Kraft 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

For the fiscal year ended December 27, 2014

OR

For the transition period from to

Commission file number 1-35491

Kraft Foods Group, Inc.

(Exact name of registrant as specified in its charter)

Registrant’s telephone number, including area code: (847) 646-2000

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes : No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No :

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act

from their obligations under those sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes : No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files). Yes : No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. :

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

Large accelerated filer : Accelerated filer

Non-accelerated filer

Smaller reporting company

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes No :

The aggregate market value of the shares of common stock held by non-affiliates of the registrant, computed by reference to the closing

price of such stock as of the last business day of the registrant's most recently completed second quarter, was $35 billion. At February 10, 2015,

there were 587,988,695 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission in connection with its

annual meeting of shareholders expected to be held on May 5, 2015 are incorporated by reference into Part III hereof.

:ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Virginia 36-3083135

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

Three Lakes Drive, Northfield, Illinois 60093-2753

(Address of principal executive offices) (Zip Code)

Title of each class Name of each exchange on which registered

Common Stock, no par value The NASDAQ Stock Market LLC

Table of contents

-

Page 1

... number 1-35491 Kraft Foods Group, Inc. (Exact name of registrant as specified in its charter) Virginia (State or other jurisdiction of incorporation or organization) 36-3083135 (I.R.S. Employer Identification No.) Three Lakes Drive, Northfield, Illinois (Address of principal executive offices... -

Page 2

-

Page 3

...14. Part IV Item 15. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 4

... meals, snack nuts, dressings, and other grocery products, primarily in the United States and Canada, under a host of iconic brands. Our product categories span breakfast, lunch, and dinner meal occasions. At December 27, 2014, we had assets of $22.9 billion. We are listed on the NASDAQ Stock Market... -

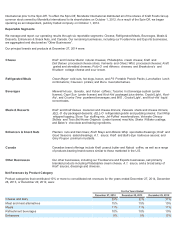

Page 5

... Exports businesses, sell primarily branded products including Philadelphia cream cheese, A.1. sauce, and a broad array of Kraft sauces, dressings and cheeses. Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Net Revenues by Product Category Product... -

Page 6

2 -

Page 7

... other retail food outlets in the United States and Canada. Our five largest customers accounted for approximately 42% of our net revenues in 2014. One of our customers, Wal-Mart Stores, Inc., accounted for approximately 26% of our net revenues in 2014. Sales Our direct customer teams work with the... -

Page 8

...Bell Home Originals Mexican-style food products for sale in U.S. grocery stores. In connection with the Spin-Off, we granted MondelÆz International licenses to use some of our trademarks in particular locations outside of the United States and Canada and we also may sell some products under brands... -

Page 9

... package designs for established products. We have approximately 600 food scientists, chemists, and engineers, with teams dedicated to particular brands and products. We maintain three key technology centers, each equipped with pilot plants and state-of-the-art instruments. Research and development... -

Page 10

... MondelÆz International, a food and beverage company and our former parent, on January 2, 2012 as the Executive Chairman, North American Grocery, and served in that capacity until the Spin-Off. Prior to that, he served as an Industrial Partner at Ripplewood Holdings LLC, a private equity firm, from... -

Page 11

... Ms. List-Stoll has served as our Executive Vice President and Chief Financial Officer since December 29, 2013. She joined Kraft Foods Group on September 3, 2013 and served as Senior Vice President, Corporate Finance until assuming her current role. Prior to joining Kraft Foods Group, she worked for... -

Page 12

product innovation, price, product quality, brand recognition and loyalty, effectiveness of marketing and distribution, promotional activity, and the ability to identify and satisfy consumer preferences. We may need to reduce our prices in response to competitive and customer pressures. These ... -

Page 13

... to drive revenue growth, limit market share decreases in our key product categories or develop innovative products for new and existing categories could materially and adversely affect our product sales, financial condition, and operating results. An impairment of the carrying value of goodwill... -

Page 14

triggering event occurs. The first step of our goodwill impairment test compares the reporting unit's estimated fair value with its carrying value. We estimate a reporting unit's fair value using planned growth rates, market-based discount rates, estimates of residual value, and estimates of market ... -

Page 15

... at key manufacturing or distribution locations, or are unable to quickly repair damage to our information, production, or supply systems, we may be late in delivering, or unable to deliver, products to our customers and may also be unable to track orders, inventory, receivables, and payables. If... -

Page 16

... earnings as a result of these accounting treatments. We are significantly dependent on information technology. We rely on information technology networks and systems, including the Internet, to process, transmit, and store electronic and financial information, to manage a variety of business... -

Page 17

... are located in Northfield, Illinois. Our headquarters are leased and house our executive offices, certain U.S. business units, and our administrative, finance, and human resource functions. We maintain additional owned and leased offices and three technology centers in the United States and Canada... -

Page 18

... 10, 2015, there were approximately 65,000 holders of record of our common stock. Information regarding our common stock high and low sales prices as reported on NASDAQ and dividends declared is included in Note 16, Quarterly Financial Data (Unaudited) , to the consolidated financial statements... -

Page 19

... shares to exercise options or to pay the related taxes for grants of restricted stock, restricted stock units, and performance based long-term incentive awards that vested. (2) On December 17, 2013, our Board of Directors authorized a $3.0 billion share repurchase program with no expiration date... -

