IHOP 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

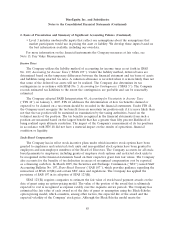

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

Advertising

Franchise fees designated for IHOP’s national advertising fund and local marketing and advertising

cooperatives are recognized as revenue as the fees are earned and become receivables from the

franchisee in accordance with SFAS No. 45, Accounting for Franchise Fee Revenue (‘‘SFAS 45’’). In

accordance with Statement of Position No. 93-7, Reporting on Advertising Costs (‘‘SOP 93-7), related

advertising obligations are accrued and the costs expensed at the same time the related revenue is

recognized. Franchise fees designated for Applebee’s national advertising fund and local advertising

cooperatives constitute agency transactions and are not recognized as revenues and expenses. In both

cases, the advertising fees are recorded as a liability against which specific costs are charged.

Advertising expense reflected in the consolidated statements of operations includes local marketing

advertising costs incurred by company-operated restaurants, contributions to the national advertising

fund made by Applebee’s company-operated restaurants and certain advertising costs incurred by the

Company to benefit future franchise operations. Costs of advertising is expensed either as incurred or

the first time the advertising takes place in accordance with SOP 93-7. Advertising expense included in

company restaurant operations and franchise operations for the years ended December 31, 2008, 2007

and 2006 was $45.3 million, $5.0 million and $1.0 million, respectively. In addition, significant

advertising expenses also are incurred by franchisees through the national advertising funds and local

marketing and advertising cooperatives.

83