IHOP 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

9. Captive Insurance Subsidiary (Continued)

sheet includes the following balances related to the captive insurance subsidiary as of December 31,

2008:

• Franchise premium receivables of approximately $0.7 million included in receivables related to

captive insurance subsidiary.

• Cash and equivalents and long-term investments restricted for the payment of claims of

approximately $5.6 million are included in restricted assets related to the captive insurance

subsidiary.

• Loss reserve related to captive insurance subsidiary of approximately $4.5 million. The current

portion of approximately $3.3 million was included in other accrued expenses and the long-term

portion of approximately of $1.2 million was included in other non-current liabilities.

Loss reserve estimates are established based upon third-party actuarial estimates of ultimate

settlement costs for incurred claims (which includes claims incurred but not reported) using data

currently available. The reserve estimates are regularly analyzed and adjusted when necessary.

Unanticipated changes in the data used to determine the reserve may require us to revise our

estimates.

The short-term portion of the reserve is computed by applying a percentage, based on historical

claims payment activity, against the total captive claims asserted as provided by the actuarial firm. The

short-term amount is deducted from the total reserve balance and the remainder is the long-term

portion. This estimate is reviewed on a quarterly basis and is adjusted as needed.

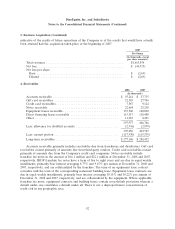

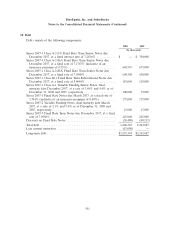

The activity in the loss and loss adjustment reserve, which included Applebee’s and participating

franchisees, is summarized in the table below:

December 31, December 31,

2008 2007

(In thousands)

Reserves, beginning of the year ........................... $7,009 $ —

Reserves assumed from acquisition ........................ — 7,622

Claims incurred ...................................... 445 (464)

Claims paid ......................................... (2,997) (149)

Reserves, end of the year ............................... 4,457 7,009

Less current portion ................................... (3,257) (3,809)

Long-term portion .................................... $1,200 $ 3,200

100