Kraft 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

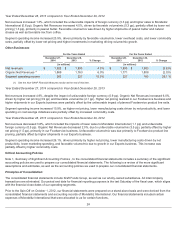

In 2014, we selected a new Performance Peer Group, which is the same as our Compensation Benchmarking Peer Group and

includes a broader spectrum of companies within our industry than in our Former Performance Peer Group. Our Performance Peer

Group currently consists of the following companies: Altria Group Inc., Campbell Soup Company, Colgate-Palmolive Company,

ConAgra Foods, Inc., General Mills, Inc., Hormel Foods Corporation, Kellogg Company, Keurig Green Mountain, Inc., Kimberly-

Clark Corporation, McDonald’s Corporation, MondelƝz International, Inc., PepsiCo, Inc., The J.M. Smucker Company, Starbucks

Corporation, The Coca-Cola Company, The Hershey Company, The Procter & Gamble Company, and Tyson Foods, Inc. Our

Former Performance Peer Group consists of the companies in the Standard & Poor's Packaged Foods & Meats Index, as follows:

Campbell Soup Company, ConAgra Foods, Inc., General Mills, Inc., The Hershey Company, Hormel Foods Corporation, Kellogg

Company, Keurig Green Mountain, Inc., McCormick and Co. Inc., Mead Johnson Nutrition Company, MondelƝz International, Inc.,

The J.M. Smucker Company, and Tyson Foods, Inc. Companies included in the Standard & Poor's Packaged Foods & Meats Index

change periodically. During 2014, Keurig Green Mountain, Inc. was added to the index and Archer Daniels Midland Company was

excluded from the index.

The above performance graph shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation

14A or 14C, or to the liabilities of Section 18 of the Exchange Act.

