IHOP 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has paid regular quarterly dividends of $0.25 per common share since May 2003. A

quarterly cash dividend of $0.25 per common share was paid on November 18, 2008, which was the

fourth dividend payment of 2008. In December 2008, the Board of Directors suspended the payment of

the quarterly cash dividend to common stockholders for the foreseeable future as part of actions the

Company is taking to maximize its financial flexibility. Future dividend declarations on the common

shares may be made at the discretion of the Board of Directors after consideration of the Company’s

earnings, financial condition, cash requirements, future prospects and other factors.

Off-Balance Sheet Arrangements

As of December 31, 2008, we had no off-balance sheet arrangements, as defined in Item 303(a)(4)

of SEC Regulation S-K.

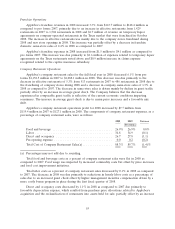

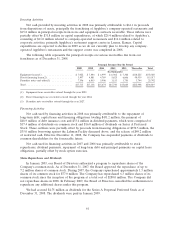

Contractual Obligations and Commitments

The following are our significant contractual obligations and commitments as of December 31,

2008:

Payments Due By Period

More than

Contractual Obligations 1 Year 2-3 Years 4-5 Years 5 Years Total

(in thousands)

Debt ........................... $ 15,000 $ 50,400 $1,398,447 $ 435,000 $1,898,847

Financing obligation ................ 31,125 63,238 63,732 445,402 603,497

Operating leases ................... 88,376 172,322 170,774 1,228,871 1,660,343

Capital leases ..................... 24,731 49,904 49,568 192,789 316,992

Purchase commitments .............. 168,639 36,357 — — 204,996

Other obligations .................. 524 893 — — 1,417

Total minimum payments ............ 328,395 373,114 1,682,521 2,302,062 4,686,092

Less interest ...................... (41,164) (77,593) (70,665) (236,682) (426,104)

$287,231 $295,521 $1,611,856 $2,065,380 $4,259,988

As discussed in Note 20 of the Notes to the Consolidated Financial Statements, effective

January 1, 2007, we adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty

in Income Taxes—an interpretation of FASB Statement No. 109. At December 31, 2008, we had a reserve

for unrecognized tax benefit including potential interest and penalties, net of related tax benefit,

totaling $23.5 million, of which approximately $1.7 million is expected to be paid within one year. For

the remaining liability, due to the uncertainties related to these tax matters, we are unable to make a

reasonably reliable estimate when cash settlement with a taxing authority will occur.

Critical Accounting Policies and Estimates

The preparation of financial statements in accordance with U.S. generally accepted accounting

principles requires us to make estimates and assumptions that affect the reported amounts of assets

and liabilities at the date of the financial statements and the reported amounts of net revenues and

expenses in the reporting period. We base our estimates and assumptions on current facts, historical

experience and various other factors that we believe to be reasonable under the circumstances, the

results of which form the basis for making judgments about the carrying values of assets and liabilities

and the accrual of costs and expenses that are not readily apparent from other sources. Accounting

assumptions and estimates are inherently uncertain and actual results may differ materially from our

estimates.

62