IHOP 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

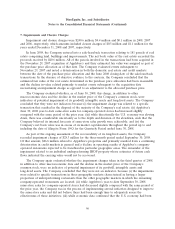

10. Debt (Continued)

unaffiliated entities, unless the Company is the surviving entity or the surviving entity assumes all of the

Company’s obligations in connection with the securitization transaction and certain other conditions are

satisfied, (v) limitations on indebtedness that may be incurred by the Company on a consolidated basis,

and (vi) recordkeeping, access to information and similar matters. The March 2007 Notes are also

subject to customary events of default, including events relating to non-payment of interest and

principal due on or in respect of the March 2007 Notes, failure to comply with covenants within certain

time frames, certain bankruptcy events, breach of representations and warranties, failure of security

interest to be effective, a valid claim being made under the relevant insurance policy and the failure to

meet the applicable debt service coverage ratio.

March 2007 Use of Proceeds

The net proceeds from the sale of the March 2007 Fixed Rate Notes on March 16, 2007 were

$171.7 million. Of this amount, $114.2 million was used to repay existing indebtedness of the Company;

$2.4 million was deposited into an interest reserve account for the Series 2007-1 FRN; and $3.1 million

was deposited into a lease payment account for payment to third-party property lessors. The Company

used the remaining proceeds primarily to pay the costs of the transaction and for share repurchases. As

of December 31, 2008, a total of $15.0 million was drawn on the Series 2007-2 VFN which was used as

part of the payment for the Applebee’s acquisition.

November 2007 Securitization Transactions

As part of the financing for the Applebee’s acquisition, certain subsidiaries of the Company

completed two separate securitization transactions with total proceeds of $2.039 billion. The

securitization transactions consisted of an issuance of debt collateralized by Applebee’s restaurant assets

and a separate issuance of debt collateralized by IHOP restaurant assets under the IHOP securitization

program.

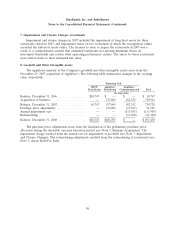

Applebee’s Securitization

On November 29, 2007, Applebee’s Enterprises LLC, Applebee’s IP LLC and other wholly-owned

subsidiaries of Applebee’s (collectively, the ‘‘Applebee’s Co-Issuers), completed a $1.794 billion

securitization transaction as described below. All of the notes issued in the Applebee’s securitization

were issued pursuant to an indenture (the ‘‘Applebee’s Base Indenture’’), and entered into by and

among the Applebee’s Co-Issuers and Wells Fargo Bank, and the related Series 2007-1 Supplement,

each dated as of November 29, 2007 (together with the Applebee’s Base Indenture, the ‘‘Applebee’s

Indenture’’).

Fixed Rate Notes

The Applebee’s securitization consists of the following four classes of fixed rate notes (the

‘‘Applebee’s November 2007-1 Notes’’):

• $350 million of Series 2007-1 Class A-2-I-X Fixed Rate Term Senior Notes, which do not have

the benefit of a financial guaranty insurance policy. These notes had an expected life of

approximately six months, with a legal maturity of 30 years. The Class A-2-I-X Fixed Rate Term

Senior Notes were repaid in July 2008.

104