Kraft 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

asset group will be disposed of before the end of its useful life. We perform undiscounted operating cash flow analyses to

determine if an impairment exists. When testing for impairment of assets held for use, we group assets and liabilities at the lowest

level for which cash flows are separately identifiable. If an impairment is determined to exist, the loss is calculated based on

estimated fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to be received,

less costs of disposal.

Goodwill and Intangible Assets :

We test goodwill and indefinite-lived intangible assets for impairment at least annually in the fourth quarter or when a triggering

event occurs. The first step of the goodwill impairment test compares the reporting unit’s estimated fair value with its carrying value.

We estimate a reporting unit’s fair value using planned growth rates, market-based discount rates, estimates of residual value, and

estimates of market multiples. If the carrying value of a reporting unit’s net assets exceeds its fair value, the second step would be

applied to measure the difference between the carrying value and implied fair value of goodwill. If the carrying value of goodwill

exceeds its implied fair value, the goodwill would be considered impaired and would be reduced to its implied fair value.

We test indefinite-lived intangible assets for impairment by comparing the fair value of each intangible asset with its carrying value.

Fair value of indefinite-lived intangible assets is determined using planned growth rates, market-based discount rates, and

estimates of royalty rates. If the carrying value exceeds fair value, the intangible asset would be considered impaired and would be

reduced to fair value.

Estimating the fair value of individual reporting units or intangible assets requires us to make assumptions and estimates regarding

our future plans, as well as industry and economic conditions. These assumptions and estimates include projected revenues and

income, interest rates, cost of capital, royalty rate, and tax rates.

Insurance and Self-Insurance:

We use a combination of insurance and self-insurance for a number of risks, including workers' compensation, general liability,

automobile liability, product liability, and our obligation for employee health care benefits. We estimate the liabilities associated with

these risks by considering historical claims experience and other actuarial assumptions.

Revenue Recognition:

We recognize revenues when title and risk of loss pass to our customers. We record revenues net of consumer incentives and

trade promotions and include all shipping and handling charges billed to customers. We also record provisions for estimated

product returns and customer allowances as reductions to revenues within the same period that the revenue is recognized. We

base these estimates principally on historical and current period experience, however, it is reasonably likely that actual experiences

will vary from the estimates we make.

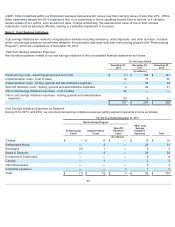

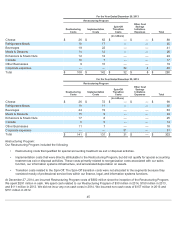

Marketing and Research and Development:

We promote our products with advertising and consumer promotions, consumer incentives, and trade promotions. Consumer

incentives and trade promotions include, but are not limited to, discounts, coupons, rebates, in-store display incentives, and

volume-based incentives. Consumer incentive and trade promotion activities are recorded as a reduction to revenues based on

amounts estimated as being due to customers and consumers at the end of a period. We base these estimates principally on

historical utilization and redemption rates.

For interim reporting purposes, we charge advertising and consumer promotion expenses to operations as a percentage of volume,

based on estimated volume and related expense for the full year. We review and adjust these estimates each quarter based on

actual experience and other information. Advertising expense was $652 million in 2014, $747 million in 2013, and $640 million in

2012. We record marketing expense in selling, general and administrative expense, except for consumer incentives and trade

promotions, which are recorded in net revenues.

We expense costs as incurred for product research and development within selling, general and administrative expenses. Research

and development expense was $149 million in 2014, $142 million in 2013, and $143 million in 2012. The amounts disclosed in prior

periods have been revised to exclude market-based impacts to postemployment benefit plans and certain other costs that are not

directly associated with our research and development activities. The impacts of these revisions to the disclosure were not material

to any prior period.

40