Kraft 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

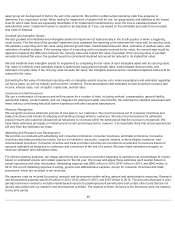

Corporate until realized. Once realized, the gains and losses are recorded within the applicable segment operating results.

When we use financial instruments, we are exposed to credit risk that a counterparty might fail to fulfill its performance obligations

under the terms of our agreement. We minimize our credit risk by entering into transactions with counterparties with investment

grade credit ratings, limiting the amount of exposure we have with each counterparty, and monitoring the financial condition of our

counterparties. We also maintain a policy of requiring that all significant, non-exchange traded derivative contracts with a duration

of greater than one year be governed by an International Swaps and Derivatives Association master agreement. We are also

exposed to market risk as the value of our financial instruments might be adversely affected by a change in foreign currency

exchange rates, commodity prices, or interest rates. We manage market risk by incorporating monitoring parameters within our risk

management strategy that limit the types of derivative instruments and derivative strategies we use and the degree of market risk

that we hedge with derivative instruments.

Commodity cash flow hedges – We are exposed to price risk related to forecasted purchases of certain commodities that we

primarily use as raw materials. We enter into commodity forward contracts primarily for coffee beans, meat products, sugar, wheat,

and dairy products. Commodity forward contracts generally are not subject to the accounting requirements for derivative

instruments and hedging activities under the normal purchases exception. We also use commodity futures and options to hedge the

price of certain commodity costs, including dairy products, coffee beans, meat products, wheat, corn products, soybean oils, sugar,

and natural gas. Some of these derivative instruments are highly effective and qualify for hedge accounting treatment. We also sell

commodity futures to unprice future purchase commitments, and we occasionally use related futures to cross-hedge a commodity

exposure.

Foreign currency cash flow hedges – We use various financial instruments to mitigate our exposure to changes in exchange rates

from third-party and intercompany actual and forecasted transactions. These instruments may include forward foreign exchange

contracts and foreign currency options. We primarily use these instruments to hedge our exposure to the Canadian dollar.

Substantially all of these derivative instruments are highly effective and qualify for hedge accounting treatment.

Interest rate cash flow hedges – We use derivative instruments, including interest rate swaps, as part of our interest rate risk

management strategy. We primarily use interest rate swaps to hedge the variability of interest payment cash flows on a portion of

our future debt obligations. Substantially all of these derivative instruments are highly effective and qualify for hedge accounting

treatment.

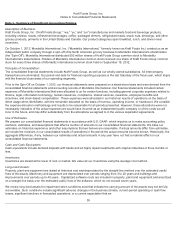

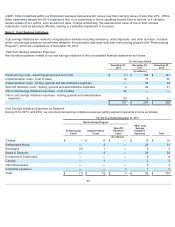

Income Taxes:

We recognize income taxes based on amounts refundable or payable for the current year and record deferred tax assets or

liabilities for any difference between U.S. GAAP accounting and tax reporting. We also recognize deferred tax assets for temporary

differences, operating loss carryforwards, and tax credit carryforwards. Inherent in determining our annual tax rate are judgments

regarding business plans, planning opportunities, and expectations about future outcomes. Realization of certain deferred tax

assets, primarily net operating loss and other carryforwards, is dependent upon generating sufficient taxable income in the

appropriate jurisdiction prior to the expiration of the carryforward periods. See Note 12, Income Taxes , for additional information.

We apply a more-likely-than-not threshold to the recognition and derecognition of uncertain tax positions. Accordingly, we recognize

the amount of tax benefit that has a greater than 50 percent likelihood of being ultimately realized upon settlement. Future changes

in judgment related to the expected ultimate resolution of uncertain tax positions will affect earnings in the quarter of such change.

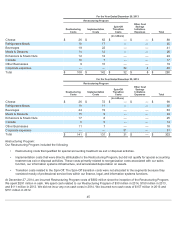

New Accounting Pronouncements:

In April 2014, the Financial Accounting Standards Board (the "FASB") issued an accounting standard update ("ASU") that modified

the criteria for reporting the disposal of a component of an entity as discontinued operations. In addition, the ASU requires

additional disclosures about discontinued operations. The ASU will be effective for all disposals of components of an entity that

occur during our fiscal year 2015 and thereafter. We do not expect the adoption of this guidance to have a material impact on our

financial statements and related disclosures.

In May 2014, the FASB issued an ASU that supersedes existing revenue recognition guidance. Under the new ASU, an entity will

apply a principles-based five step model to recognize revenue upon the transfer of promised goods or services to customers and in

an amount that reflects the consideration for which the entity expects to be entitled in exchange for those goods or services. The

ASU will be effective beginning in the first quarter of our fiscal year

42