IHOP 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

sublicensees will use the intellectual property assets in accordance with such guidelines. Franchisee and

sublicensee noncompliance with the terms and conditions of the governing franchise agreement or

other sublicense agreement may reduce the overall goodwill associated with our brands. Franchisees

and other sublicensees may refer to our intellectual property improperly in writings or conversation,

resulting in the weakening of the distinctiveness of our intellectual property. There can be no assurance

that the franchisees or other sublicensees will not take actions that could have a material adverse effect

on the reputation of the Applebee’s or IHOP intellectual property. Any such actions could have a

corresponding material adverse effect on our business and revenues.

In addition, even if the sublicensee product suppliers, manufacturers, distributors, or advertisers

observe and maintain the quality and integrity of the intellectual property assets in accordance with the

relevant sublicense agreement, any product manufactured by such suppliers may be subject to

regulatory sanctions and other actions by third parties which can, in turn, negatively impact the

perceived quality of our restaurants and the overall goodwill of our brands, regardless of the nature

and type of product involved. Any such actions could have a material adverse effect on our business, by

virtue of, among other things, reducing the public’s acceptance of Applebee’s or IHOP restaurants,

thereby reducing restaurant revenues and corresponding franchise payments to us.

We are heavily dependent on information technology and any material failure of that technology could

impair our ability to efficiently operate our business. We rely heavily on information systems across our

operations, including for examplepoint-of-sale processing in our restaurants, management of our supply

chain, collection of cash, payment of obligations and various other processes and procedures. Our

ability to efficiently manage our business depends significantly on the reliability and capacity of these

systems. The failure of these systems to operate effectively, problems with maintenance, upgrading or

transitioning to replacement systems, or a breach in security of these systems could cause delays in

customer service and reduce efficiency in our operations. Significant capital investments might be

required to remediate any problems.

Item 1B. Unresolved Staff Comments.

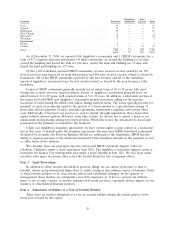

On December 2, 2008, the Company received a comment letter from the Staff of the SEC’s

Division of Corporation Finance (the ‘‘Staff’’) with respect to the Company’s Quarterly Report on

Form 10-Q for the quarterly period ended September 30, 2008. The Company responded to the Staff’s

comments on December 30, 2008. On January 30, 2009, the Company received a follow-up comment

letter from the Staff that the Company responded to on February 18, 2009. The follow-up comments

are summarized as follows:

Consolidated Statements of Operations

• Explain why certain assets included in discontinued operations were not included under the

caption of ‘‘assets held for sale.’’ Explain why property and equipment is shown as being net

instead of at the lower of cost or fair value. Provide a description of the nature of the liabilities

classified as non-current liabilities related to discontinued operations.

Notes to Consolidated Financial Statements

• Address whether there has been a change in credit risk associated with franchisees or

distributors, and indicate whether there is a concentration of credit risk in any franchisee.

• Explain how the Company originally estimated the economic obsolescence factors that resulted

in a downward revision of the allocated value of Property & Equipment, and ensure that future

filings describe in clear terms the nature of these factors to better explain why the fair value

allocation has been written down.

26