IHOP 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162

|

|

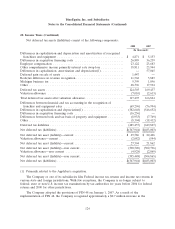

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

21. Net (Loss) Income Per Share

The computation of the Company’s basic and diluted net (loss) income per share is as follows:

Year Ended December 31,

2008 2007 2006

(In thousands, except per share

data)

Numerator for basic and dilutive income (loss) per common share:

Net (loss) income ....................................... $(154,459) $ (480) $44,553

Less: Series A preferred stock dividends ..................... (19,000) (1,561) —

Less: Accretion of Series B preferred stock ................... (2,151) (181) —

Less: Share of net loss allocated to unvested participating restricted

stock ............................................. 6,417 — —

(Loss) income available to common stockholders ................ $(169,193) $(2,222) $44,553

Denominator:

Weighted average outstanding shares of common stock ............ 16,764 17,232 18,085

Dilutive effect of:

Common stock equivalents ............................... — — 213

Common stock and common stock equivalents .................. 16,764 17,232 18,298

Net (loss) income per common share:

Basic ............................................... $ (10.09) $ (0.13) $ 2.46

Diluted ............................................. $ (10.09) $ (0.13) $ 2.43

For the years ended December 31, 2008 and 2007, diluted loss per common share is computed

using the weighted average number of common shares outstanding during the period, as the 756,000

and 627,000 shares, respectively, from common stock equivalents would have been antidilutive.

126