IHOP 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

maintain a minimum level of system-wide sales. At December 31, 2008, the Applebee’s DSCR was 2.0x

and the IHOP DSCR was 3.0x.

Our ability to pay the interest on our indebtedness, to make scheduled payments of principal and

to fund planned capital expenditures will depend on our future performance, which, to a certain extent,

is subject to general economic, financial, competitive, legislative, regulatory and other factors that are

beyond our control. Based upon the current level of operations and our current expectations for future

periods in light of the current economic environment, we currently anticipate that our cash and cash

equivalents, together with expected cash flows from operations, sale-leaseback and refranchising will be

sufficient to meet our anticipated cash requirements for working capital, retirement of securitized debt,

capital expenditures and other obligations for at least the next 12 months. Further, we currently believe

that we will remain in compliance with the debt covenants discussed above for at least the next

12 months.

We believe that we will have the necessary liquidity through our current cash balances, operating

cash flow, the IHOP revolving credit facility and proceeds from additional franchising of Applebee’s

company-operated restaurants for the next year to fund our debt service requirements, capital

expenditures and other operational cash requirements. However, if we are not able to achieve

forecasted revenue targets and operating improvements or effect franchisings of Applebee’s restaurants

at prices currently anticipated, this assessment will have to be reconsidered. Additionally, certain

Applebee’s Notes have accelerated payment dates of December 2012, and we will likely seek to

refinance this debt if it has not been repaid prior to then. We may not be able to effect any future

refinancing of our debt on commercially reasonable terms or at all.

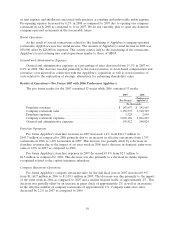

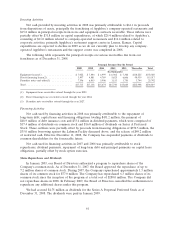

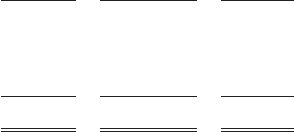

Cash Flows

In summary, our cash flows were as follows:

2008 2007 2006

(In thousands)

Net cash provided by operating activities ............. $110,839 $ 106,323 $ 64,859

Net cash provided by (used in) investing activities ...... 35,195 (1,937,392) 9,296

Net cash (used in) provided by financing activities ...... (58,429) 1,838,391 (77,750)

Net increase (decrease) in cash and cash equivalents .... $ 87,605 $ 7,322 $ (3,595)

Operating Activities

Cash provided by operating activities is primarily driven by revenues earned and collected from our

franchisees, operating earnings from our company-operated restaurants and rental operations profit

from our leases. Franchise revenues consist of royalties, IHOP advertising fees, and sales of proprietary

products for IHOP which fluctuate with increases or decreases in franchise retail sales. Franchise retail

sales are impacted by the development of IHOP and Applebee’s restaurants by our franchisees and by

fluctuations in same-store sales. Company-operated operating earnings are impacted by many factors

which include, but are not limited, to changes in traffic pattern, pricing activities and changes in

operating expenses. Rental operations profit is rental income less rental expenses. Rental income

includes revenue from operating leases and interest income from direct financing leases. Rental

expenses are costs of prime operating leases and interest expense on prime capital leases on franchisee-

operated restaurants.

Cash provided by operating activities increased to $110.8 million in 2008 from $106.3 million in

2007. The increase was due primarily to the inclusion of Applebee’s operating activities for a full year

in 2008 as opposed to one month in 2007, substantially offset by the increased interest on securitized

debt. Cash paid for interest in 2008 was $194.8 million as compared to $31.3 million in 2007.

60