Kraft 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

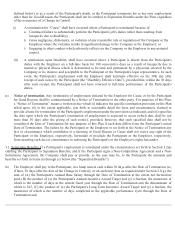

in the Plan until the amounts and benefits payable under the Plan have been paid or provided to the Participant in full.

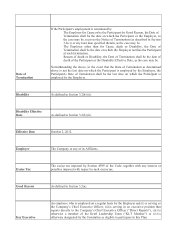

3. Separation Benefits

3.1. Right to Separation Benefits . A Participant shall be entitled to receive from the Employer the Separation Benefits as

p

rovided in Section 3.3, if a Change in Control has occurred and the Participant's employment by the Employer is

terminated under circumstances specified in Section 3.2(a), whether the termination is voluntary or involuntary, and if (i)

such termination occurs after such Change in Control and on or before the second anniversary thereof, or (ii) such

termination is reasonably demonstrated by the Participant to have been initiated by a third party that has taken steps

reasonably calculated to effect a Change in Control or otherwise to have arisen in connection with or in anticipation o

f

such Change in Control and such Change in Control occurs within 90 days of the termination. Termination o

f

employment shall have the same meaning as “separation from service” within the meaning of Treasury Regulation §

1.409A-1(h).

3.2. Termination of Employment .

The Participant must notify the Company of any event purporting to constitute Good Reason within 45 days following

the Participant's knowledge of its existence, and the Company or the Employer shall have 20 days in which to correct o

r

remove such Good Reason, or such event shall not constitute Good Reason.

(a)

Terminations which give rise to Separation Benefits under this Plan. The circumstances specified in this Section

3.2(a) are any termination of employment with the Employer by action of the Company or any of its Affiliates o

r

by a Participant for Good Reason, other than as set forth in Section 3.2(b) below. For purposes of this Plan, “Goo

d

Reason” shall mean:

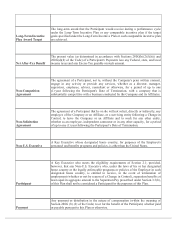

(i)

the assignment to the Participant of any duties substantially inconsistent with the Participant's position,

authority, duties or responsibilities in effect immediately prior to the Change in Control, or any othe

r

action by the Company or the Employer that results in a marked diminution in the Participant's position,

authority, duties or responsibilities, excluding for this purpose:

a.

changes in the Participant's position, authority, duties or responsibilities which are consistent with the

Participant's education, experience, etc.;

b.

an isolated, insubstantial and inadvertent action not taken in bad faith and that is remedied by the

Company and/or the Employer promptly after receipt of notice thereof given by the Participant;

(ii)

any material reduction in the Participant's base salary, annual incentive or long-term incentive opportunity

as in effect immediately prior to the Change in Control;

(iii)

the Employer requiring the Participant to be based at any office or location other than any other location

which does not extend the Participant's home to work commute as of the time of the Change in Control by

more than 50 miles;

(iv)

the Employer requiring the Participant to travel on business to a substantially greater extent than require

d

immediately prior to the Change in Control; or

(v)

any failure by the Company to require any successor (whether direct or indirect, by purchase, merger,

consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to

assume expressly and agree to perform this Plan in the same manner and to the same extent that the

Company or the Employer would be required to perform it if no such succession had taken place, as

required by Article 5.

(b)

Terminations which DO NOT give rise to Separation Benefits under this Plan. Notwithstanding Section 3.2(a),

if a Participant's employment is terminated for Cause or Disability (as those terms are