Kraft 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

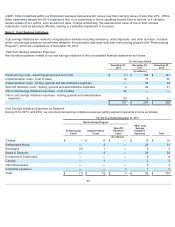

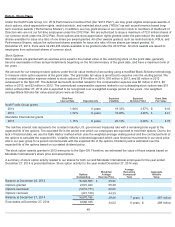

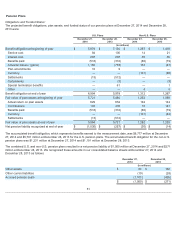

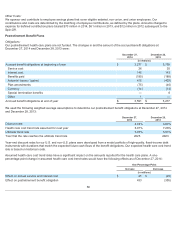

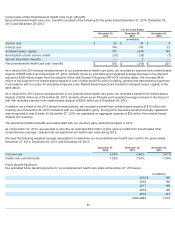

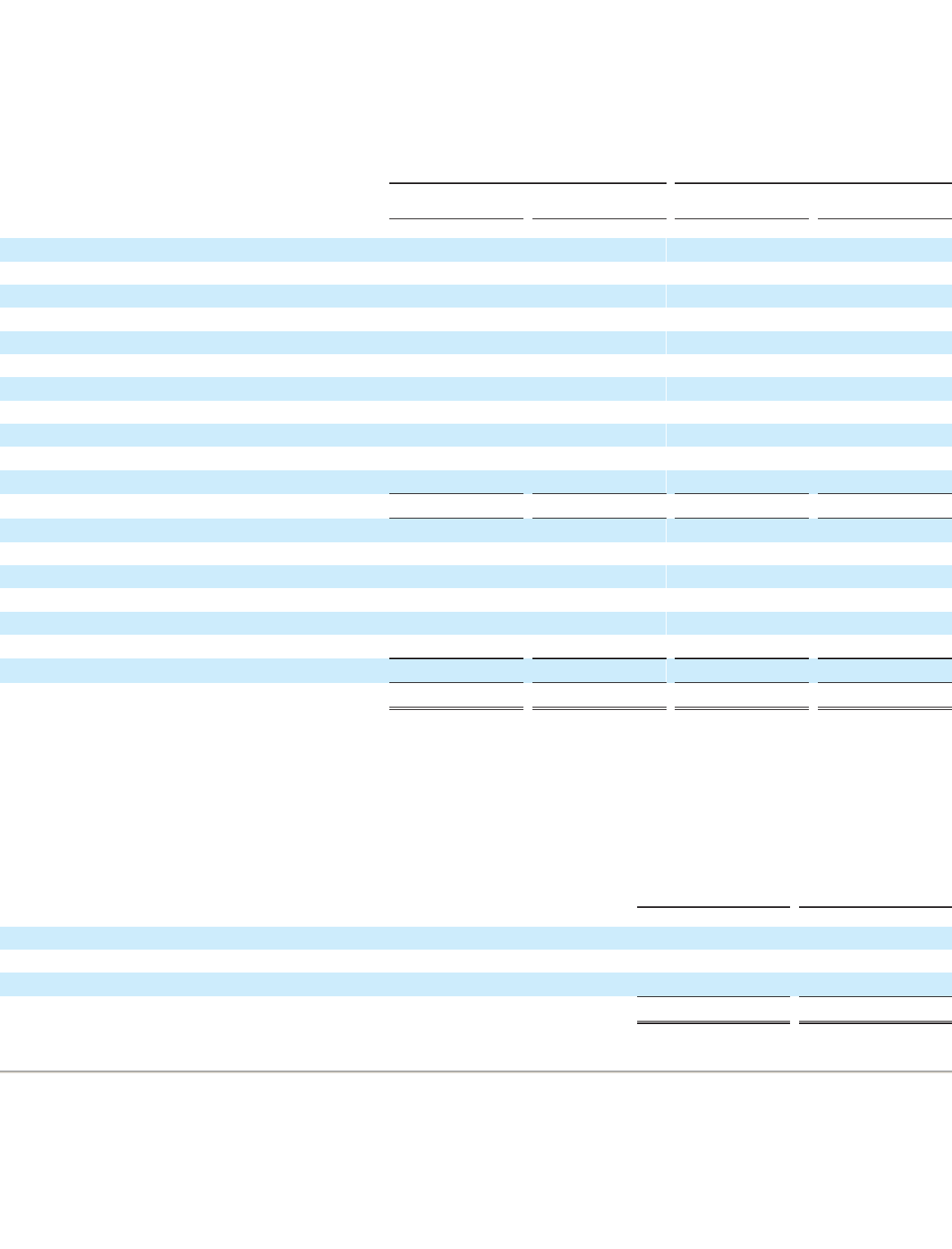

Pension Plans

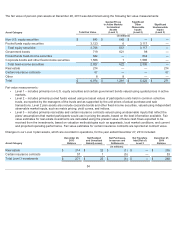

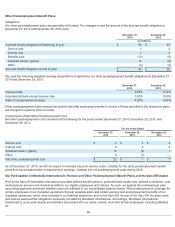

Obligations and Funded Status:

The projected benefit obligations, plan assets, and funded status of our pension plans at December 27, 2014 and December 28,

2013 were:

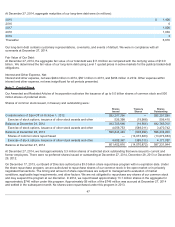

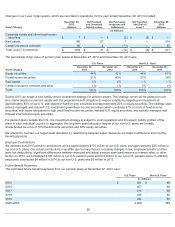

The accumulated benefit obligation, which represents benefits earned to the measurement date, was $6,777 million at December

27, 2014 and $5,781 million at December 28, 2013 for the U.S. pension plans. The accumulated benefit obligation for the non-U.S.

pension plans was $1,231 million at December 27, 2014 and $1,191 million at December 28, 2013.

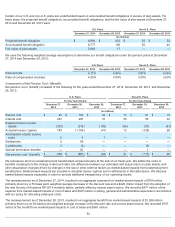

The combined U.S. and non-U.S. pension plans resulted in a net pension liability of $1,060 million at December 27, 2014 and $271

million at December 28, 2013. We recognized these amounts in our consolidated balance sheets at December 27, 2014 and

