IHOP 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

18. Stock-Based Incentive Plans (Continued)

the model may not be indicative of the actual fair values of the Company’s stock-based awards. The

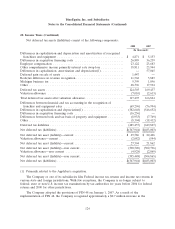

following table summarizes the assumptions used to value options granted in the respective periods:

2008 2007 2006

Risk free interest rate ........................ 2.83% 4.39% 4.67%

Weighted average historical volatility .............. 77.9% 24.9% 28.2%

Dividend yield .............................. 3.09% 1.75% 1.96%

Expected years until exercise ................... 5 Years 5 Years 5 Years

Forfeitures ................................ 7.02% 6.72% 12.03%

Weighted average fair value of options granted ...... $ 18.70 $ 14.21 $ 13.81

Stock-Based Compensation Expense

From time to time, the Company grants stock options and restricted stock to officers, directors and

employees of the Company under the 2001 Plan and the 2005 Plan. The stock options generally vest

over a three-year period and have a maturity of ten years from the issuance date. Option exercise

prices equal the closing price on the New York Stock Exchange of the Company’s common stock on

the date of grant. Restricted stock provides for the issuance of a share of the Company’s common stock

at no cost to the holder and generally vests over terms determined by the Compensation Committee of

the Company’s Board of Directors. The restricted stock generally vests only if the employee is actively

employed by the Company on the vesting date, and unvested restricted shares are forfeited upon

termination, retirement before age 65, death or disability, unless the Compensation Committee of the

Company’s Board of Directors determines otherwise. When vested options and restricted stock are

issued, the Company generally issues new shares from its authorized but unissued share pool or utilizes

treasury stock

The following table summarizes the Company’s stock-based compensation expense included as a

component of general and administrative expenses in the consolidated financial statements:

Year Ended December 31,

2008 2007 2006

(In thousands)

Total stock-based compensation:

Pre-tax compensation expense ................. $12,089 $ 6,958 $ 3,911

Tax benefit ............................... (4,739) (2,726) (1,519)

Total stock-based compensation expense, net of tax . . . $ 7,350 $ 4,232 $ 2,392

As of December 31, 2008, $15.3 million and $6.8 million (including forfeitures) of total

unrecognized compensation cost related to restricted stock and stock options, respectively, is expected

to be recognized over a weighted average period of approximately 1.81 years for restricted stock and

2.28 years for stock options.

120