IHOP 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

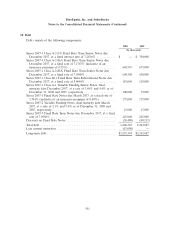

10. Debt (Continued)

Property Leasing, LLC and IHOP Real Estate, LLC, were formed as subsidiaries of IHOP

Franchising, LLC and an existing subsidiary, IHOP Properties, Inc., was transferred to IHOP

Franchising, LLC and converted to a limited liability company. On and after the closing of the

securitization transaction, these three subsidiaries (the ‘‘Real Estate Subsidiaries’’) own the real

property assets related to the IHOP restaurant franchising business, including the fee and leasehold

interests on the real property on which many IHOP restaurants are located and the related leases and

sub-leases, respectively, to franchisees.

In connection with the securitization transaction, the franchise agreements, franchise notes, area

license agreements (related to the United States and Mexico), product sales agreements, equipment

leases and other assets related to the IHOP restaurant franchising business were transferred to IHOP

Franchising, LLC, the intellectual property related to the IHOP restaurant franchising business, among

other things, was transferred to IHOP IP, LLC, the fee interests in real property and related franchisee

leases were transferred to IHOP Real Estate, LLC and certain of the leasehold interests related to the

IHOP franchised restaurants and the related subleases to franchisees were transferred to IHOP

Property Leasing, LLC. The remaining leasehold interests and franchisee subleases are owned by IHOP

Properties, LLC. The IHOP Co-Issuers have pledged all of their assets to the Indenture Trustee as

security for the March 2007 Notes and any additional notes issued by the IHOP Co-Issuers. Although

the March 2007 Notes are expected to be repaid solely from these subsidiaries’ assets, the March 2007

Notes are solely obligations of the IHOP Co-Issuers and none of the Company, its direct or indirect

subsidiaries, including the Real Estate Subsidiaries, guarantee or are in any way liable for the IHOP

Co-Issuers’ obligations under the Indenture, the March 2007 Notes or any other obligation in

connection with the issuance of the March 2007 Notes. The Company has agreed, however, to

guarantee the performance of the obligations of International House of Pancakes, LLC., its wholly

owned direct subsidiary, as servicer in connection with the servicing of the assets included as collateral

under the Indenture and certain indemnity obligations relating to the transfer of the collateral assets to

the IHOP Co-Issuers and the Real Estate Subsidiaries.

March 2007 Third Party Credit Enhancement

The March 2007 Notes are rated ‘‘Aaa,’’ and ‘‘AAA’’ by Moody’s Investors Services, Inc. and

Standard & Poor’s Ratings Services, respectively. Timely payment of interest (other than contingent

interest) and the outstanding principal of the March 2007 Notes were insured under a financial

guaranty insurance policy issued by Financial Guaranty Insurance Company (‘‘FGIC’’), the obligations

of which are rated ‘‘Aaa’’ and ‘‘AAA.’’ The insurance policy has been issued under an Insurance and

Indemnity Agreement among FGIC, the Company and various subsidiaries of the Company.

March 2007 Covenants/Restrictions

The March 2007 Notes are subject to a series of covenants and restrictions under the Indenture

customary for transactions of this type, including those relating to (i) the maintenance of specified

reserve accounts to be used to make required payments in respect of the March 2007 Notes, (ii) certain

debt service coverage and consolidated leverage ratios to be met, the failure of which may result in

early amortization of the outstanding principal amounts due in respect of the March 2007 Notes or

removal of International House of Pancakes, Inc., as servicer, among other things, (iii) optional

prepayment subject to certain conditions, (iv) the Company’s maintenance of more than 50% ownership

interest in International House of Pancakes, LLC. and a restriction on the Company’s merger with

103