Kraft 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

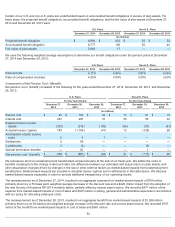

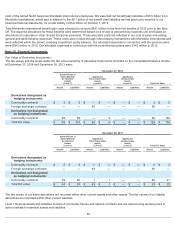

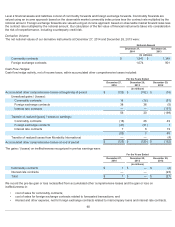

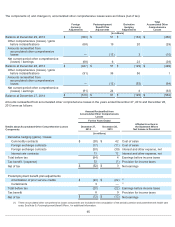

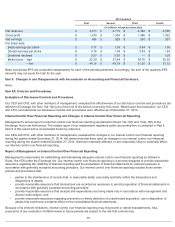

Based on our valuation at December 27, 2014, we would expect to transfer unrealized losses of $4 million (net of taxes) for

commodity cash flow hedges, unrealized gains of $17 million (net of taxes) for foreign currency cash flow hedges, and unrealized

losses of $8 million (net of taxes) for interest rate cash flow hedges to earnings during the next 12 months.

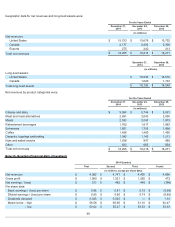

Hedge Coverage:

At December 27, 2014, we had hedged forecasted transactions for the following durations:

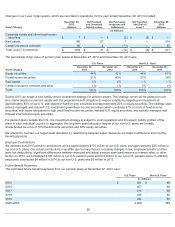

Economic Hedges:

Gains recorded in pre-tax earnings for economic hedges that are not designated as hedging instruments included:

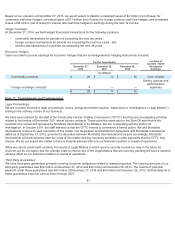

Note 11. Commitments and Contingencies

Legal Proceedings:

We are routinely involved in legal proceedings, claims, and governmental inquiries, inspections or investigations (“Legal Matters”)

arising in the ordinary course of our business.

We have been advised by the staff of the Commodity Futures Trading Commission (“CFTC”) that they are investigating activities

related to the trading of December 2011 wheat futures contracts. These activities arose prior to the Spin-Off and involve the

business now owned and operated by MondelƝz International or its affiliates. We are cooperating with the staff in its

investigation. In October 2014, the staff advised us that the CFTC intends to commence a formal action. We and MondelƝz

International continue to seek resolution of this matter. Our Separation and Distribution Agreement with MondelƝz International

dated as of September 27, 2012, governs the allocation between MondelƝz International and us and, accordingly, MondelƝz

International will predominantly bear the costs of this matter and any monetary penalties or other payments that the CFTC may

impose. We do not expect this matter to have a material adverse effect on our financial condition or results of operations.

While we cannot predict with certainty the results of Legal Matters in which we are currently involved or may in the future be

involved, we do not expect that the ultimate costs to resolve any of the Legal Matters that are currently pending will have a material

adverse effect on our financial condition or results of operations.

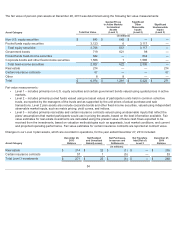

Third-Party Guarantees:

We have third-party guarantees primarily covering long-term obligations related to leased properties. The carrying amounts of our

third-party guarantees was $22 million at December 27, 2014 and $24 million at December 28, 2013. The maximum potential

payment under these guarantees was $42 million at December 27, 2014 and $53 million at December 28, 2013. Substantially all of

these guarantees expire at various times through 2027 .

61

• commodity transactions for periods not exceeding the next two years ;

• foreign currency transactions for periods not exceeding the next four years ; and

• interest rate transactions for periods not exceeding the next 28 years .

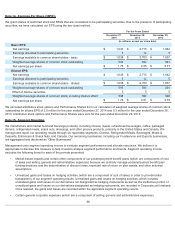

For the Years Ended Location of

(Losses) / Gains

Recognized

Earnings

December 27,

2014

December 28,

2013

December 29,

2012

(in millions)

Commodity contracts $ 26 $14 $36 Cost of sales

Foreign exchange contracts 2 — —

Selling, general and

administrative

expenses

$ 28 $14 $36