Page 20

... of the Company We manufacture and market food and beverage products, including cheese, meats, refreshment beverages, coffee, packaged dinners, refrigerated meals, snack nuts, dressings, and other grocery products, primarily in the United States and Canada. Our product categories span breakfast... -

Page 21

... in Beverages and Enhancers & Snack Nuts, partially offset by higher net pricing in Meals & Desserts and Refrigerated Meals. Favorable volume/mix (0.5 pp) was driven primarily by base business growth, despite an unfavorable product line pruning impact of approximately one percentage point. 17 -

Page 22

... manufacturing costs driven by net productivity and favorable retirement-related benefit adjustments primarily resulting from lowerthan-expected claims experience in 2014. Lower selling, general and administrative expenses were driven primarily by lower marketing spending. Cost savings initiatives... -

Page 23

18 -

Page 24

...partial year in 2012 related to this debt. Our effective tax rate was 25.8% in 2014, 33.6% in 2013, and 33.1% in 2012. See Note 12, Income Taxes, to the consolidated financial statements for a discussion of tax rates. Results of Operations by Reportable Segment We manage and report operating results... -

Page 25

... income: Cheese Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Market-based impacts to postemployment benefit plans Certain other postemployment benefit plan income / (expense) Unrealized (losses) / gains on hedging activities General corporate expenses... -

Page 26

... 14.9%, primarily due to lower manufacturing costs driven by net productivity and higher net pricing, partially offset by higher commodity costs and increased marketing investments primarily in new protein snacks and in lunch combinations. Year Ended December 28, 2013 compared to Year Ended December... -

Page 27

...pp). Lower net pricing was due primarily to lower net pricing in coffee, increased promotions in ready-to-drink beverages, and increased competitive activity in liquid concentrates. Favorable volume/mix was driven primarily by growth in new on-demand coffee and liquid concentrate products as well as... -

Page 28

... and higher marketing spending across spoonable and pourable salad dressings and snack nuts, and unfavorable volume/mix. This decrease was partially offset by lower overhead costs and lower manufacturing costs driven by net productivity. Canada For the Years Ended December 27, 2014 December 28, 2013... -

Page 29

... to prepare our consolidated financial statements. Principles of Consolidation: The consolidated financial statements include Kraft Foods Group, as well as our wholly-owned subsidiaries. All intercompany transactions are eliminated. Our period end date for financial reporting purposes is the last... -

Page 30

... general corporate expenses related to finance, legal, information technology, human resources, compliance, shared services, insurance, employee benefits and incentives, and stock-based compensation. These expenses were allocated in our historical results of operations on the basis of direct... -

Page 31

... postretirement plans. Our 2015 discount rate assumption is 4.17% for our U.S. pension plans and 3.87% for our non-U.S. pension plans. We model these discount rates using a portfolio of high quality, fixedincome debt instruments with durations that match the expected future cash flows of the benefit... -

Page 32

...employees and retirees. Our consolidated statements of earnings for the year ended December 29, 2012 included expense allocations for these benefits of $491 million through September 30, 2012, which were determined based on a review of personnel by business unit and based on allocations of corporate... -

Page 33

... in 2014, $2.0 billion in 2013, and $3.0 billion in 2012. Net earnings in 2014 included significant unfavorable non-cash market-based impacts to postemployment benefit plans and the related deferred tax effects. Operating cash flows in 2014 also reflected lower pension contributions. Net earnings in... -

Page 34

...related to our income tax obligations as of December 27, 2014. Equity and Dividends On December 17, 2013, our Board of Directors authorized a $3.0 billion share repurchase program with no expiration date. Under the share repurchase program, we are authorized to repurchase shares of our common stock... -

Page 35

... to net revenues is set forth below. 2014 Compared to 2013 Net Revenues Impact of Currency Sales to MondelÆz International Organic Net Revenues (in millions) Year Ended December 27, 2014 Cheese Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Total... -

Page 36

... commodity prices, foreign currency exchange rates, and interest rates. We also sell commodity futures to unprice future purchase commitments, and we occasionally use related futures to crosshedge a commodity exposure. We are not a party to leveraged derivatives and, by policy, do not use financial... -

Page 37

... prices, foreign currency rates, and interest rates under normal market conditions. The computation does not represent actual losses in fair value or earnings to be incurred by us, nor does it consider the effect of favorable changes in market rates. We cannot predict actual future movements... -

Page 38

Item 8. Financial Statements and Supplementary Data. Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Kraft Foods Group, Inc.: In our opinion, the consolidated financial statements listed in the index appearing under Item 15(a) present fairly, in ... -

Page 39

Kraft Foods Group, Inc. Consolidated Statements of Earnings (in millions of U.S. dollars, except per share data) For the Years Ended December 27, 2014 December 28, 2013 December 29, 2012 Net revenues Cost of sales Gross profit Selling, general and administrative expenses Asset impairment and exit ... -

Page 40

... Foods Group, Inc. Consolidated Statements of Comprehensive Earnings (in millions of U.S. dollars) For the Years Ended December 27, 2014 December 28, 2013 December 29, 2012 Net earnings Other comprehensive (losses) / earnings: Currency translation adjustment Postemployment benefits: Prior service... -

Page 41

... in 2014 and $26 in 2013) Inventories Deferred income taxes Other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other assets TOTAL ASSETS LIABILITIES Current portion of long-term debt Accounts payable Accrued marketing Accrued employment costs... -

