Kraft 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

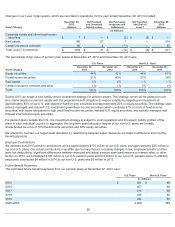

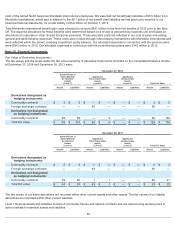

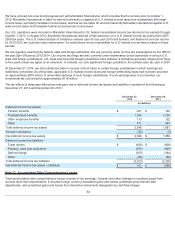

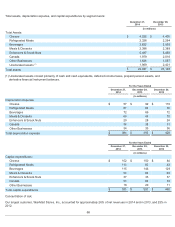

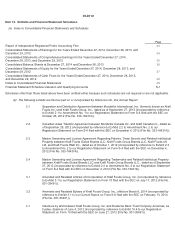

The components of, and changes in, accumulated other comprehensive losses were as follows (net of tax):

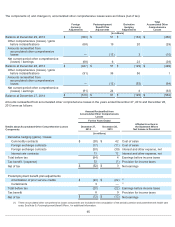

Amounts reclassified from accumulated other comprehensive losses in the years ended December 27, 2014 and December 28,

2013 were as follows:

65

Foreign

Currency

Adjustments

Postemployment

Benefit Plan

Adjustments

Derivative

Hedging

Adjustments

Total

Accumulated Other

Comprehensive

Losses

(in millions)

Balance at December 29, 2012 $(359 ) $ 51 $(152) $(460 )

Other comprehensive (losses) / gains

before reclassifications (68 ) 19 20 (29)

Amounts reclassified from

accumulated other comprehensive

losses — (13 ) 3 (10)

Net current-period other comprehensive

(losses) / earnings (68 ) 6 23 (39)

Balance at December 28, 2013 $(427 ) $ 57 $(129) $(499 )

Other comprehensive (losses) / gains

before reclassifications (91 ) 36 56 1

Amounts reclassified from

accumulated other comprehensive

losses — (12 ) (52) (64)

Net current-period other comprehensive

(losses) / earnings (91 ) 24 4 (63)

Balance at December 27, 2014 $(518 ) $ 81 $(125) $(562 )

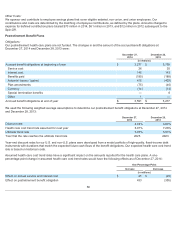

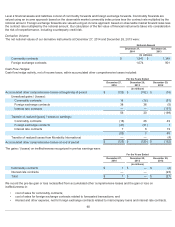

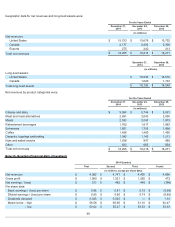

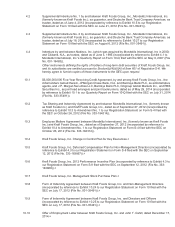

Amount Reclassified from

Accumulated Other Comprehensive

Losses

For the Years Ended

Details about Accumulated Other Comprehensive Losses

Components

December 27,

2014

December 28,

2013

Affected Line Item in

the Statement Where

Net Income is Presented

(in millions)

Derivative hedging (gains) / losses

Commodity contracts $ (30 ) $ 42 Cost of sales

Foreign exchange contracts (17 ) (11 ) Cost of sales

Foreign exchange contracts (50 ) (39 ) Interest and other expense, net

Interest rate contracts 13 12 Interest and other expense, net

Total before tax (84 ) 4 Earnings before income taxes

Tax benefit / (expense) 32 (1 ) Provision for income taxes

Net of tax $ (52 ) $3

Net earnings

Postemployment benefit plan adjustments

Amortization of prior service credits $(23 ) $(22 )

(1)

Curtailments 3 —

(1)

Total before tax (20 ) (22 ) Earnings before income taxes

Tax benefit 8 9 Provision for income taxes

Net of tax $(12 ) $(13 ) Net earnings

(1) These accumulated other comprehensive losses components are included in the computation of net periodic pension and postretirement health care

costs. See Note 9, Postemployment Benefit Plans , for additional information.