IHOP 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

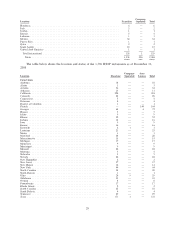

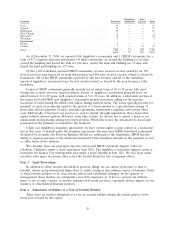

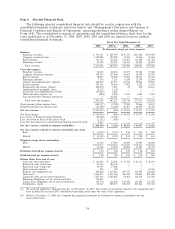

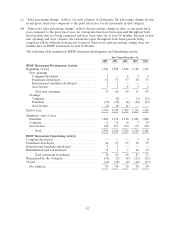

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with the

consolidated financial statements and notes thereto and ‘‘Management’s Discussion and Analysis of

Financial Condition and Results of Operations’’ appearing elsewhere in this Annual Report on

Form 10-K. The consolidated statement of operations and the consolidated balance sheet data for the

years ended and as of December 31, 2008, 2007, 2006, 2005 and 2004 are derived from our audited

consolidated financial statements. Fiscal Year Ended December 31,

2008 2007(a) 2006 2005 2004

(In thousands, except per share amounts)

Revenues

Franchise revenues ............................. $ 353,331 $ 205,757 $179,331 $167,384 $157,584

Company restaurant sales ......................... 1,103,228 125,905 13,585 13,964 31,564

Rental income ................................ 131,347 132,422 132,101 131,626 131,763

Financing revenues ............................. 25,722 20,475 24,543 35,049 38,091

Total revenues .............................. 1,613,628 484,559 349,560 348,023 359,002

Costs and expenses

Franchise expenses ............................. 96,243 88,054 83,079 78,768 77,402

Company restaurant expenses ...................... 978,197 117,448 15,601 15,095 34,701

Rental expenses ............................... 98,057 98,402 97,904 98,391 95,392

Financing expenses ............................. 7,314 1,215 4,240 12,299 12,556

General and administrative expenses .................. 182,239 81,597 63,543 58,801 59,890

Interest expense ............................... 203,141 28,654 7,902 8,322 8,395

Impairment and closure charges ..................... 240,630 4,381 43 896 14,112

Amortization of intangible assets .................... 12,132 1,132———

(Gain) loss on extinguishment of debt ................. (15,242) 2,223———

Other (income) expense, net ....................... (926) 2,030 4,398 4,585 2,387

Loss on derivative financial instrument ................ — 62,131———

Total costs and expenses ........................ 1,801,785 487,267 276,710 277,157 304,835

(Loss) income before income taxes .................... (188,157) (2,708) 72,850 70,866 54,167

(Benefit) provision for income taxes ................... (33,698) (2,228) 28,297 26,929 20,746

Net (loss) income ............................... $(154,459) $ (480) $ 44,553 $ 43,937 $ 33,421

Net (loss) income ............................... $(154,459) $ (480) $ 44,553 $ 43,937 $ 33,421

Less: Series A Preferred stock dividends ................. (19,000) (1,561) — — —

Less: Accretion of Series B Preferred stock ............... (2,151) (181) — — —

Less: Net loss allocated to unvested participating restricted stock . 6,417 ————

Net (loss) income available to common stockholders ......... $ (169,193) $ (2,222) $ 44,553 $ 43,937 $ 33,421

Net (loss) income available to common stockholders per share:

Basic ...................................... $ (10.09) $ (0.13) $ 2.46 $ 2.26 $ 1.62

Diluted .................................... $ (10.09) $ (0.13) $ 2.43 $ 2.24 $ 1.61

Weighted average shares outstanding:

Basic ...................................... 16,764 17,232 18,085 19,405 20,606

Diluted .................................... 16,764 17,232 18,298 19,603 20,791

Dividends declared per common share(b) ................ $ 1.00 $ 1.00 $ 1.00 $ 1.00 $ 1.00

Dividends paid per common share(b) .................. $ 1.00 $ 1.00 $ 1.00 $ 1.00 $ 1.00

Balance Sheet Data (end of year)

Cash and cash equivalents ........................ $ 114,443 $ 26,838 $ 19,516 $ 23,111 $ 44,031

Restricted cash—short-term ....................... 83,355 128,138———

Restricted cash—long-term ........................ 53,395 57,962———

Short-term investments .......................... 276 300 — — 14,504

Property and equipment, net ....................... 824,482 1,139,616 309,737 317,959 326,848

Total assets .................................. 3,361,217 3,831,162 766,250 770,203 821,084

Long-term debt, net of current maturities .............. 1,853,367 2,263,887 94,468 114,210 133,768

Financing obligations, net of current maturities ........... 318,651 ————

Capital lease obligations, net of current maturities ......... 161,310 168,242 170,412 172,681 173,925

Stockholders’ equity ............................ 42,767 209,373 289,213 293,846 339,764

(a) We acquired Applebee’s International, Inc. on November 29, 2007. The results of operations related to this acquisition have

been included in our fiscal 2007 consolidated operating results since the date of the acquisition.

(b) Effective December 11, 2008, the Company has suspended payments of dividends to common stockholders for the

foreseeable future.

34