Page 42

... 28, 2013 Comprehensive earnings / (losses): Net earnings Other comprehensive losses, net of income taxes Exercise of stock options, issuance of other stock awards, and other Repurchase of common stock under share repurchase program Dividends declared ($2.15 per share) Balance at December 27, 2014... -

Page 43

...: Depreciation and amortization Stock-based compensation expense Deferred income tax provision Asset impairments Market-based impacts to postemployment benefit plans Other non-cash expense, net Change in assets and liabilities: Receivables, net Inventories Accounts payable Other current assets Other... -

Page 44

...Foods Group," "we," "us," and "our") manufactures and markets food and beverage products, including cheese, meats, refreshment beverages, coffee, packaged dinners, refrigerated meals, snack nuts, dressings, and other grocery products, primarily in the United States and Canada. Our product categories... -

Page 45

... annually in the fourth quarter or when a triggering event occurs. The first step of the goodwill impairment test compares the reporting unit's estimated fair value with its carrying value. We estimate a reporting unit's fair value using planned growth rates, market-based discount rates, estimates... -

Page 46

... plans is charged to expense over the working life of the covered employees. We account for defined benefit costs using a mark-to-market policy. Under this accounting method, we recognize net actuarial gains or losses and changes in the fair value of plan assets in cost of sales and selling, general... -

Page 47

...year be governed by an International Swaps and Derivatives Association master agreement. We are also exposed to market risk as the value of our financial instruments might be adversely affected by a change in foreign currency exchange rates, commodity prices, or interest rates. We manage market risk... -

Page 48

... with the sales. Note 4. Goodwill and Intangible Assets Goodwill by reportable segment at December 27, 2014 and December 28, 2013 was: December 27, 2014 (in millions) December 28, 2013 Cheese Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Goodwill... -

Page 49

... December 27, 2014 Restructuring Program Spin-Off Transition Costs (in millions) Other Cost Savings Initiatives Expenses Restructuring Costs Implementation Costs Total Cheese Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Corporate expenses Total... -

Page 50

... December 28, 2013 Restructuring Program Spin-Off Transition Costs (in millions) Other Cost Savings Initiatives Expenses Restructuring Costs Implementation Costs Total Cheese Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Corporate expenses Total... -

Page 51

... credit facility. The credit facility replaced our $3.0 billion five-year credit agreement dated as of May 18, 2012. Long-Term Debt: Our long-term debt consists of the following at December 27, 2014 and December 28, 2013: December 27, 2014 December 28, 2013 Maturity Date Fixed Interest Rate Payment... -

Page 52

... December 27, 2014, December 28, 2013 or December 29, 2012. On December 17, 2013, our Board of Directors authorized a $3.0 billion share repurchase program with no expiration date. Under the share repurchase program, we are authorized to repurchase shares of our common stock in the open market or in... -

Page 53

... life of the options based on our stated dividend policy. The stock option awards granted in 2012 were prior to the Spin-Off. Therefore, we estimated the value of those awards based on MondelÆz International's share price and assumptions. A summary of stock option activity related to our shares... -

Page 54

.... We granted these shares based on the final business performance rating for the 2011-2013 award cycle. These shares were adjusted and converted into new equity awards using a formula designed to preserve the value of the awards immediately prior to the Spin-Off. • Also during 2014, we granted... -

Page 55

... health care benefits, and other postemployment benefits, as follows: • Pension benefits - We provide pension coverage to certain U.S. and non-U.S. employees through separate plans. Local statutory requirements govern many of these plans. Salaried and non-union hourly employees hired prior to 2009... -

Page 56

... (14) $ The accumulated benefit obligation, which represents benefits earned to the measurement date, was $6,777 million at December 27, 2014 and $5,781 million at December 28, 2013 for the U.S. pension plans. The accumulated benefit obligation for the non-U.S. pension plans was $1,231 million at... -

Page 57

...December 28, 2013: U.S. Plans December 27, 2014 December 28, 2013 Non-U.S. Plans December 27, 2014 December 28, 2013 Discount rate Rate of compensation increase 4.17% 4.00% 4.94% 4.00% 3.87% 3.00% 4.56% 3.00% Components of Net Pension Cost / (Benefit): Net pension cost / (benefit) consisted of... -

Page 58

...41 million from market-based impacts into inventory. Net pension costs included settlement losses of $69 million in 2013 related to retiring employees who elected lump-sum payments. Net pension costs also included special termination benefits associated with our voluntary early retirement program of... -

Page 59

...certain government bonds valued using quoted prices in active markets. • Level 2 - includes primarily pooled funds valued using net asset values of participation units held in common collective trusts, as reported by the managers of the trusts and as supported by the unit prices of actual purchase... -

Page 60

... to our non-U.S. pension plans. In addition, employees contributed $4 million in 2014 to our non-U.S. plans and $5 million in 2013. Future Benefit Payments: The estimated future benefit payments from our pension plans at December 27, 2014 were: U.S. Plans Non-U.S. Plans (in millions) 2015 2016 2017... -

Page 61

... Year-end discount rates for our U.S. and non-U.S. plans were developed from a model portfolio of high-quality, fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Our expected health care cost trend rate is based on historical costs... -

Page 62

... benefits were associated with our voluntary early retirement program in 2013. As of December 27, 2014, we expected to amortize an estimated $33 million of prior service credits from accumulated other comprehensive earnings / (losses) into net postretirement health care costs during 2015. We used... -

