Kraft 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

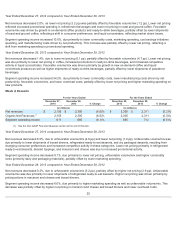

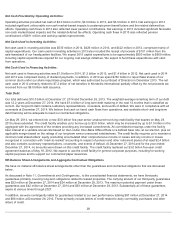

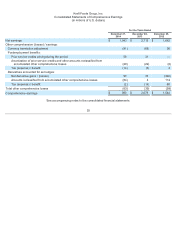

While we do not anticipate further changes in the 2015 assumptions for our U.S. and non-U.S. pension and postretirement health

care plans, as a sensitivity measure, a fifty-basis point change in our discount rate or a fifty-basis point change in the actual rate of

return on plan assets would have the following effects, increase / (decrease) in cost, as of December 27, 2014:

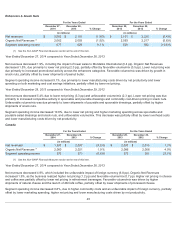

Prior to the Spin-Off, MondelƝz International provided defined benefit pension, postretirement health care, defined contribution, and

multiemployer pension and medical benefits to our eligible employees and retirees. Our consolidated statements of earnings for the

year ended December 29, 2012 included expense allocations for these benefits of $491 million through September 30, 2012, which

were determined based on a review of personnel by business unit and based on allocations of corporate or other shared functional

personnel. We consider the expense allocation methodology and results to be reasonable for all periods presented. These costs

are reflected in cost of sales and selling, general and administrative expenses. These costs were funded through intercompany

transactions with MondelƝz International and were reflected within the parent company investment equity balance.

New Accounting Pronouncements

See Note 1, Summary of Significant Accounting Policies , to the consolidated financial statements for a discussion of new

accounting pronouncements.

Contingencies

See Note 11, Commitments and Contingencies, to the consolidated financial statements for a discussion of contingencies.

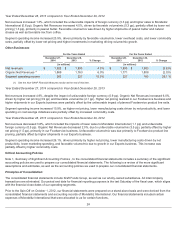

Commodity Trends

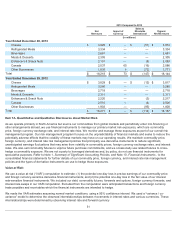

We purchase and use large quantities of commodities, including dairy products, meat products, coffee beans, nuts, soybean and

vegetable oils, sugar and other sweeteners, corn products and wheat to manufacture our products. In addition, we purchase and

use significant quantities of resins and cardboard to package our products and natural gas to operate our facilities. We continuously

monitor worldwide supply and cost trends of these commodities.

During 2014, our aggregate commodity costs increased over the prior year, primarily as a result of record high dairy costs as well

as increases in packaging materials, nuts and meat product costs, partially offset by lower costs of coffee beans, soybean and

vegetable oils, sugar and flour and grain costs. Our commodity costs increased approximately $430 million in 2014 and

approximately $120 million in 2013 compared to the prior year. We expect commodity cost volatility to continue in 2015. We

manage commodity cost volatility primarily through pricing and risk management strategies. As a result of these risk management

strategies, our commodity cost experience may not immediately correlate with market price trends.

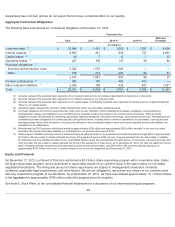

Liquidity and Capital Resources

We believe that cash generated from our operating activities and our $3.0 billion revolving credit facility with our commercial paper

program will provide sufficient liquidity to meet our working capital needs, expected cost savings initiatives expenditures, planned

capital expenditures and contributions to our postemployment benefit plans, purchases under our discretionary share repurchase

program, future contractual obligations, and payment of our anticipated quarterly dividends. We will use our cash on hand and our

commercial paper program for daily funding requirements. Overall, we do not expect any negative effects on our funding sources

that would have a material effect on our short-term or long-term liquidity.

27

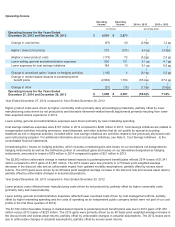

U.S. Plans Non-US. Plans

Fifty-Basis-Point Fifty-Basis-Point

Increase Decrease Increase Decrease

(in millions)

Effect of change in discount rate on pension costs $ (499 ) $ 562 $(99) $111

Effect of change in actual rate of return on plan assets on pension costs (29 ) 29 (7 ) 7

Effect of change in discount rate on postretirement health care costs (205 ) 229 (13 ) 15