Kraft 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

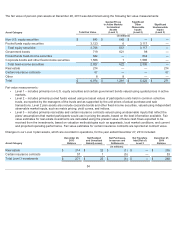

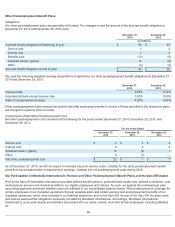

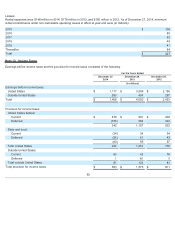

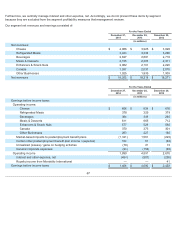

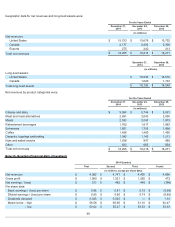

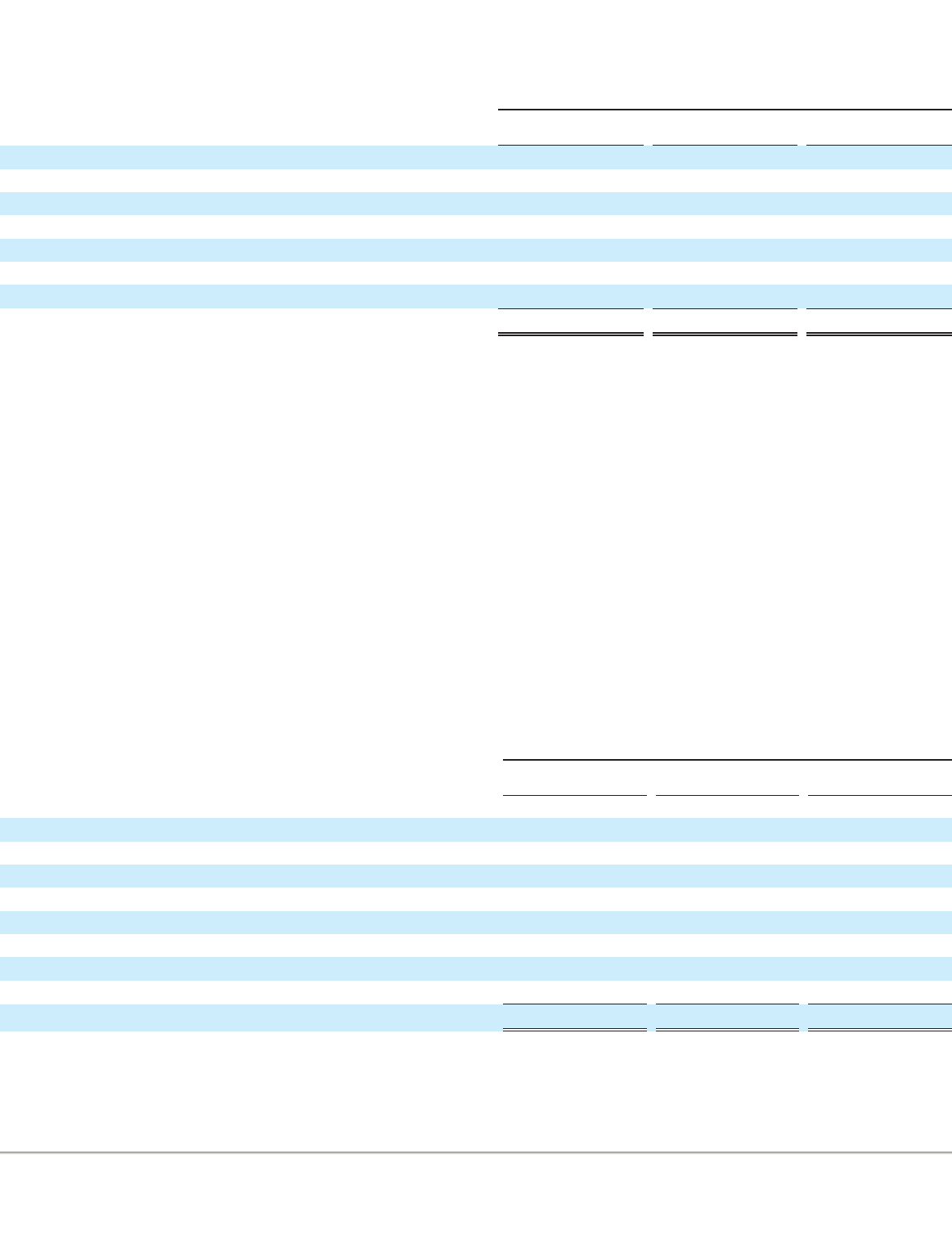

The effective income tax rate on pre-tax earnings differed from the U.S. federal statutory rate for the following reasons :