Page 63

...December 27, 2014 December 28, 2013 Discount rate Assumed ultimate annual turnover rate Rate of compensation increase 2.86% 0.50% 4.00% 3.10% 0.50% 4.00% Other postemployment costs arising from actions that offer employees benefits in excess of those specified in the respective plans are charged... -

Page 64

... of 2012 prior to the SpinOff. The expense allocations for these benefits were determined based on a review of personnel by business unit and based on allocations of corporate or other shared functional personnel. These allocated costs are reflected in our cost of sales and selling, general and... -

Page 65

... forwards are valued using an income approach based on the observable market commodity index prices less the contract rate multiplied by the notional amount. Foreign exchange forwards are valued using an income approach based on observable market forward rates less the contract rate multiplied by... -

Page 66

.... In October 2014, the staff advised us that the CFTC intends to commence a formal action. We and MondelÆz International continue to seek resolution of this matter. Our Separation and Distribution Agreement with MondelÆz International dated as of September 27, 2012, governs the allocation between... -

Page 67

... 27, 2014 December 28, 2013 (in millions) December 29, 2012 $ $ 106 85 62 49 41 84 427 Earnings before income taxes: United States Outside United States Total Provision for income taxes: United States federal: Current Deferred State and local: Current Deferred Total United States Outside United... -

Page 68

... 27, 2014 December 28, 2013 December 29, 2012 U.S. federal statutory rate Increase / (decrease) resulting from: U.S. state and local income taxes, net of federal tax benefit Domestic manufacturing deduction Foreign rate differences Changes in uncertain tax positions Other Effective tax rate 35... -

Page 69

...2014 (in millions) December 28, 2013 Deferred income tax assets: Pension benefits Postretirement benefits Other employee benefits Other Total deferred income tax assets Valuation allowance Net deferred income tax assets Deferred income tax liabilities: Trade names Property, plant and equipment Debt... -

Page 70

...22) Earnings before income taxes 9 Provision for income taxes (13) Net earnings These accumulated other comprehensive losses components are included in the computation of net periodic pension and postretirement health care costs. See Note 9, Postemployment Benefit Plans , for additional information... -

Page 71

... 15. Segment Reporting We manufacture and market food and beverage products, including cheese, meats, refreshment beverages, coffee, packaged dinners, refrigerated meals, snack nuts, dressings, and other grocery products, primarily in the United States and Canada. We manage and report our operating... -

Page 72

..., 2014 December 28, 2013 (in millions) December 29, 2012 Earnings before income taxes: Operating income: Cheese Refrigerated Meals Beverages Meals & Desserts Enhancers & Snack Nuts Canada Other Businesses Market-based impacts to postemployment benefit plans Certain other postemployment benefit plan... -

Page 73

...Snack Nuts Canada Other Businesses Total capital expenditures Concentration of risk: $ $ 152 110 115 50 37 53 18 535 $ $ 150 80 146 68 33 60 20 557 $ $ 84 83 129 63 37 33 11 440 Our largest customer, Wal-Mart Stores, Inc., accounted for approximately 26% of net revenues in 2014 and in 2013... -

Page 74

...Ended December 27, 2014 December 28, 2013 (in millions) December 29, 2012 Cheese and dairy Meat and meat alternatives Meals Refreshment beverages Enhancers Coffee Desserts, toppings and baking Nuts and salted snacks Other Total net revenues Note 16. Quarterly Financial Data (Unaudited) $ $ 5,954... -

Page 75

...in Internal Control Over Financial Reporting Management's annual report on internal control over financial reporting (as defined in Rules 13a-15(f) and 15(d)-15(f) of the Exchange Act) is set forth below. The related report of our independent registered public accounting firm is contained in Part II... -

Page 76

... also audited the effectiveness of our internal control over financial reporting as of December 27, 2014, as stated in their report which appears herein under Item 8. February 19, 2015 Item 9B. Other Information. None. PART III Item 10. Directors, Executive Officers and Corporate Governance. We have... -

Page 77

... employees to purchase shares of Kraft Foods Group common stock at a discount of up to 15% of the market price of Kraft Foods Group common stock on the date of purchase. Information related to the security ownership of certain beneficial owners and management is included in our 2015 Proxy Statement... -

Page 78

...are not applicable. (b) The following exhibits are filed as part of, or incorporated by reference into, this Annual Report: 2.1 Separation and Distribution Agreement between MondelÆz International, Inc. (formerly known as Kraft Foods Inc.) and Kraft Foods Group, Inc., dated as of September 27, 2012... -

Page 79

73 -

Page 80

... to Exhibit 4.3 to our Registration Statement on Form S-8 filed with the SEC on September 12, 2012 (File No. 333183868)).+ Kraft Foods Group, Inc. Management Stock Purchase Plan.+ Form of Indemnity Agreement between Kraft Foods Group, Inc. and Non-Management Directors (incorporated by reference to... -

Page 81

...11 Offer of Employment Letter between MondelÆz International, Inc. (formerly known as Kraft Foods Inc.) and Kim K. W. Rucker, dated July 16, 2012 (incorporated by reference to Exhibit 10.25 to Amendment No. 2 to our Registration Statement on Form S-4 filed with the SEC on December 4, 2012 (File No... -

Page 82

... Restricted Stock Unit Agreement.+ Retirement Agreement and General Release between Kraft Foods Group, Inc. and W. Anthony Vernon, dated as of December 18, 2014.+ List of subsidiaries of Kraft Foods Group, Inc. Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm... -

