Kraft 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have been advised by the staff of the Commodity Futures Trading Commission (“CFTC”) that they are investigating activities

related to the trading of December 2011 wheat futures contracts. These activities arose prior to the Spin-Off and involve the

business now owned and operated by MondelƝz International or its affiliates. We are cooperating with the staff in its

investigation. In October 2014, the staff advised us that the CFTC intends to commence a formal action. We and MondelƝz

International continue to seek resolution of this matter. Our Separation and Distribution Agreement with MondelƝz International

dated as of September 27, 2012, governs the allocation between MondelƝz International and us and, accordingly, MondelƝz

International will predominantly bear the costs of this matter and any monetary penalties or other payments that the CFTC may

impose. We do not expect this matter to have a material adverse effect on our financial condition or results of operations.

While we cannot predict with certainty the results of Legal Matters in which we are currently involved or may in the future be

involved, we do not expect that the ultimate costs to resolve any of the Legal Matters that are currently pending will have a material

adverse effect on our financial condition or results of operations.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is listed on the NASDAQ Global Select Market (“NASDAQ”). At February 10, 2015, there were approximately

65,000 holders of record of our common stock.

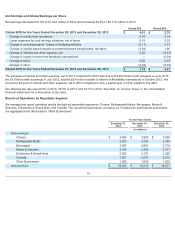

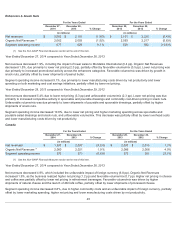

Information regarding our common stock high and low sales prices as reported on NASDAQ and dividends declared is included in

Note 16, Quarterly Financial Data (Unaudited) , to the consolidated financial statements.

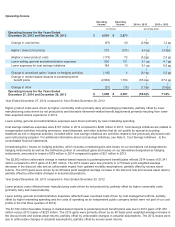

Comparison of Cumulative Total Return

The following graph compares the cumulative total return on our common stock with the cumulative total return of the Standard &

Poor’s 500 Index and our performance peer group index. This graph covers the period from September 17, 2012 (the first day our

common stock began “when-issued” trading on the NASDAQ) through December 26, 2014 (the last trading day of our 2014 fiscal

year). The graph shows total shareholder return assuming $100 was invested on September 17, 2012 and dividends were

reinvested.

14