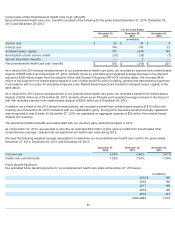

Our 2014 effective tax rate was favorably impacted by $64 million of domestic manufacturing deductions, favorable tax rates in

foreign jurisdictions, most significantly Canada, changes in uncertain tax positions and the net impact of other discrete tax items.

Our 2013 effective tax rate was favorably impacted by $49 million of domestic manufacturing deductions, favorable tax rates in

foreign jurisdictions, most significantly Canada, and the net impact of other discrete tax items. This favorability was partially offset

by $68 million of state and local taxes.

Our 2012 effective tax rate was favorably impacted by $66 million of domestic manufacturing deductions, favorable tax rates in

foreign jurisdictions, most significantly Canada, and changes in uncertain tax positions. This favorability was partially offset by $56

million of state and local taxes.

The calculation of the percentage point impact of domestic manufacturing deductions, uncertain tax positions and other discrete

items on the effective tax rate was affected by earnings before income taxes. Fluctuations in earnings could impact comparability of

reconciling items between periods.

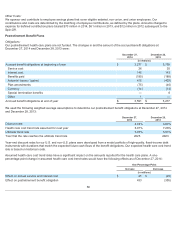

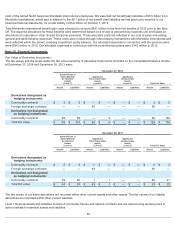

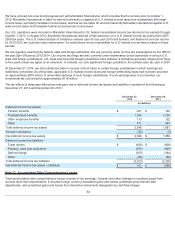

Our unrecognized tax benefits of $256 million at December 27, 2014 are included in other current liabilities and other liabilities. If

we had recognized all of these benefits, the net impact on our income tax provision would have been $167 million . Of the net

unrecognized tax benefits, approximately $100 million to $140 million are expected to be resolved within the next 12 months.

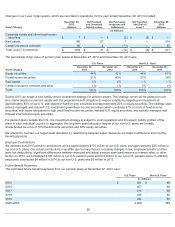

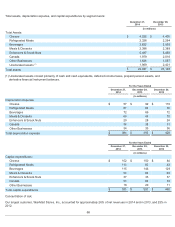

The changes in our unrecognized tax benefits were:

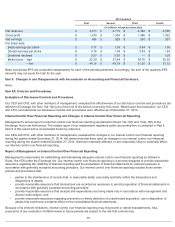

We include accrued interest and penalties related to uncertain tax positions in our tax provision. Our provision for income taxes

included a benefit of $30 million in 2014, expense of $13 million in 2013, and expense of $18 million in 2012 for interest and

penalties. Accrued interest and penalties were $41 million as of December 27, 2014, and $74 million as of December 28, 2013.

63

For the Years Ended

December 27,

2014

December 28,

2013

December 29,

2012

U.S. federal statutory rate 35.0 % 35.0 % 35.0 %

Increase / (decrease) resulting from:

U.S. state and local income taxes, net of federal tax benefit 0.2 % 1.7 % 2.3 %

Domestic manufacturing deduction (4.6)% (1.2 )% (2.7 )%

Foreign rate differences (2.2)% (1.1 )% (1.1 )%

Changes in uncertain tax positions (0.9)% 0.2 % (0.8 )%

Other (1.7)% (1.0 )% 0.4 %

Effective tax rate 25.8 % 33.6 % 33.1 %

For the Years Ended

December 27,

2014

December 28,

2013

December 29,

2012

(in millions)

Beginning of year $259 $258 $371

Increases from prior period tax positions 26 2 11

Decreases from prior period tax positions (74) (5) (90 )

Decreases from statute of limitations expirations (14) (28 ) —

Increases from current period tax positions 67 39 16

Net transfers to MondelƝz International — — (9)

Decreases relating to settlements with taxing authorities (3) (3) (33 )

Currency and other (5) (4) (8 )

End of year $256 $259 $258