Page 83

... duly authorized. KRAFT FOODS GROUP, INC. /s/ Teri List-Stoll Teri List-Stoll Executive Vice President and Chief Financial Officer Date: February 19, 2015 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of... -

Page 84

E. Follin Smith /S/ W. ANTHONY VERNON W. Anthony Vernon Director February 19, 2015 76 -

Page 85

.... D Col. E Description Deductions (b) 2014: Allowances related to accounts receivable Allowance for deferred taxes 2013: Allowances related to accounts receivable Allowance for deferred taxes 2012: Allowances related to accounts receivable Allowance for deferred taxes $ $ 26 3 29 $ $ (2) $ 20... -

Page 86

EXHIBIT 10.4 Kraft Foods Group, Inc. Change in Control Plan for Key Executives Adopted: October 2, 2012 As Amended Effective June 23, 2014 -

Page 87

-

Page 88

... any base salary that has been earned and deferred. Board The Board of Directors of the Company. The annual incentive award that the Participant would receive in a fiscal year under Annual Incentive Award the Management Incentive Plan or any comparable annual incentive plan if the target goals... -

Page 89

... by an employee benefit plan or related trust sponsored or maintained by the Company or any of its Affiliates; or (3) any acquisition pursuant to a merger or consolidation described in clause (C) of this definition. (B) During any consecutive 24 month period, persons who constitute the Board at the... -

Page 90

Company Kraft Foods Group, Inc., a corporation organized under the laws of the Commonwealth of Virginia, or any successor thereto. -

Page 91

... Employer and (i) is serving as the Company' s Chief Executive Officer, (ii) is serving in an executive position that reports directly to the Company' s Chief Executive Officer ("Direct Reports"), (iii) is otherwise a member of the Kraft Leadership Team ("KLT Member") or (iv) is otherwise designated... -

Page 92

-

Page 93

... country or the legally enforceable programs or policies of the Employer in such designated home country, is entitled to receive, in the event of termination of employment (whether or not by reason of a Change in Control), separation benefits at least equal in aggregate amount to the Separation Pay... -

Page 94

... Pay Multiple is two (2). Separation Pay Multiple For all other Participants, the Separation Pay Multiple is one and one-half (1.5). U.S. Executive A Participant whose designated home country, for purposes of the Employer's personnel and benefits programs and policies, is the United States... -

Page 95

...'s base salary, annual incentive or long-term incentive opportunity as in effect immediately prior to the Change in Control; the Employer requiring the Participant to be based at any office or location other than any other location which does not extend the Participant's home to work commute... -

Page 96

...if the Participant signs a Non-Competition Agreement and a NonSolicitation Agreement, the Company shall pay or provide, as the case may be, to the Participant the amounts and benefits set forth in items (a) through (e) below (the "Separation Benefits"): (a) The Employer shall pay to the Participant... -

Page 97

... in sub clauses (B) and (C), shall be reduced by any amount paid or payable under the Kraft Foods Group, Inc. 2012 Performance Incentive Plan on account of the same fiscal year or performance cycle, as applicable. (b) The Employer also shall pay to the Participant, in a lump sum in cash within 30... -

Page 98

... costs payable by the Company pursuant to Sections 3.3(c) and (e) hereof. For all purposes under the applicable Company non-qualified defined benefit pension plan, the Company shall credit the Participant with a number of additional years of service equal to the applicable Separation Pay Multiple... -

Page 99

...in the following order: first, Separation Pay under Section 3.3(b), then Accrued Obligations payable under Section 3.3(a), other than Annual Base Salary through the Date of Termination, followed by outplacement services payable under Section 3.3(d), welfare benefits payable under Section 3.3(c), and... -

Page 100

...Company and its Affiliates to pay or provide the Separation Benefits described in Section 3.3 are contingent on the Participant's (for him/herself, his/her heirs, legal representatives and assigns) agreement to execute a general release in the form and substance to be provided by Employer, releasing... -

Page 101

... Employer based on matters covered by Section 409A of the Code, including the tax treatment of any award made under the Plan, and the Employer shall not under any circumstances have any liability to any Participant or other person for any taxes, penalties or interest due on amounts paid or payable... -

Page 102

... plans, programs, policies and arrangements of the Company or its Affiliates providing severance benefits, EXCEPT FOR the 2012 Performance Incentive Plan. IN WITNESS WHEREOF, the Company has caused this Plan to be executed by its duly authorized officer effective as of the Effective Date set forth... -

Page 103

KRAFT FOODS GROUP, INC. By: /s/ Diane Johnson May Diane Johnson May Executive Vice President, Human Resources -

Page 104

EXHIBIT 10.7 Kraft Foods Group, Inc Management Stock Purchase Plan - PLAN DOCUMENT - -

Page 105

... This Kraft Foods Group, Inc. Management Stock Purchase Plan (this "MSPP") was adopted by the Board of Directors (the "Board") of Kraft Foods Group, Inc. (the "Company") on October 29, 2012 and amended on January 30, 2014 and January 1, 2015. This MSPP is intended to provide certain key employees of... -

Page 106

... the Shares are listed, quoted or traded, or, if no such sale of Shares is reported on such date, the fair market value of the Shares as determined by the Committee in good faith. Any DCU granted to a Participant under this MSPP shall be credited to a Deferred Compensation Unit bookkeeping account... -

