IHOP 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

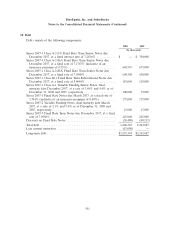

10. Debt (Continued)

• $675 million of Series 2007-1 Class A-2-II-A Fixed Rate Term Senior Notes that have the benefit

of a financial guaranty insurance policy covering payment of interest when due and payment of

principal at the applicable legal final maturity date. These notes have an expected life of

approximately five years, with a legal maturity of 30 years.

• $650 million of Series 2007-1 Class A-2-II-X Fixed Rate Term Senior Notes, which do not have

the benefit of a financial guaranty insurance policy. These notes have an expected life of

approximately five years, with a legal maturity of 30 years.

• $119 million of Series 2007-1 Class M-1 Fixed Rate Term Subordinated Notes, which do not

have the benefit of a financial guaranty insurance policy. These notes have an expected life of

approximately four years, with a legal maturity of 30 years.

The Applebee’s Indenture includes provisions which accelerate certain of the payment dates which,

if not met, would require the Company to use operating funds to begin to pay down the outstanding

debt. The accelerated payment dates for the Applebee’s securitization are as follows:

Class A-2-II-A Fixed Rate Term Senior Notes ...................... December 2012

Class A-2-II-X Fixed Rate Term Senior Notes ...................... December 2012

Class M-1 Fixed Rate Term Subordinated Notes ..................... December 2012

As of December 31, 2008, there was no acceleration of payment dates.

Series 2007-1 Class A-1 Variable Funding Senior Notes

The Applebee’s securitization also included a $100 million revolving credit facility of Series 2007-1

Class A-1 Variable Funding Senior Notes issued in two classes, with each drawdown allocated between

the two classes on a pro rata basis. The 2007-1 Class A-1-A Variable Funding Notes in an amount up to

$30 million have the benefit of a financial guaranty insurance policy covering payment of interest when

due and payment of principal at the legal final maturity date. The Series 2007-1 Class A-1-X Variable

Funding Notes in an amount up to $70 million do not have the benefit of a financial guaranty

insurance policy. As of December 31, 2008, there was $100 million outstanding under this facility,

consisting of $30.0 million insured and $70.0 million uninsured. As of December 31, 2007, there was

$75 million outstanding under this facility, consisting of $22.5 million insured and $52.5 million

uninsured.

Securitization Structure

All of the Applebee’s November 2007-1 Notes were issued by indirect subsidiaries of Applebee’s

that hold substantially all of the intellectual property, franchising assets and other restaurant assets of

the Applebee’s system and a certificate representing the right to receive a portion of the weekly

residual cash flow remaining in securitization by certain subsidiaries of the Company. The servicing and

repayment obligations related to the Applebee’s November 2007-1 Notes and certain ongoing fees and

expenses, including the premiums payable to the financial guaranty insurance company, are solely the

responsibility of these indirect subsidiaries. Neither DineEquity, Inc., which is the ultimate parent of

each of the subsidiaries involved in the securitization, nor Applebee’s has guaranteed or is in any way

liable for the obligations of the subsidiaries involved in the securitization, including the Applebee’s

105