3,334

Beverages 2,681 — — 2,681

Meals & Desserts 2,305 — — 2,305

Enhancers & Snack Nuts 2,101 — (8 ) 2,093

Canada 2,037 — (16 ) 2,021

Other Businesses 1,835 — (72 ) 1,763

Total $18,218 $ — $(147 ) $18,071