Page 107

... affiliate's pension plan, as the case may be, (ii) for a retirement not set forth in Section 4.3(c)(i) above, the effective date of the Participant's retirement, provided that such Participant's Matching RSUs shall vest on a pro rata basis calculated based on the months of service completed during... -

Page 108

... of descent and distribution. In no event may any award be transferred in exchange for consideration. 7.4 Representations and Restrictions . The Committee may require each person acquiring Shares pursuant to an award to represent to and agree with the Company in writing that such person is acquiring... -

Page 109

... are part of, or are received upon conversion of, the award that gives rise to the withholding requirement. In no event shall the Fair Market Value of the Shares to be withheld and delivered pursuant to this Section 7.6 to satisfy applicable withholding taxes in connection with the benefit exceed... -

Page 110

... date the application was received. 8.3 Notice of Denial of Claim. In the event that any Participant, beneficiary or other claimant claims to be entitled to a benefit under this MSPP, and the Committee determines that such claim should be denied, in whole or in part, the Committee shall, in writing... -

Page 111

... Chief Executive Officer of Kraft Foods Group, Inc. ("Kraft" or the "Company"), effective December 28, 2014. This letter sets forth all of the terms and conditions of the offer. Annualized Compensation (Range of Opportunity) Target 1,100,000 1,760,000 6,640,000 9,500,000 Annual Base Salary Annual... -

Page 112

... position of Chief Executive Officer of Kraft, the treatment of equity awards granted to you upon assumption of that role or at any other future date while you remain CEO (unless specifically stated otherwise in the applicable stock award agreement) will be as follows: Reason CEO Position No Longer... -

Page 113

...-tax basis a portion of your salary and/or your annual incentive to a future date. Investment opportunities under this program are designed to mirror the Company' s 401(k) plan. Additional information for this program will be provided to you upon request. Management Stock Purchase Plan (MSPP) Kraft... -

Page 114

...sign a non-competition and non-solicitation agreement, which includes, among other things, restrictions from working for a competitor and/or soliciting business or employees away from Kraft for 12 months following any termination of employment or, if longer, the period during which you are receiving... -

Page 115

Page 5 (c) your right to reimbursement or in-kind benefits is not subject to liquidation or exchange for any other benefit. -

Page 116

If you have any questions, you can reach me at (847) 646-2000. Sincerely, __/s/ Diane Johnson May_____ Diane Johnson May Executive Vice President, Human Resources I accept the offer as expressed above. __/s/ John T. Cahill _____ _ Signature Date John T. Cahill 12/17/2014 -

Page 117

... while an employee of the Company, or any customer about which I had access to confidential information by virtue of my employment with the Company; or disclose to any person, firm, association, corporation or business entity of any kind the names or addresses of any such customer; or directly or... -

Page 118

... THE TERMS, CONSEQUENCES, AND BINDING EFFECT OF THIS AGREEMENT AND FULLY UNDERSTAND IT. FINALLY, I AGREE THAT I HAVE BEEN PROVIDED AN OPPORTUNITY TO SEEK THE ADVICE OF AN ATTORNEY OF MY CHOICE BEFORE SIGNING THIS AGREEMENT. John T. Cahill /s/ John T. Cahill Employee Signature 12/17/2014 Date -

Page 119

... employee identified in the Award Statement (the " Optionee ") attached hereto under the Kraft Foods Group, Inc. 2012 Performance Incentive Plan (the " Plan ") a non-qualified stock option (the " Option "). The Option entitles the Optionee to exercise up to the aggregate number of shares set forth... -

Page 120

... Shares being exercised upon any exercise of this Option unless it has received payment in a form acceptable to the Company for all applicable Tax-Related Items, as well as amounts due to the Company as " theoretical taxes " pursuant to the then-current international assignment and tax and/or social... -

Page 121

... by the Optionee, to withhold all applicable Tax-Related Items legally due by the Optionee and any theoretical taxes from the Optionee' s wages or other cash compensation paid by the Company and/or the Employer or from proceeds of the sale of Option Shares acquired at exercise either through... -

Page 122

...-ofservice payments, bonuses, long-service awards, pension, retirement or welfare benefits; (g) (h) the future value of the underlying Option Shares is unknown, indeterminable and cannot be predicted with certainty; if the underlying shares of Common Stock do not increase in value, the Option will... -

Page 123

... the Company and the Employer may hold certain personal information about the Optionee, including, but not limited to, the Optionee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or... -

Page 124

...or her local human resources representative. 12. Interpretation . The terms and provisions of the Plan (a copy of which will be furnished to the Optionee upon written request to the Office of the Corporate Secretary, Kraft Foods Group, Inc., Three Lakes Drive, Northfield, Illinois, U.S.A. 60093) are... -

Page 125

...' s participation in the Plan, on the Option, and on any shares of Common Stock acquired under the Plan, to the extent the Company determines it is necessary or advisable for legal or administrative reasons, and to require the Optionee to sign any additional agreements or undertakings that may be... -

Page 126

... promotes the business goodwill of the Company by fostering productive, long-term relationships between the Company and its employees. As a result of the Optionee' s position and the Optionee' s Partners, and employee contacts, the Optionee recognizes that the Optionee will gain valuable information... -

Page 127

... the Optionee had access to confidential information by virtue of the Optionee's employment with the Company; or disclose to any person, firm, association, corporation or business entity of any kind the names or addresses of any such customer; or directly or indirectly in any way request, suggest... -

