Kraft 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

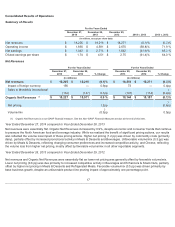

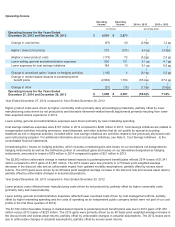

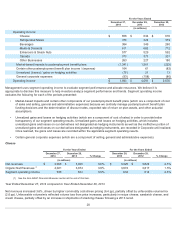

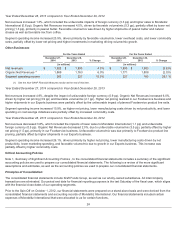

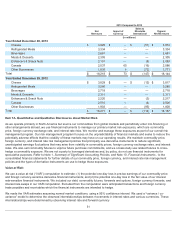

Year Ended December 28, 2013 compared to Year Ended December 29, 2012

Net revenues increased 1.3%, which included the unfavorable impacts of foreign currency (3.3 pp) and higher sales to MondelƝz

International (0.6 pp). Organic Net Revenues increased 4.0%, driven by favorable volume/mix (5.3 pp), partially offset by lower net

pricing (1.3 pp), primarily in peanut butter. Favorable volume/mix was driven by higher shipments of peanut butter and natural

cheese as well as favorable mix from coffee.

Segment operating income increased 23.9%, driven primarily by favorable volume/mix, lower overhead costs, and lower commodity

costs, partially offset by lower net pricing and higher investments in marketing driving volume/mix growth.

Other Businesses

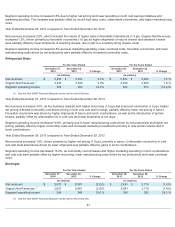

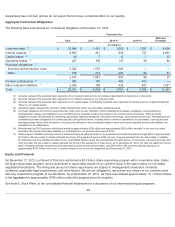

Year Ended December 27, 2014 compared to Year Ended December 28, 2013

Net revenues increased 4.9%, despite the impact of unfavorable foreign currency (0.9 pp). Organic Net Revenues increased 6.0%,

driven by higher net pricing (3.9 pp) and favorable volume/mix (2.1 pp). Higher net pricing realized in our Foodservice business and

higher shipments in our Exports business were partially offset by the unfavorable impact of planned Foodservice product line exits.

Segment operating income increased 15.9%, as higher net pricing, lower manufacturing costs driven by net productivity, and lower

spending on cost savings initiatives were partially offset by increased commodity costs.

Year Ended December 28, 2013 compared to Year Ended December 29, 2012

Net revenues decreased 3.6%, which included the impacts of lower sales to MondelƝz International (1.1 pp) and unfavorable

foreign currency (0.5 pp). Organic Net Revenues decreased 2.0%, due to unfavorable volume/mix (3.5 pp), partially offset by higher

net pricing (1.5 pp), primarily in our Foodservice business. Unfavorable volume/mix was due primarily to Foodservice product line

pruning, partially offset by higher shipments in our Exports business.

Segment operating income increased 26.1%, driven primarily by higher net pricing, lower manufacturing costs driven by net

productivity, lower marketing spending, and favorable volume/mix due to growth in our Exports business. This increase was

partially offset by higher commodity costs.

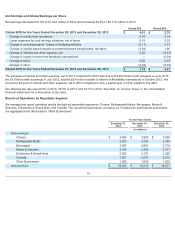

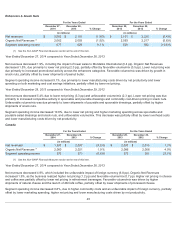

Critical Accounting Policies

Note 1, Summary of Significant Accounting Policies , to the consolidated financial statements includes a summary of the significant

accounting policies we used to prepare our consolidated financial statements. The following is a review of the more significant

assumptions and estimates, as well as the accounting policies we used to prepare our consolidated financial statements.

Principles of Consolidation:

The consolidated financial statements include Kraft Foods Group, as well as our wholly-owned subsidiaries. All intercompany

transactions are eliminated. Our period end date for financial reporting purposes is the last Saturday of the fiscal year, which aligns

with the financial close dates of our operating segments.

Prior to the Spin-Off on October 1, 2012, our financial statements were prepared on a stand-alone basis and were derived from the

consolidated financial statements and accounting records of MondelƝz International. Our financial statements included certain

expenses of MondelƝz International that were allocated to us for certain functions,

24

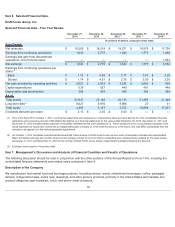

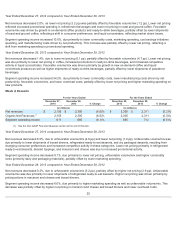

For the Years Ended For the Years Ended

December 27,

2014

December 28,

2013 % Change

December 28,

2013

December 29,

2012 % Change

(in millions) (in millions)

Net revenues $ 1,925 $ 1,835 4.9 % $1,835 $ 1,903 (3.6 )%

Organic Net Revenues

(1)

1,869 1,763 6.0 % 1,771 1,808 (2.0 )%

Segment operating income 263 227 15.9 % 227 180 26.1 %

(1) See the Non-GAAP Financial Measures section at the end of this item.