IHOP 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

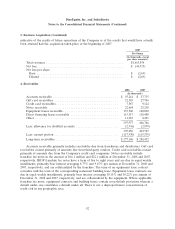

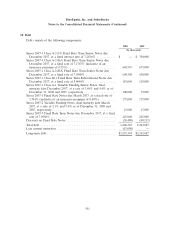

8. Goodwill and Other Intangible Assets (Continued)

The Company did not have any intangible assets prior to the November 29, 2007 acquisition of

Applebee’s. As of December 31, 2008, intangible assets arising from the Applebee’s acquisition are as

follows:

Not Subject to

Amortization Subject to Amortization

Liquor Franchising Recipes and

Tradename Licenses Rights Menus Leaseholds Total

Balance, December 31, 2006 .... $ — $ — $ — $ — $ — $ —

Acquisition of business ........ 790,000 6,374 200,485 15,730 — 1,012,589

Amortization expense ......... — — (981) (151) — (1,132)

Balance, December 31, 2007 .... 790,000 6,374 199,504 15,579 — 1,011,457

Additions ................. — — — — 7,276 7,276

Purchase price adjustments ..... — (1,695) — — 376 (1,319)

Amortization expense ......... — — (10,027) (2,106) (1,652) (13,785)

Impairment ................ (44,064) — — — — (44,064)

Refranchising .............. — (1,757) — — (1,772) (3,529)

Balance, December 31, 2008 .... $745,936 $ 2,922 $189,477 $13,473 $ 4,228 $ 956,036

Annual amortization expense for next five fiscal years is estimated to be approximately

$13.1 million annually. The weighted average life of the intangible assets subject to amortization is 18.7

and 19.3 years at December 31, 2008 and 2007, respectively.

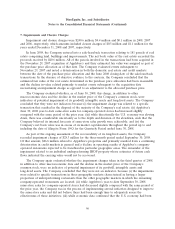

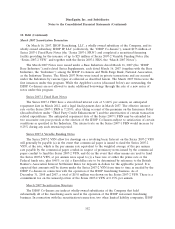

Gross and net carrying amounts of intangible assets subject to amortization at December 31, 2008

and 2007 are as follows:

December 31, 2008 December 31, 2007

Accumulated Accumulated

Gross Amortization Net Gross Amortization Net

(In thousands)

Franchising rights ......... $200,485 $(11,008) $189,477 $200,485 $ (981) $199,504

Recipes and menus ........ 15,730 (2,257) 13,473 15,730 (151) 15,579

Leaseholds .............. 5,880 (1,652) 4,228 — — —

Total .................... $222,095 $(14,917) $207,178 $216,215 $(1,132) $215,083

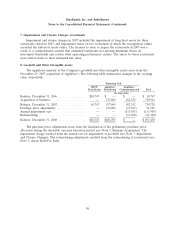

9. Captive Insurance Subsidiary

In connection with the acquisition of Applebee’s, the Company acquired Neighborhood

Insurance, Inc., a Vermont corporation and a wholly-owned captive insurance subsidiary of Applebee’s,

which provides Applebee’s and qualified Applebee’s franchisees with workers’ compensation and

general liability insurance. The captive insurance subsidiary ceased writing insurance prior to the

acquisition. Cost of other franchise income includes costs related to the resolution of claims arising

from franchisee participation in the captive insurance program. The Company’s consolidated balance

99