Kraft 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adversely affect our product sales, financial condition, and operating results.

Volatility of capital markets or macro-economic factors could adversely affect our business.

Changes in financial and capital markets, including market disruptions, limited liquidity, and interest rate volatility, may increase the

cost of financing as well as the risks of refinancing maturing debt. In addition, our borrowing costs can be affected by short and

long-term ratings assigned by rating organizations. A decrease in these ratings could limit our access to capital markets and

increase our borrowing costs, which could materially and adversely affect our financial condition and operating results.

Adverse changes in the capital markets or interest rates, differences or changes in actuarial assumptions from actual

experience, and legislative or other regulatory actions could substantially increase our postemployment obligations and

materially and adversely affect our profitability and operating results.

We sponsor a number of benefit plans for employees in the United States and Canada, including defined benefit pension plans,

retiree health and welfare, active health care, severance, and other postemployment benefits. As of December 27, 2014, the

projected benefit obligation of our defined benefit pension plans was $8.3 billion and these plans had assets of $7.2 billion. The

difference between plan obligations and assets, or the funded status of the plans, significantly affects the net periodic benefit costs

of our pension plans and the ongoing funding requirements of those plans. Among other factors, changes in interest rates, mortality

rates, early retirement rates, investment returns, minimum funding requirements, and the market value of plan assets can affect the

level of plan funding, cause volatility in the net periodic pension cost, and consequently volatility in our reported net income, and

increase our future funding requirements. Legislative and other governmental regulatory actions may also increase funding

requirements for our pension plans’ benefits obligation.

We estimate the 2015 pension contributions will be approximately $195 million. Volatile economic conditions increase the risk that

we will be required to make additional cash contributions to the pension plans and recognize further increases in our net pension

cost. A significant increase in our pension funding requirements could negatively affect our ability to invest in our business or pay

dividends on our common stock.

Volatility in the market value of all or a portion of the derivatives we use to manage exposures to fluctuations in

commodity prices may cause volatility in our operating results and net earnings.

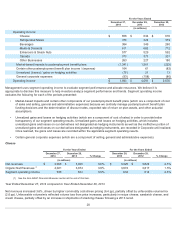

We use commodity futures and options to partially hedge the price of certain input costs, including dairy products, coffee beans,

meat products, wheat, corn products, soybean oils, sugar, and natural gas. For derivatives not designated as hedging instruments,

changes in the values of these derivatives are currently recorded in earnings, resulting in volatility in both gross profits and net

earnings. We report these gains and losses in cost of sales in our consolidated statements of earnings to the extent we utilize the

underlying input in our manufacturing process. We report these gains and losses in the unallocated corporate items line in our

segment operating results until we utilize the underlying input in our manufacturing process, at which time we reclassify the gains

and losses to segment operating income. We may experience volatile earnings as a result of these accounting treatments.

We are significantly dependent on information technology.

We rely on information technology networks and systems, including the Internet, to process, transmit, and store electronic and

financial information, to manage a variety of business processes and activities, and to comply with regulatory, legal, and tax

requirements. We also depend on our information technology infrastructure for digital marketing activities and for electronic

communications among our locations, personnel, customers, and suppliers. These information technology systems, some of which

are managed by third parties, may be susceptible to damage, disruptions, or shutdowns due to hardware failures, computer viruses,

hacker attacks, telecommunication failures, user errors, catastrophic events or other factors. If our information technology systems

suffer severe damage, disruption, or shutdown and our business continuity plans do not effectively resolve the issues in a timely

manner, we could experience business disruptions, transaction errors, processing inefficiencies, and the loss of customers and

sales, causing our product sales, financial condition, and operating results to be adversely affected and the reporting of our

financial results to be delayed.

In addition, if we are unable to prevent security breaches or disclosure of non-public information, we may suffer financial and

reputational damage, litigation or remediation costs or penalties because of the unauthorized disclosure of confidential information

belonging to us or to our partners, customers, consumers, or suppliers.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our

12