IHOP 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

16. Preferred Stock and Stockholders’ Equity (Continued)

shares may be made at the discretion of the Board of Directors after consideration of the Company’s

earnings, financial condition, cash requirements, future prospects and other factors.

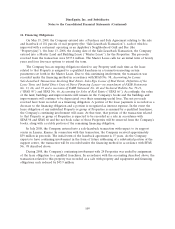

17. Other Comprehensive (Loss) Income

The components of comprehensive (loss) income, net of taxes, are as follows:

Year Ended December 31,

2008 2007 2006

(In thousands)

Net (loss) income ......................... $(154,459) $ (480) $44,553

Other comprehensive income (net of tax):

Interest rate swap ....................... 7,716 (36,605) 72

Temporary decline in available-for-sale securities . (386) — —

Total comprehensive (loss) income ............. $(147,129) $(37,085) $44,625

The amount of income tax benefit allocated to the interest rate swap was $3.0 million,

$24.1 million and nil for the year ended December 31, 2008, 2007 and 2006, respectively.

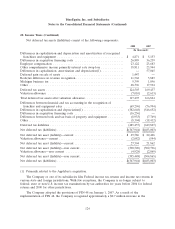

18. Stock-Based Incentive Plans

The Stock Incentive Plan (the ‘‘1991 Plan’’) was adopted in 1991 and amended and restated in

1998 to authorize the issuance of up to 3,760,000 shares of common stock pursuant to options,

restricted stock, and other long-term stock- based incentives to officers and key employees of the

Company. The 2001 Stock Incentive Plan (the ‘‘2001 Plan’’) was adopted in 2001 and amended and

restated in 2005 and 2008 to authorize the issuance of up to 4,200,000 shares of common stock. No

option can be granted at an option price of less than the fair market value at the date of grant as

defined by the Plan. Exercisability of options is determined at, or after, the date of grant by the

administrator of both Plans. All options granted under both plans through December 31, 2008, become

exercisable one-third after one year, two-thirds after two years and 100% after three years or

immediately upon a change in control of the Company, as defined in both plans.

The Stock Option Plan for Non-Employee Directors (the ‘‘Directors Plan’’) was adopted in 1994

and amended and restated in 1999 to authorize the issuance of up to 400,000 shares of common stock

pursuant to options to non-employee members of the Company’s Board of Directors. Options are to be

granted at an option price equal to 100% of the fair market value of the stock on the date of grant.

Options granted pursuant to the Directors Plan vest and become exercisable one-third after one year,

two-thirds after two years and 100% after three years or immediately upon a change in control of the

Company, as defined in the Directors Plan. Options for the purchase of shares are granted to each

non-employee Director under the Directors Plan as follows: (1) an option to purchase 15,000 shares on

February 23, 1995, or on the Director’s election to the Board of Directors if he or she was not a

Director on such date, and (2) an option to purchase 5,000 shares annually in conjunction with the

Company’s Annual Meeting of Stockholders for that year.

The 2005 Stock Incentive Plan for Non-Employee Directors (the ‘‘2005 Plan’’) was adopted in 2005

to authorize the issuance of up to 200,000 shares of common stock to non-employee members of the

Company’s Board of Directors. Awards may be made in common stock, in options to purchase common

117