Kraft 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

including general corporate expenses related to finance, legal, information technology, human resources, compliance, shared

services, insurance, employee benefits and incentives, and stock-based compensation. These expenses were allocated in our

historical results of operations on the basis of direct usage when identifiable, with the remainder allocated on the basis of revenue,

operating income, or headcount. We consider the expense allocation methodology and results to be reasonable for all periods

presented. However, these allocations were not necessarily indicative of the actual expenses we would have incurred as an

independent public company or of the costs we will incur in the future, and may differ substantially from the allocations we agreed to

in the various separation agreements.

Revenue Recognition:

We recognize revenues when title and risk of loss pass to our customers. We record revenues net of consumer incentives and

trade promotions and include all shipping and handling charges billed to customers. We also record provisions for estimated

product returns and customer allowances as reductions to revenues within the same period that the revenue is recognized. We

base these estimates principally on historical and current period experience, however, it is reasonably likely that actual experience

will vary from the estimates we have made.

Marketing and Research and Development:

We promote our products with advertising and consumer promotions, consumer incentives, and trade promotions. Consumer

incentives and trade promotions include, but are not limited to, discounts, coupons, rebates, in-store display incentives, and

volume-based incentives. Consumer incentive and trade promotion activities are recorded as a reduction to revenues based on

amounts estimated as being due to customers and consumers at the end of a period. We base these estimates principally on

historical utilization and redemption rates.

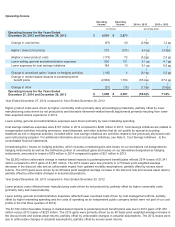

For interim reporting purposes, we charge advertising and consumer promotion expenses to operations as a percentage of volume,

based on estimated volume and related expense for the full year. We review and adjust these estimates each quarter based on

actual experience and other information. Advertising expense was $652 million in 2014, $747 million in 2013, and $640 million in

2012. We record marketing expense in selling, general and administrative expense, except for consumer incentives and trade

promotions, which are recorded in net revenues.

We expense costs as incurred for product research and development within selling, general and administrative expenses. Research

and development expense was $149 million in 2014, $142 million in 2013, and $143 million in 2012. The amounts disclosed in prior

periods have been revised to conform with the current year presentation.

Income Taxes:

We recognize income taxes based on amounts refundable or payable for the current year and record deferred tax assets or

liabilities for any difference between accounting principles generally accepted in the United States of America (“U.S. GAAP”) and

tax reporting. We also recognize deferred tax assets for temporary differences, operating loss carryforwards, and tax credit

carryforwards. Inherent in determining our annual tax rate are judgments regarding business plans, planning opportunities, and

expectations about future outcomes. Realization of certain deferred tax assets, primarily net operating loss and other carryforwards,

is dependent upon generating sufficient taxable income in the appropriate jurisdiction prior to the expiration of the carryforward

periods. See Note 12, Income Taxes , to the consolidated financial statements for additional information.

We apply a more-likely-than-not threshold to the recognition and derecognition of uncertain tax positions. Accordingly, we recognize

the amount of tax benefit that has a greater than 50 percent likelihood of being ultimately realized upon settlement. Future changes

in judgment related to the expected ultimate resolution of uncertain tax positions will affect earnings in the quarter of such change.

Goodwill and Intangible Assets:

We test goodwill and indefinite-lived intangible assets for impairment at least annually in the fourth quarter or when a triggering

event occurs. The first step of the goodwill impairment test compares the reporting unit’s estimated fair value with its carrying value.

We estimate a reporting unit’s fair value using planned growth rates, market-based discount rates, estimates of residual value, and

estimates of market multiples. If the carrying value of a reporting unit’s net assets exceeds its fair value, the second step would be

applied to measure the difference between the carrying value and implied fair value of goodwill. If the carrying value of goodwill

exceeds its implied fair value, the goodwill would be considered impaired and reduced to its implied fair value.

25