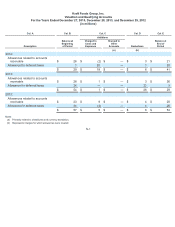

Kraft 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

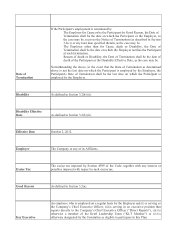

Change in Control

“Change in Control” means the occurrence of any of the following events:

(A) Acquisition of 20% or more of the outstanding voting securities of the Company

by another entity or group; excluding, however, the following:

(1) any acquisition by the Company or any of its Affiliates;

(2) any acquisition by an employee benefit plan or related trust sponsored or

maintained by the Company or any of its Affiliates; or

(3) any acquisition pursuant to a merger or consolidation described in clause (C) of

this definition.

(B) During any consecutive 24 month period, persons who constitute the Board at the

beginning of such period cease to constitute at least 50% of the Board; provided that

each new Board member who is approved by a majority of the directors who began

such 24 month period shall be deemed to have been a member of the Board at the

beginning of such 24 month period;

(C) The consummation of a merger or consolidation of the Company with another

company, and the Company is not the surviving company; or, if after such transaction,

the other entity owns, directly or indirectly, 50% or more of the outstanding voting

securities of the Company; excluding, however, a transaction pursuant to which all or

substantially all of the individuals or entities who are the beneficial owners of the

outstanding voting securities of the Company immediately prior to such transaction

will beneficially own, directly or indirectly, more than 50% of the combined voting

power of the outstanding securities entitled to vote generally in the election of

directors (or similar persons) of the entity resulting from such transaction (including,

without limitation, an entity which as a result of such transaction owns the Company

either directly or indirectly) in substantially the same proportions relative to each other

as their ownership, immediately prior to such transaction, of the outstanding voting

securities of the Company; or

(D) The consummation of a plan of complete liquidation of the Company or the sale or

disposition of all or substantially all of the Company's assets, other than a sale or

disposition pursuant to which all or substantially all of the individuals or entities who

are the beneficial owners of the outstanding voting securities of the Company

immediately prior to such transaction will beneficially own, directly or indirectly,

more than 50% of the combined voting power of the outstanding securities entitled to

vote generally in the election of directors (or similar persons) of the entity purchasing

or acquiring the Company's assets in substantially the same proportions relative to

each other as their ownership, immediately prior to such transaction, of the

outstanding voting securities of the Company.

For the avoidance of doubt, the separation of the Company from Kraft Foods Inc. shall

not be considered a Change in Control.

Code The Internal Revenue Code of 1986, as amended from time to time.

Committee

The Board’ s Compensation Committee or a subcommittee thereof, any successor

thereto or such other committee or subcommittee as may be designated by the Board

to administer the Plan.