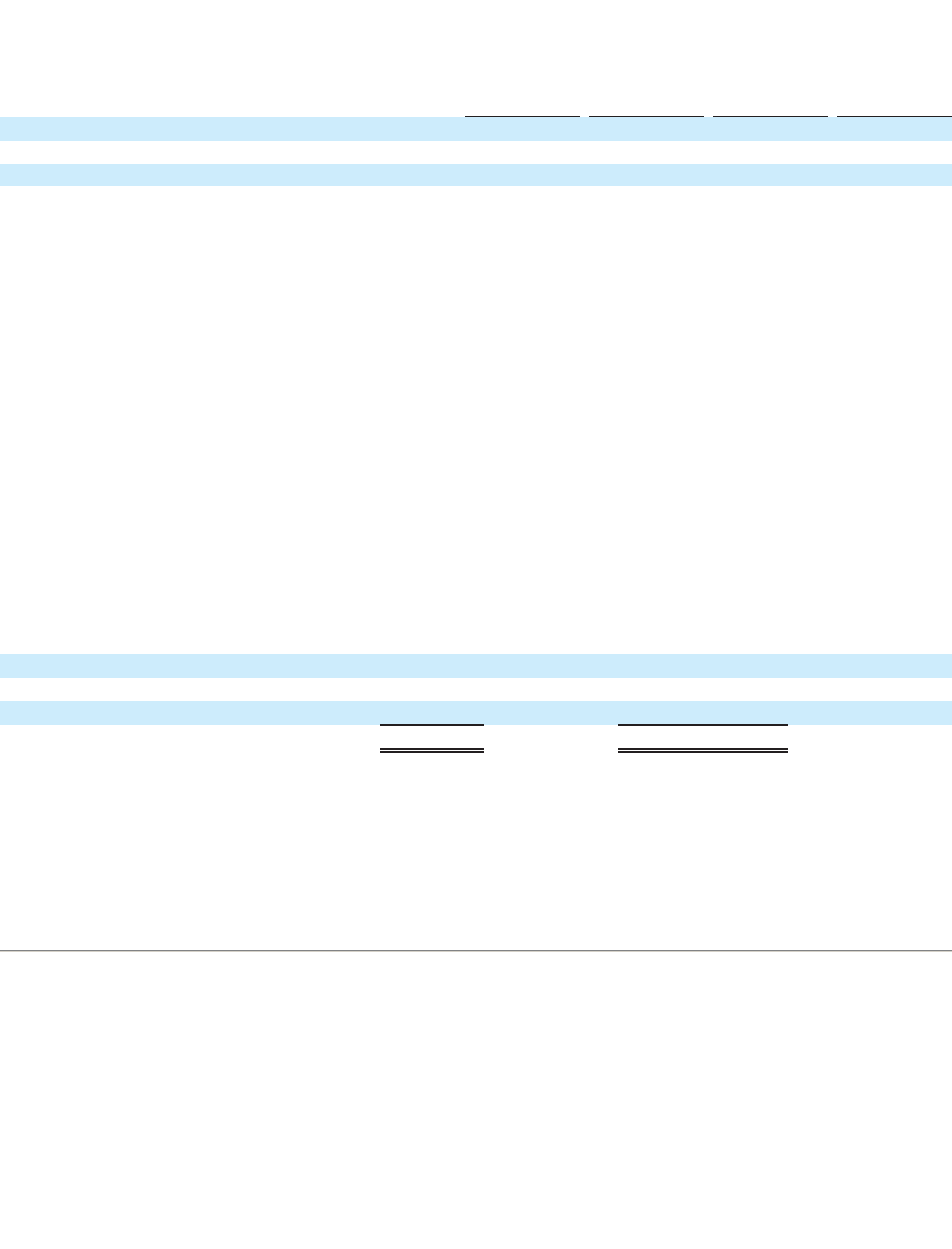

Issuer Purchases of Equity Securities during the Quarter ended December 27, 2014

Our share repurchase activity for the three months ended December 27, 2014 was:

(1) Includes shares tendered by individuals who used shares to exercise options or to pay the related taxes for grants of restricted stock, restricted stock units, and

performance based long-term incentive awards that vested.

(2) On December 17, 2013, our Board of Directors authorized a $3.0 billion share repurchase program with no expiration date. Under the share repurchase program,

we are authorized to repurchase shares of our common stock in the open market or in privately negotiated transactions. The timing and amount of share

repurchases are subject to management's evaluation of market conditions, applicable legal requirements, and other factors. We are not obligated to repurchase

any shares of our common stock and may suspend the program at our discretion. As of December 27, 2014, we have repurchased approximately 13.1 million

shares in the aggregate under this program since its inception.

15

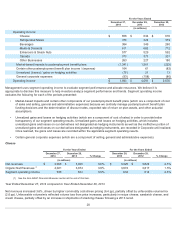

Date

Kraft Foods

Group S&P 500

Performance

Peer Group

Former

Performance

Peer Group

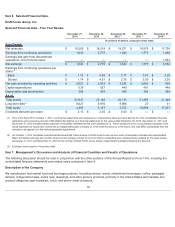

September 17, 2012 $100.00 $100.00 $100.00 $ 100.00

December 28, 2012 99.59 96.64 98.42 102.40

December 27, 2013 125.20 129.60 124.25 136.73

December 26, 2014 154.53 150.02 143.14 159.03

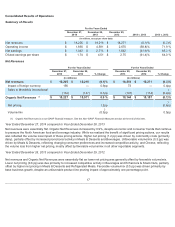

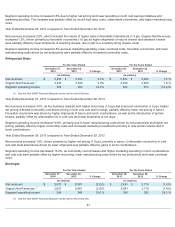

Total Number

of Shares

(1)

Average Price

Paid Per Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Program

(2)

Dollar Value of Shares

that May Yet be

Purchased Under the

Program

(2)

9/28/2014 - 10/25/2014 1,812,616 $ 55.94 1,697,190

10/26/2014 - 11/22/2014 1,219,402 57.63 1,207,147

11/23/2014 - 12/27/2014 966,953 60.23 954,280 $2,254,120,747

For the Quarter Ended December 27, 2014 3,998,971 57.49 3,858,617