IHOP 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

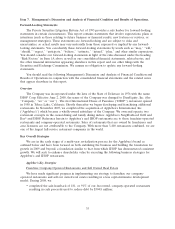

Significant Known Events, Trends or Uncertainties Impacting or Expected to Impact Comparisons of

Reported or Future Results

Global Economic Contraction

In 2008, economic conditions in both the U.S. and worldwide have experienced a downturn due to

the compounded effects of the subprime lending crisis, the credit market liquidity crisis, and the

collateral effects of each on the finance and banking industries. In addition, volatile energy costs,

concerns about inflation and deflation, slower economic activity, softness in both the commercial and

residential real estate markets, decreased consumer confidence, reduced corporate profits and capital

spending and rising unemployment have combined to create generally adverse business conditions for

all industries and sectors. These conditions make it extremely difficult for us to accurately forecast and

plan future business activities as the reduction in disposable income for discretionary spending could

cause our customers to change historic purchasing behavior and choose lower-cost dining options or

alternatives to dining out.

These economic developments may affect our business and operations in a number of ways,

including but not limited to:

• lower profitability and cash flows from company-operated restaurants;

• reduced payments from franchisees due to both a lower sales base on which royalties and other

payments are calculated and possible impairment to the ability of franchisees to make payments

when due as the result of the economic effects cited above on their businesses;

• limited availability of financing for franchisees to fulfill their new restaurant development

commitments;

• limited credit availability for potential purchasers of Applebee’s company-operated restaurants;

• lower proceeds from refranchising transactions due to both lower sales and profitability or

inability to consummate transactions at all; and

• lower estimated fair values for goodwill, intangible assets and long-lived assets resulting in future

non-cash impairment charges.

We cannot predict the effect or duration of this economic slowdown or the timing or strength of a

subsequent recovery in the economy in general or the restaurant industry in particular. If our business

significantly deteriorates due to these macroeconomic effects, our financial condition and results of

operations will likely be materially and adversely affected.

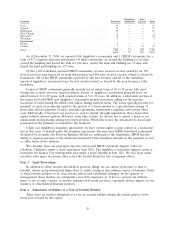

Securitized Debt and Related Interest Expense

We incurred a substantial amount of indebtedness to finance the Applebee’s acquisition. As a

result, our interest expense has increased significantly from that reported in prior years and is expected

to remain as one of the largest components of costs and expenses in the future until such time that

debt balances are repaid or otherwise retired.

Significant Gains and Charges

There were several significant gains and charges affecting the comparisons with previously reported

results. In 2008, we recognized impairment and closure charges of $240.6 million and a gain on

extinguishment of debt of $15.2 million. In 2007, we recognized a loss on a derivative financial

instrument of $62.1 million, impairment and closure charges of $4.4 million and a loss on

extinguishment of debt of $2.2 million. Each transaction is discussed in further detail under paragraphs

captioned with those descriptions elsewhere in Item 7. Given the uncertainty as to the length of the

current economic contraction and the timing and degree of recovery, it is reasonably possible that

38