Kraft 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

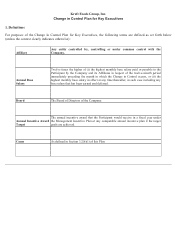

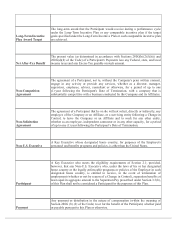

Long-Term Incentive

Plan Award Target

The long-term award that the Participant would receive during a performance cycle

under the Long-Term Incentive Plan or any comparable incentive plan if the target

goals specified under the Long-Term Incentive Plan or such comparable incentive plan

are achieved.

Net After-Tax Benefit

The present value (as determined in accordance with Sections 280G(b)(2)(A)(ii) and

280G(d)(4) of the Code) of a Participant's Payments less any Federal, state, and local

income taxes and any Excise Tax payable on such amount.

Non-Competition

Agreement

The agreement of a Participant, not to, without the Company's prior written consent,

engage in any activity or provide any services, whether as a director, manager,

supervisor, employee, adviser, consultant or otherwise, for a period of up to one

(1) year following the Participant's Date of Termination, with a company that is

substantially competitive with a business conducted by the Company and its Affiliates.

Non-Solicitation

Agreement

The agreement of a Participant that he or she will not solicit, directly or indirectly, any

employee of the Company or an Affiliate, or a surviving entity following a Change in

Control, to leave the Company or an Affiliate and to work for any other entity,

whether as an employee, independent contractor or in any other capacity, for a period

of up to one (1) year following the Participant’ s Date of Termination.

Non-U.S. Executive

A Key Executive whose designated home country, for purposes of the Employer's

personnel and benefits programs and policies, is other than the United States.

Participant

A Key Executive who meets the eligibility requirements of Section 2.1; provided,

however, that any Non-U.S. Executive who, under the laws of his or her designated

home country or the legally enforceable programs or policies of the Employer in such

designated home country, is entitled to receive, in the event of termination of

employment (whether or not by reason of a Change in Control), separation benefits at

least equal in aggregate amount to the Separation Pay prescribed under Section 3.3(b),

of this Plan shall not be considered a Participant for the purposes of this Plan.

Payment

Any payment or distribution in the nature of compensation (within the meaning of

Section 280G (b) (2) of the Code) to or for the benefit of the Participant, whether paid

or payable pursuant to this Plan or otherwise.