December 28, 2013 as follows:

51

U.S. Plans Non-U.S. Plans

December 27,

2014

December 28,

2013

December 27,

2014

December 28,

2013

(in millions)

Benefit obligation at beginning of year $5,978 $7,130 $1,267 $1,418

Service cost 84 100 14 21

Interest cost 287 287 55 55

Benefits paid (518) (316 ) (80 ) (79 )

Actuarial losses / (gains) 1,160 (778 ) 153 (47 )

Plan amendments 16 9 — —

Currency — — (101 ) (98 )

Settlements (13 ) (512 ) — —

Curtailments — (3 ) — (9)

Special termination benefits — 61 — 1

Other — — 4 5

Benefit obligation at end of year 6,994 5,978 1,312 1,267

Fair value of plan assets at beginning of year 5,721 5,460 1,253 1,089

Actual return on plan assets 629 654 194 144

Contributions 145 435 16 181

Benefits paid (518) (316 ) (80 ) (79 )

Currency — — (101 ) (82 )

Settlements (13 ) (512 ) — —

Fair value of plan assets at end of year 5,964 5,721 1,282 1,253

Net pension liability recognized at end of year $ (1,030 ) $ (257) $(30 ) $ (14)

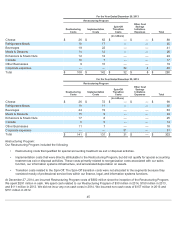

December 27,

2014

December 28,

2013

(in millions)

Other assets $ 64 $162

Other current liabilities (19 ) (28 )

Accrued pension costs (1,105 ) (405 )

$ (1,060 ) $ (271 )