Kraft 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

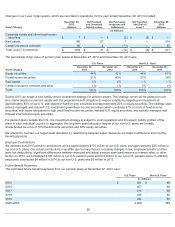

Other Costs:

We sponsor and contribute to employee savings plans that cover eligible salaried, non-union, and union employees. Our

contributions and costs are determined by the matching of employee contributions, as defined by the plans. Amounts charged to

expense for defined contribution plans totaled $70 million in 2014, $61 million in 2013, and $12 million in 2012 subsequent to the

Spin-Off.

Postretirement Benefit Plans

Obligations:

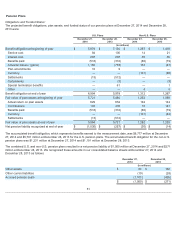

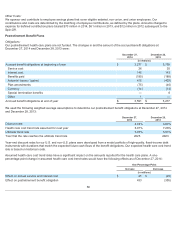

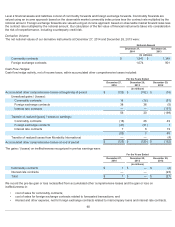

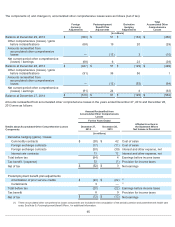

Our postretirement health care plans are not funded. The changes in and the amount of the accrued benefit obligations at

December 27, 2014 and December 28, 2013 were:

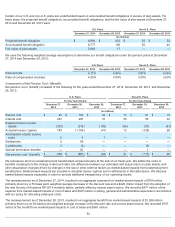

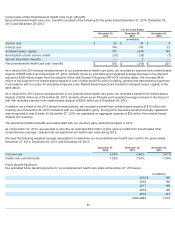

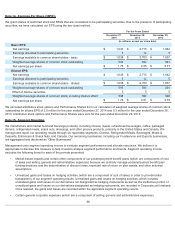

We used the following weighted average assumptions to determine our postretirement benefit obligations at December 27, 2014

and December 28, 2013:

Year-end discount rates for our U.S. and non-U.S. plans were developed from a model portfolio of high-quality, fixed-income debt

instruments with durations that match the expected future cash flows of the benefit obligations. Our expected health care cost trend

rate is based on historical costs.

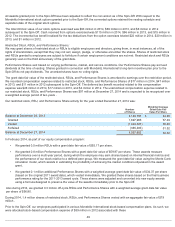

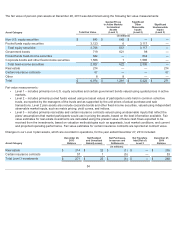

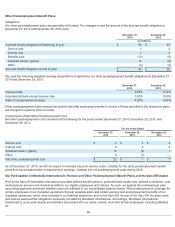

Assumed health care cost trend rates have a significant impact on the amounts reported for the health care plans. A one-

percentage-point change in assumed health care cost trend rates would have the following effects as of December 27, 2014:

56

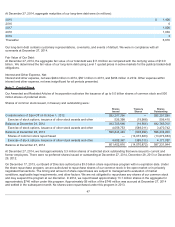

December 27,

2014 December 28,

2013

(in millions)

Accrued benefit obligations at beginning of year $ 3,277 $3,738

Service cost 26 35

Interest cost 148 143

Benefits paid (190 ) (188 )

Actuarial losses / (gains) 418 (403 )

Plan amendments (75 ) (40 )

Currency (14 ) (14 )

Special termination benefits — 6

Other 1 —

Accrued benefit obligations at end of year $ 3,591

$ 3,277

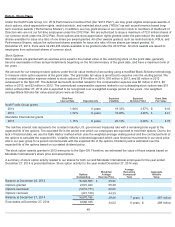

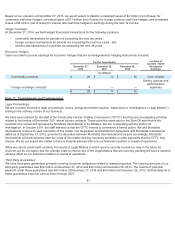

December 27,

2014

December 28,

2013

Discount rate 4.08 % 4.69 %

Health care cost trend rate assumed for next year 6.91 % 7.28 %

Ultimate trend rate 5.00 % 5.03 %

Year that the rate reaches the ultimate trend rate 2023 2023

One-Percentage-Point

Increase Decrease

(in millions)

Effect on annual service and interest cost $ 25 $(20 )

Effect on postretirement benefit obligation 433 (355 )