Kraft 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 3

1) continued failure to substantially perform the job’ s duties (other than resulting from incapacity due to disability);

2) gross negligence, dishonesty, or violation of any reasonable rule or regulation of the Company where the violation results in

significant damage to the Company; or

3) engaging in other conduct that materially adversely reflects on the Company.

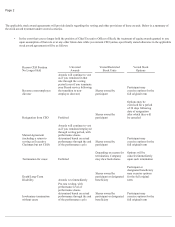

Perquisites

You will be eligible for:

You will be responsible for the associated taxes with respect to these perquisites.

Deferred Compensation Program

You will be eligible to participate in the Executive Deferred Compensation Program. This program allows you to voluntarily defer on a pre-tax

basis a portion of your salary and/or your annual incentive to a future date. Investment opportunities under this program are designed to mirror

the Company’ s 401(k) plan. Additional information for this program will be provided to you upon request.

Management Stock Purchase Plan (MSPP)

Kraft also provides voluntary stock purchase opportunities. You can elect to defer up to 50% of your annual Management Incentive Plan cash

bonus award in the form of deferred stock units, and the Company will match 25% of this bonus deferral into the MSPP in the form of restricted

stock units with a three year vest. Additional information for this program will be provided to you prior to the next enrollment period.

Stock Ownership Guidelines

You will be required to attain and hold Company stock equal in value to six times your base salary. You will have five years from your

assumption of the Chief Executive Officer role to achieve this level of ownership. Stock held for ownership determination includes common

stock held directly or indirectly, unvested restricted/deferred stock or share equivalents held in the Company’ s 401(k) plan. It does not include

stock options or unvested performance shares.

At Will Employment Status/Separation from the Company

You will be a U.S. employee of the Company and your employment status will be governed by and shall be construed in accordance with the

laws of the United States. As such, your status will be that of an “at will” employee. This means that either you or Kraft is free to terminate the

employment relationship at any time, for any or no reason, with or without notice.

In the event your employment is terminated by Kraft without “cause” (as defined above) and you execute and do not revoke a general release of

claims in favor of the Company and related entities and individuals within the timeframe and in a form to be prescribed by the Company (but in

any event no later than 45 days following your date of termination), you shall be eligible to receive (i) your prorated annual cash bonus for the

year of termination, determined based on actual Company performance through the end of the performance period and payable no later than the

March 15

th

immediately following the year in which your termination of employment occurs and (ii) severance in an amount equal to your then-

current base salary for a period of 24 months following your termination date and payable in accordance with the Company’ s normal payroll

schedule. In the event your employment is terminated under circumstances that entitle you to severance benefits under the Company’ s Change in

• For purposes of the stock awards, “cause” means:

• use of Company-provided aircraft for commuting between personal residence and the Company’ s office in Northfield, Illinois; and

• an annual financial counseling allowance of $10,000. You may use any firm of your choosing and submit requests for payment

directly to the Company.