IHOP 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

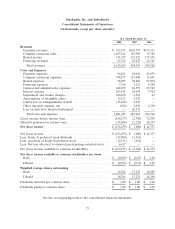

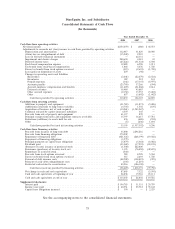

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

Statement of Operations. These reclassifications had no effect on the net income or financial position

previously reported.

With respect to (ii), the following amounts were reclassified in the balance sheet:

Amount 2007 Presentation 2008 Presentation of 2007 Amounts

(in thousands)

$5,727 Current assets of discontinued operations Assets held for sale

325 Current assets of discontinued operations Prepaid income taxes

2,558 Non-current assets of discontinued Other assets, net

operations

3,302 Non-current liabilities of discontinued Other liabilities

operations

With respect to (ii), the reported Income from discontinued operations, net of tax of $30 was

reclassified into the following 2007 line items:

Amount

(in thousands)

Company restaurant expenses .............................. $ 13

Other (income) expense .................................. (117)

Impairment and closure charges ............................. 55

Income before income taxes ............................... 49

Provision for income taxes ................................. (19)

Net income ........................................... $ 30

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting

principles (‘‘GAAP’’) requires the Company’s management to make estimates and assumptions that

affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the

date of the consolidated financial statements, and the reported amounts of revenues and expenses

during the reporting period. On an ongoing basis, the Company evaluates its estimates, including those

related to provisions for doubtful accounts, legal contingencies, income taxes, goodwill and intangible

assets. The Company bases its estimates on historical experience and on various other assumptions that

are believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Concentration of Credit Risk

The Company’s cash, cash equivalents, receivables and investments are potentially subject to

concentration of credit risk. Cash, cash equivalents and investments are placed with financial

institutions that management believes are creditworthy. The Company does not believe that it is

exposed to any significant credit risk on cash and cash equivalents. At times, cash and cash equivalent

balances may be in excess of FDIC insurance limits.

Receivables are derived from revenues earned from franchisees and distributors located primarily

in the United States. The Company is subject to a concentration of credit risk with respect to

77