Kraft 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

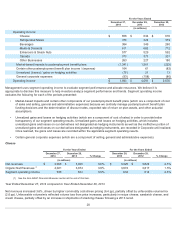

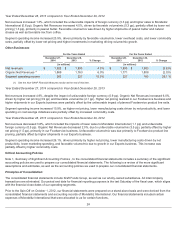

Segment operating income increased 3.5% due to higher net pricing and lower spending on both cost savings initiatives and

marketing activities. This increase was partially offset by record high dairy costs, unfavorable volume/mix, and higher manufacturing

costs.

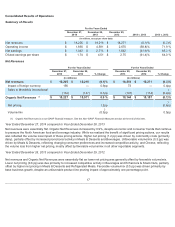

Year Ended December 28, 2013 compared to Year Ended December 29, 2012

Net revenues increased 2.5%, which included the impact of higher sales to MondelƝz International (1.0 pp). Organic Net Revenues

increased 1.5%, driven primarily by favorable volume/mix (1.6 pp) as higher shipments of natural cheese and sandwich cheese

were partially offset by lower shipments of snacking cheese, due in part to a voluntary string cheese recall.

Segment operating income increased 2.6% as lower marketing spending, lower overhead costs, favorable volume/mix, and lower

manufacturing costs driven by net productivity were partially offset by increased commodity costs.

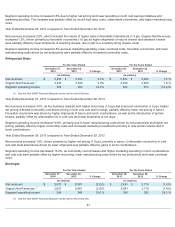

Refrigerated Meals

Year Ended December 27, 2014 compared to Year Ended December 28, 2013

Net revenues increased 3.0%, as the business realized both higher net pricing (1.5 pp) and improved volume/mix (1.5 pp). Higher

net pricing reflected commodity cost-driven pricing in both cold cuts and hot dogs, partially offset by lower net pricing in bacon.

Favorable volume/mix was driven by higher shipments of bacon and lunch combinations, as well as the introduction of protein

snacks, partially offset by unfavorable mix in cold cuts and lower shipments of hot dogs.

Segment operating income increased 14.9%, primarily due to lower manufacturing costs driven by net productivity and higher net

pricing, partially offset by higher commodity costs and increased marketing investments primarily in new protein snacks and in

lunch combinations.

Year Ended December 28, 2013 compared to Year Ended December 29, 2012

Net revenues increased 1.6%, driven primarily by higher net pricing (1.9 pp), primarily in bacon. Unfavorable volume/mix in cold

cuts and meat alternatives driven by lower shipments was partially offset by gains in lunch combinations.

Segment operating income decreased 13.2%, as commodity cost increases and higher marketing spending in lunch combinations

and cold cuts were partially offset by higher net pricing, lower manufacturing costs driven by net productivity and lower overhead

costs.

Beverages

21

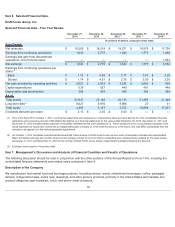

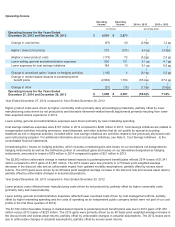

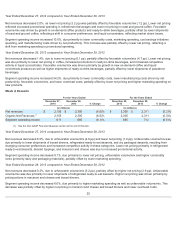

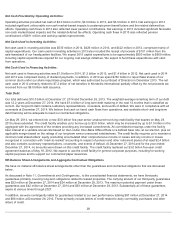

For the Years Ended For the Years Ended

December 27,

2014 December 28,

2013 % Change December 28,

2013 December 29,

2012 % Change

(in millions) (in millions)

Net revenues $ 3,433 $ 3,334 3.0 % $3,334 $ 3,280 1.6 %

Organic Net Revenues

(1)

3,433 3,334 3.0 % 3,334 3,280 1.6 %

Segment operating income 378 329 14.9 % 329 379 (13.2 )%

(1) See the Non-GAAP Financial Measures section at the end of this item.

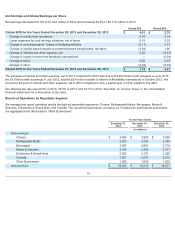

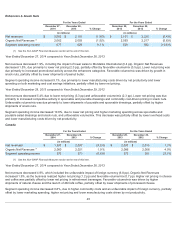

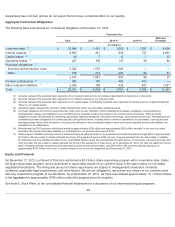

For the Years Ended For the Years Ended

December 27,

2014

December 28,

2013 % Change

December 28,

2013

December 29,

2012 % Change

(in millions) (in millions)

Net revenues $2,627 $ 2,681 (2.0 )% $2,681 $2,718 (1.4 )%

Organic Net Revenues

(1)

2,627 2,681 (2.0 )% 2,681 2,718 (1.4 )%

Segment operating income 384 349 10.0 % 349 260 34.2 %

(1) See the Non-GAAP Financial Measures section at the end of this item.