Page 128

... III from any amounts payable by or on behalf of the Company or any Affiliate to the Optionee, including, without limitation, any amount payable to the Optionee as salary, wages, vacation pay, bonus or the settlement of any exercised Option Shares or any stock-based award. This right of setoff... -

Page 129

... of shares of Common Stock to pay the Grant Price or any Tax-Related Items in connection with the Option. Form of Settlement. Options granted to employees resident in Canada shall be paid in shares of Common Stock only. The following provisions apply for Optionees employed in Quebec: Data Privacy... -

Page 130

... Securities Law Information. The Optionee is permitted to sell shares of Common Stock acquired under the Plan through the designated broker appointed under the Plan, if any, provided that the sale of shares of Common Stock takes place outside of Canada through the facilities of a stock exchange on... -

Page 131

..., in its sole discretion. (d) "GAAP" means U.S. generally accepted accounting principles. (e) "PSP Award Share Payout" means an amount equal to the (i) the PSP Award Target, divided by (ii) the Fair Market Value of a share of Common Stock on the annual stock grant date, rounded up to the next whole... -

Page 132

... "Normal Retirement" means retirement from active employment under a pension plan of the Company or an Affiliate, on or after the date specified as normal retirement age in the pension plan, if any, under which the Participant is at that time accruing pension benefits for his or her current service... -

Page 133

... to the terms and conditions of the 2012 Plan and shall reduce the number of shares available for issuance thereunder. (ii) Dividends . The PSP Award payment shall include the total amount of dividends paid on each share of Common Stock having a record date during the period beginning on first day... -

Page 134

... Taxes . Regardless of any action the Company or the Participant's employer (the " Employer ") takes with respect to any or all income tax, social insurance, payroll tax, payment on account or other tax-related items related to the Participant's participation in the 2012 Plan and legally applicable... -

Page 135

... method be used to satisfy any Tax Related Items withholding. Shares of Common Stock deducted from the payment of this PSP Award in satisfaction of Tax-Related Items withholding shall be valued at the Fair Market Value of the Common Stock received in payment of the vested PSP Award on the date as of... -

Page 136

... and the United States Dollar that may affect the value of the PSP Award, any shares of Common Stock paid to the Participant or any proceeds resulting from the Participant's sale of such shares . 7. Data Privacy . By participating in the 2012 Plan and in exchange for receiving the PSP Award, the... -

Page 137

... applicable law, including the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act, or any securities exchange on which the Common Stock is listed or traded, as may be in effect from time to time as well as any policy relating to the repayment or forfeiture of compensation... -

Page 138

... or sale of any shares of Common Stock issued in payment of the PSP Award. The Participant is hereby advised to consult with his or her own personal tax, legal and financial advisors before taking any action related to the PSP Award. 23. Language . If the Participant has received this Agreement or... -

Page 139

... system established and maintained by the Company or a third party designated by the Company. 26. Imposition of Other Requirements . The Company reserves the right to impose other requirements on the Participant's participation in the 2012 Plan or on the PSP Award and on any shares of Common Stock... -

Page 140

... that merely limiting the Partners, and employees Participant can solicit after termination will not be sufficient to protect the Company's legitimate business interests. (b) Non-Competition and Non-Solicitation Obligations . Therefore, in exchange for receiving the PSP Award, the Participant... -

Page 141

... which the Participant had access to confidential information by virtue of the Participant's employment with the Company; or disclose to any person, firm, association, corporation or business entity of any kind the names or addresses of any such customer; or directly or indirectly in any way request... -

Page 142

... Section III from any amounts payable by or on behalf of the Company or any Affiliate to the Participant, including, without limitation, any amount payable to the Participant as salary, wages, vacation pay, bonus or the settlement of the PSP Award or any stock-based award. This right of setoff shall... -

Page 143

... contained herein shall be applicable to the Participant. CANADA TERMS AND CONDITIONS Time and Form of Payment. PSP Awards granted to employees resident in Canada shall be paid in shares of Common Stock only. Termination of Employment Before Vesting Date . This provision supplements Section... -

Page 144

information in his or her employee file. -

Page 145

... is permitted to sell shares of Common Stock acquired under the Agreement through the designated broker appointed under the 2012 Plan, if any, provided that the sale of shares takes place outside of Canada through the facilities of a stock exchange on which the shares are listed ( i.e. , the NASDAQ... -

Page 146

...KRAFT FOODS GROUP, INC. 2012 PERFORMANCE INCENTIVE PLAN GLOBAL RESTRICTED STOCK UNIT AGREEMENT KRAFT FOODS GROUP, INC., a Virginia corporation (the " Company "), hereby grants to the employee (the " Employee ") named in the Award Statement attached hereto (the " Award Statement ") as of the date set... -

Page 147

... authorization by the Employee, to withhold all applicable Tax-Related Items legally due by the Employee and any theoretical taxes from the Employee' s wages or other cash compensation paid by the Company and/or the Employer or from proceeds of the sale of the shares of Common Stock issued upon... -

Page 148

... the Employee at such time in accordance with Section 7 (based on the value of shares of Common Stock at the time of payment), subject to a six-month delay from the date treated as a separation from service within the meaning of Section 409A(a)(2)(A)(i) of the Code. Original Issue or Transfer Taxes... -

