IHOP 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

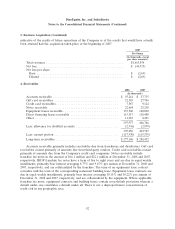

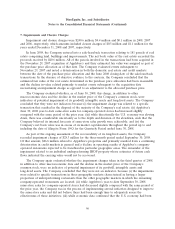

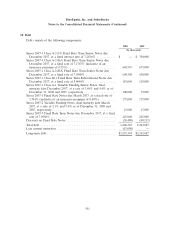

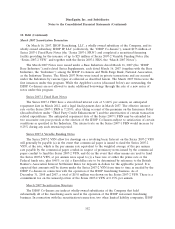

6. Property and Equipment

Property and equipment by category is as follows:

2008 2007

(In thousands)

Land ..................................................... $ 172,775 $ 213,583

Buildings and improvements .................................... 400,250 572,884

Leaseholds and improvements ................................... 274,577 290,789

Equipment and fixtures ........................................ 110,811 130,760

Construction in progress ....................................... 5,955 18,969

Properties under capital lease obligations ........................... 59,643 60,828

1,024,011 1,287,813

Less accumulated depreciation and amortization ...................... (199,529) (148,197)

Property and equipment, net .................................... $ 824,482 $1,139,616

The Company records capitalized interest in connection with the development of new restaurants

and amortizes it over the estimated useful life of the related asset. In 2008 and 2007, the Company

capitalized $457,000 and $191,000, respectively, of interest costs.

Accumulated depreciation and amortization includes accumulated amortization for properties

under capital lease obligations in the amount of $21.7 million and $19.2 million at December 31, 2008

and 2007, respectively.

In 2007, Applebee’s Services, Inc. (ASI), a subsidiary of Applebee’s International, Inc. entered into

a transaction with the City of Lenexa, Kansas, to lease the land, building and equipment for its new

corporate headquarters. In conjunction with the Applebee’s acquisition, the Company assumed this

lease. The transaction is designed to provide the Company with property tax exemptions for the facility

of up to 90% after the effect of payments in lieu of taxes paid to the City. In conjunction with the

lease, the City purchased the facility with the proceeds of up to $52 million in Industrial Revenue

Bonds (‘‘IRBs’’) due May 1, 2018, which will be funded periodically during the construction period. ASI

is the sole purchaser of the IRBs. The City has assigned the lease to the bond trustee for the benefit of

the bondholder. From inception, the Company has funded approximately $40.6 million of the IRBs and

has included this amount in property and equipment in the consolidated balance sheet. Due to the

bargain purchase option contained within the lease, the Company has classified this amount as a capital

lease.

On May 1, 2008, the Company paid off $4.1 million of the IRBs and surrendered $34.6 million of

the IRBs. The remaining $1.9 million of IRBs were transferred in July, 2008 as part of a sale-leaseback

transaction (see Note 11, Financing Obligations). In connection with the sale-leaseback transaction the

Company received approximately $39 million in proceeds. The initial term of the leaseback agreement

is 15 years. As the Company expects to have continuing involvement in the form of future subleasing of

a substantial portion of the corporate headquarters facility, the transaction was recorded under the

financing method in accordance with SFAS No. 98.

95