IHOP 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investing Activities

Net cash provided by investing activities in 2008 was primarily attributable to $61.1 in proceeds

from dispositions of assets, principally the franchising of Applebee’s company-operated restaurants and

$15.8 million in principal receipts from notes and equipment contracts receivable. These inflows were

partially offset by $31.8 million in capital expenditures, of which $25.4 million related to Applebee’s,

consisting of $11.0 million related to company-operated restaurants and $14.4 million related to

corporate activities, primarily Applebee’s restaurant support center in Lenexa, Kansas. Capital

expenditures are expected to decline in 2009 as we do not currently plan to develop any company-

operated Applebee’s restaurants and the support center was completed in 2008.

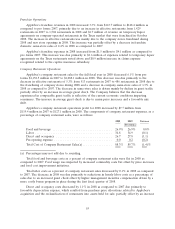

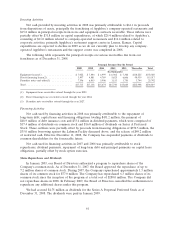

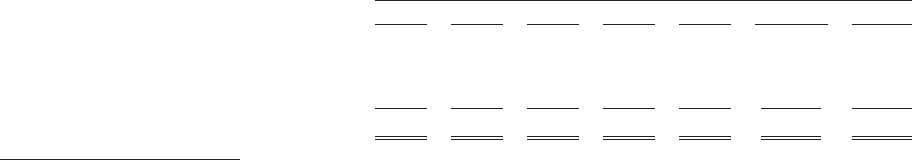

The following table represents the principal receipts on various receivables due from our

franchisees as of December 31, 2008:

Principal Receipts Due By Period

2009 2010 2011 2012 2013 Thereafter Total

(In thousands)

Equipment leases(1) ................... $7,022 $ 7,044 $ 6,999 $ 6,962 $ 7,308 $118,225 $153,560

Direct financing leases(2) ................ 3,497 4,081 4,769 5,625 6,606 90,939 115,517

Franchise notes and other(3) ............. 7,196 6,013 3,906 3,153 1,730 3,744 25,742

Total ............................. $17,715 $17,138 $15,674 $15,740 $15,644 $212,908 $294,819

(1) Equipment lease receivables extend through the year 2029.

(2) Direct financing lease receivables extend through the year 2024.

(3) Franchise note receivables extend through the year 2027.

Financing Activities

Net cash used by financing activities in 2008 was primarily attributable to the repayment of

long-term debt, capital lease and financing obligations totaling $431.2 million, the payment of

$48.9 million of debt issuance costs and $33.4 million in dividend payments, which were comprised of

$17.4 million of dividends on common stock and $16.0 million of dividends on Series A Preferred

Stock. These outflows were partially offset by proceeds from financing obligations of $370.5 million, the

$35.0 million borrowing against the Lehman Facility discussed above, and the release of $49.2 million

of restricted cash. Effective December 11, 2008, the Company has suspended payments of dividends to

common shareholders for the foreseeable future.

Net cash used in financing activities in 2007 and 2006 was primarily attributable to stock

repurchases, dividend payments, repayment of long-term debt and principal payments on capital lease

obligations, partially offset by stock option exercises.

Share Repurchases and Dividends

In January 2003, our Board of Directors authorized a program to repurchase shares of the

Company’s common stock. As of December 31, 2007, the Board approved the repurchase of up to

7.2 million shares of common stock. During 2007, the Company repurchased approximately 1.3 million

shares of its common stock for $77.0 million. The Company has repurchased 6.3 million shares of its

common stock since the inception of the program at a total cost of $280.0 million. The Company did

not repurchase shares in 2008. In February 2009, the Board of Directors cancelled the authorization to

repurchase any additional shares under this program.

We had accrued $4.75 million as dividends for the Series A Perpetual Preferred Stock as of

December 31, 2008. The dividends were paid in January 2009.

61