Kraft 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

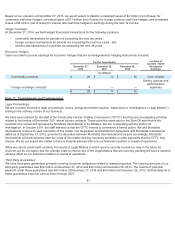

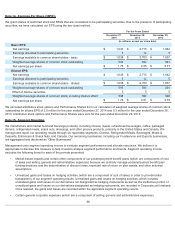

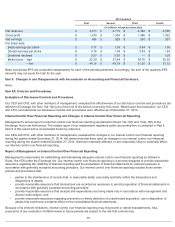

We have entered into a tax sharing agreement with MondelƝz International, which provides that for periods prior to October 1,

2012, MondelƝz International is liable for and will indemnify us against all U.S. federal income taxes and substantially all foreign

income taxes, excluding Canadian income taxes; and that we are liable for and will indemnify MondelƝz International against U.S.

state income taxes and Canadian federal and provincial income taxes.

Our U.S. operations were included in MondelƝz International’s U.S. federal consolidated income tax returns for tax periods through

October 1, 2012. In August 2014, MondelƝz International reached a final resolution on a U.S. federal income tax audit of the 2007-

2009 tax years. The U.S. federal statute of limitations remains open for tax year 2010 and forward, and federal income tax returns

for 2010-2012 are currently under examination. As noted above we are indemnified for U.S. federal income taxes related to these

periods.

We are regularly examined by federal, state and foreign authorities. We are currently under income tax examinations by the IRS for

the post Spin-Off period 2012-2014. Our income tax filings are also currently under examination by tax authorities in various U.S.

state and foreign jurisdictions. U.S. state and local and foreign jurisdictions have statutes of limitations generally ranging from three

to five years unless we agree to an extension. In Canada, our only significant foreign jurisdiction, the earliest open tax year is 2007.

At December 27, 2014, we had outside tax basis in excess of book basis in certain foreign subsidiaries in which earnings are

indefinitely reinvested. As of that date, applicable U.S. federal income taxes and foreign withholding taxes had not been provided

on approximately $578 million of unremitted earnings of such foreign subsidiaries. If such earnings were to be remitted, our

incremental tax cost would be approximately $118 million .

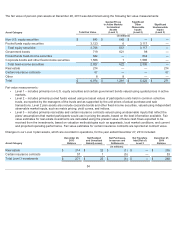

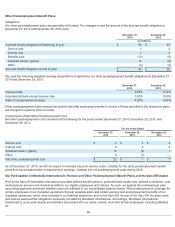

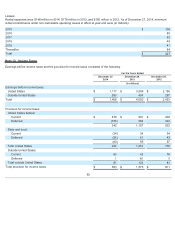

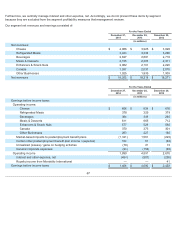

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities consisted of the following at

December 27, 2014 and December 28, 2013:

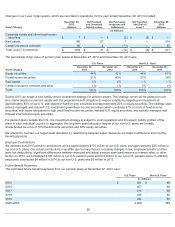

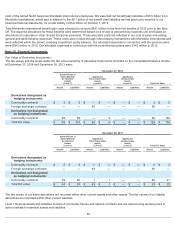

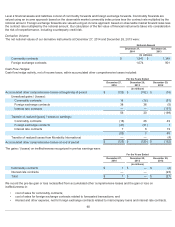

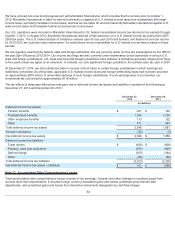

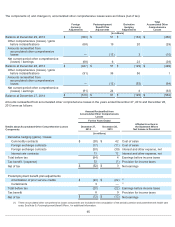

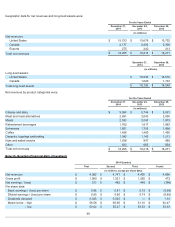

Note 13. Accumulated Other Comprehensive Losses

Total accumulated other comprehensive losses consists of net earnings / (losses) and other changes in business equity from

sources other than shareholders. It includes foreign currency translation gains and losses, postemployment benefit plan

adjustments, and unrealized gains and losses from derivative instruments designated as cash flow hedges.

64

December 27,

2014 December 28,

2013

(in millions)

Deferred income tax assets:

Pension benefits $ 407 $ 104

Postretirement benefits 1,355 1,238

Other employee benefits 113 122

Other 471 497

Total deferred income tax assets 2,346 1,961

Valuation allowance (20 ) (3 )

Net deferred income tax assets $ 2,326 $ 1,958

Deferred income tax liabilities:

Trade names $ (828 ) $ (828)

Property, plant and equipment (979 ) (949 )

Debt exchange (350 ) (384 )

Other (66 ) (65 )

Total deferred income tax liabilities (2,223 ) (2,226 )

Net deferred income tax assets / (liabilities) $103 $(268)