Page 149

... Stock; (j) the Employee is hereby advised to consult with the Employee' s own personal tax, legal and financial advisors regarding the Employee' s participation in the Plan before taking any action related to the Plan; the award of Restricted Shares and the benefits evidenced by this Agreement... -

Page 150

... of the Data by contacting the Employee's local human resources representative. The Employee authorizes the Company, UBS and any other possible recipients which may assist the Company (presently or in the future) with implementing, administering and managing the Plan to receive, possess, use, retain... -

Page 151

... Foods Group or under an employment contract with any member of the Kraft Foods Group, on or after the date specified as the normal retirement age in the pension plan or employment contract, if any, under which the Employee is at that time accruing pension benefits for his or her current service... -

Page 152

... the Company determines it is necessary or advisable in order to comply with laws in the country where the Employee resides regarding the issuance of shares of Common Stock, or to facilitate the administration of the Plan, and to require the Employee to sign any additional agreements or undertakings... -

Page 153

..., promotes the business goodwill of the Company by fostering productive, long-term relationships between the Company and its employees. As a result of the Employee' s position and Employee' s Partners, and employee contacts, the Employee recognizes that the Employee will gain valuable information... -

Page 154

... the Company, or any customer about which the Employee had access to confidential information by virtue of the Employee' s employment with the Company; or disclose to any person, firm, association, corporation or business entity of any kind the names or addresses of any such customer; or directly or... -

Page 155

...this Section III from any amounts payable by or on behalf of the Company or any Affiliate to the Employee, including, without limitation, any amount payable to the Employee as salary, wages, vacation pay, bonus or the settlement of the Restricted Shares or any stock-based award. This right of setoff... -

Page 156

... KRAFT FOODS GROUP, INC. 2012 PERFORMANCE INCENTIVE PLAN GLOBAL RESTRICTED STOCK UNIT AGREEMENT TERMS AND CONDITIONS This Appendix B includes additional terms and conditions that govern the Restricted Shares granted to the Employee under the Plan if he or she resides in one of the countries listed... -

Page 157

..., the Employee is permitted to sell shares of Common Stock acquired under the Plan through the designated broker appointed under the Plan, if any, provided that the sale of shares of Common Stock takes place outside of Canada through the facilities of a stock exchange on which the shares are listed... -

Page 158

... Retirement Date. The sole compensation that the Executive will receive for his service as a director in the period between the Retirement Date and the date of Kraft' s 2015 Annual Meeting of Shareholders will be a pro-rated portion of the annual cash compensation provided to Kraft' s non-employee... -

Page 159

... Thrift Plan benefits shall be paid no earlier than September 30, 2015, with the specific date determined in accordance with the terms of the Supplemental Thrift Plan. Executive shall receive a 2014 Management Incentive Plan (MIP) payment, payable based on Executive' s individual 2014 target... -

Page 160

... he has used in the course of his employment, no later than Retirement Date; provided, however, that Executive may retain only such company property relating to his service as a director through the date of Kraft' s 2015 Annual Meeting of Shareholders. 5. As consideration for Kraft' s payment to the... -

Page 161

..., such as financial and sales data (including budgets, forecasts and historical financial data), operational information, plans and strategies; business and marketing strategies and plans for various products and services; information regarding suppliers, consultants, employees, and contractors... -

Page 162

... are members of the Kraft Leadership Team or members of the Kraft Board of Directors as of the date hereof (the "Kraft Covered Persons") will knowingly make any public statement that would disparage Executive; provided however that statements by Kraft and the Kraft Covered Persons that are made in... -

Page 163

...Kraft, including its predecessors, successors, parents, subsidiaries, affiliated corporations, limited liability companies and partnerships, and all of their employee benefit plans, officers, directors, fiduciaries, employees, assigns, representatives, agents, and counsel (collectively the "Released... -

Page 164

... and the Executive will not receive the payments or benefits that are being provided by this Agreement. The Executive also understands that if he does not revoke this Agreement within 7 days after he signs it, this Agreement shall become effective as of such date and will be complete, final and... -

Page 165

/s/ William A. Vernon William A. Vernon Date: 12/18/2014 ACCEPTED FOR KRAFT FOODS GROUP, INC. By: /s/ Diane Johnson May Diane Johnson May Title: Executive Vice President, Human Resources Date: 12/17/2014 -

Page 166

... BBQ Company KFG Management Services LLC KFG Netherlands Holdings C.V. Kraft Canada Inc. Kraft Food Ingredients Corp. Kraft Foods Group Brands LLC Kraft Foods Group Exports LLC Kraft Foods Group Foundation Kraft Foods Group Holdings LLC Kraft Foods Group International Holdings LLC Kraft Foods Group... -

Page 167

... PUBLIC ACCOUNTING FIRM We hereby consent to the incorporation by reference in the Registration Statements on Form S-3 (No. 333-191647) and S-8 (Nos. 333-184873, 333-184872, 333-184180, 333-183868, 333-183867, and 333-183866) of Kraft Foods Group, Inc. of our report dated February 19, 2015 relating... -

Page 168

... financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 19, 2015 /s/ John T. Cahill John T. Cahill Chairman and Chief Executive Officer... -

Page 169

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 19, 2015 /s/ Teri List-Stoll Teri List-Stoll Executive Vice President... -

Page 170

... List-Stoll, Executive Vice President and Chief Financial Officer of Kraft Foods Group, Inc. ("Kraft"), certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that Kraft's Annual Report on Form 10-K for the period ended December 27, 2014...