Kraft 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a $261 million trademark within our Enhancers business had excess fair values over their carrying values of less than 20% . While

these trademarks passed the 2014 impairment test, if our projections of future operating income were to decline, or if valuation

factors outside of our control, such as discount rates, change unfavorably, the estimated fair value of one or both of these

trademarks could be adversely affected, leading to a potential impairment in the future.

Note 5. Cost Savings Initiatives

Cost savings initiatives are related to reorganization activities including severance, asset disposals, and other activities. Included

within cost savings initiatives are activities related to the previously disclosed multi-year restructuring program (the "Restructuring

Program"), which we completed as of December 27, 2014.

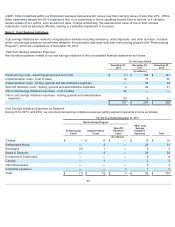

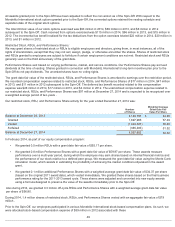

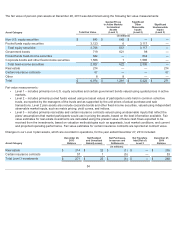

Total Cost Savings Initiatives Expenses:

We recorded expenses related to our cost savings initiatives in the consolidated financial statements as follows:

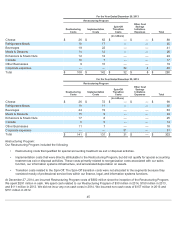

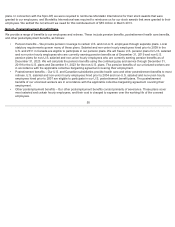

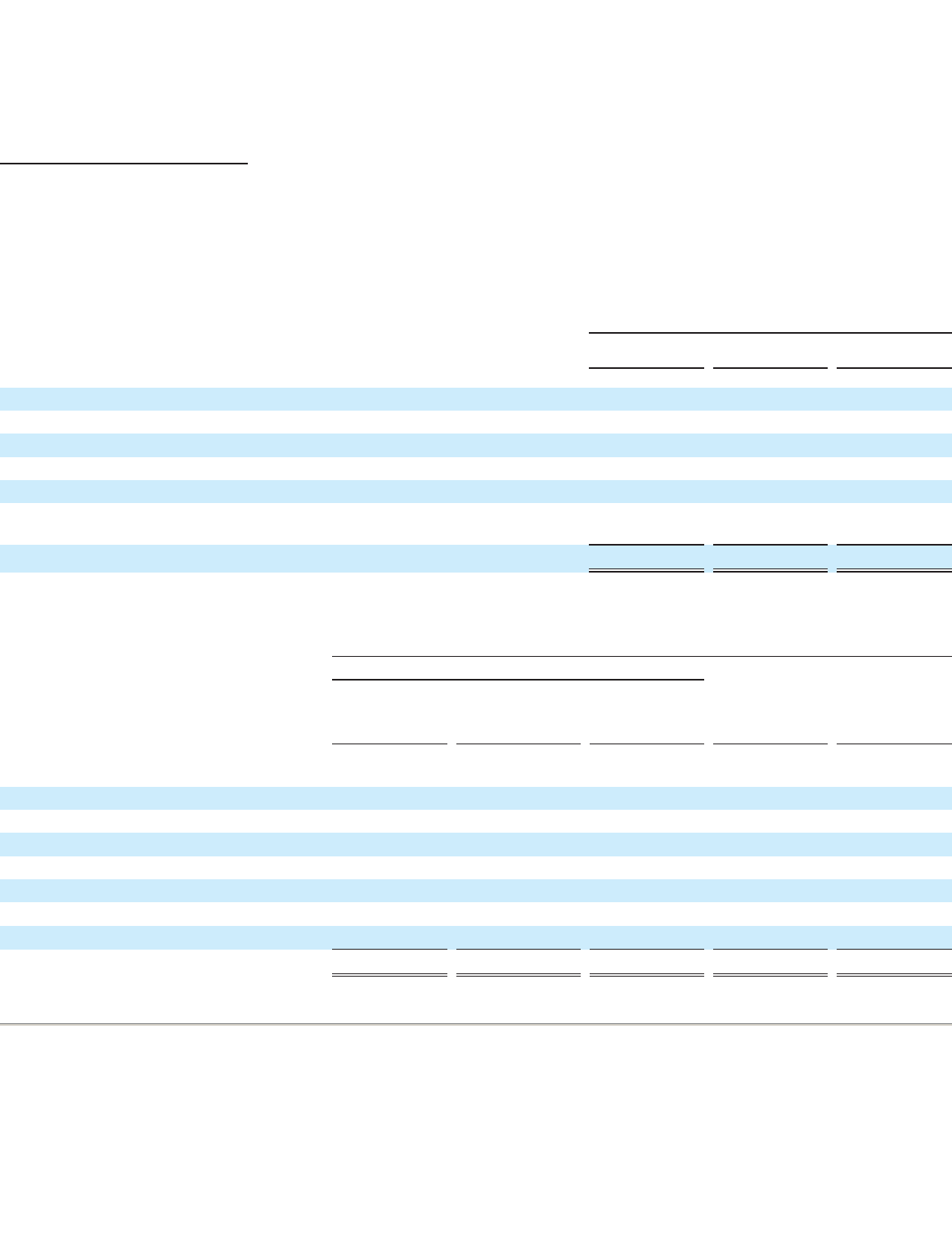

Cost Savings Initiatives Expenses by Segment:

During 2014, 2013, and 2012, we recorded cost savings initiatives expenses within segment operating income as follows:

44

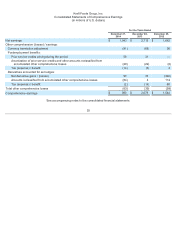

For the Years Ended

December 27,

2014

December 28,

2013

December 29,

2012

(in millions)

Restructuring costs - Asset impairment and exit costs $(1 ) $108 $141

Implementation costs - Cost of sales 12 77 97

Implementation costs - Selling, general and administrative expenses — 65 34

Spin-Off transition costs - Selling, general and administrative expenses 4 32 31

Other cost savings initiatives expenses - Cost of sales 49 — —

Other cost savings initiatives expenses - Selling, general and administrative

expenses 43 8 —

$107 $290 $303

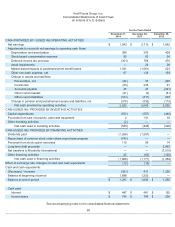

For the Year Ended December 27, 2014

Restructuring Program

Restructuring

Costs

Implementation

Costs

Spin-Off

Transition

Costs

Other Cost

Savings

Initiatives

Expenses Total

(in millions)

Cheese $ 1 $6 $— $12 $19

Refrigerated Meals — 2 — 29 31

Beverages (2 ) 1 — 9 8

Meals & Desserts — 2 — 28 30

Enhancers & Snack Nuts — — — 8 8

Canada — 1 — 2 3

Other Businesses — — — 3 3

Corporate expenses — — 4 1 5

Total $(1 ) $12

$4

$92

$ 107