IHOP 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

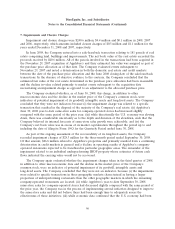

5. Assets Held for Sale (Continued)

In December 2007, the Company began to actively market approximately 40 company-operated

Applebee’s restaurants in California and Nevada. The marketing of these restaurants was part of the

Company’s plan to ultimately refranchise approximately 100 Applebee’s restaurants in 2008. The assets

for these restaurants, totaling $47.8 million, were presented as assets held for sale in the consolidated

balance sheet as of December 31, 2007. As the preliminary purchase price allocation was finalized

during 2008, certain purchase price fair values were revised downward. As a result, assets held for sale

were reduced by $11.0 million. Additionally, as the result of continuing deterioration in the credit

markets in general and a decline in operating results of Applebee’s company-operated restaurants

expected to be franchised in particular geographic areas, an impairment was recognized on assets held

for sale of $5.6 million.

During 2008, four parcels of land held for future restaurant development, three company-owned

restaurants in the Delaware market, forty-nine company-owned stores in the Texas market and seven

company-owned stores in the New Mexico market were reclassified as assets held for sale. Additionally,

one company-owned restaurant was reclassified out of assets held for sale after a determination was

made the Company had continuing involvement with the property.

The sales of the restaurants in California and Delaware were completed in the third fiscal quarter

of 2008 and the sales of the restaurants in Nevada and Texas along with a closed store site were

completed in the fourth fiscal quarter of 2008. The Company received proceeds of approximately

$49.4 million from these transactions.

At December 31, 2008, assets held for sale comprised primarily seven company-operated

restaurants in New Mexico expected to be sold in the first fiscal quarter of 2009 and four parcels of

land held for future restaurant development.

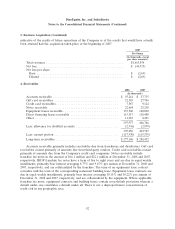

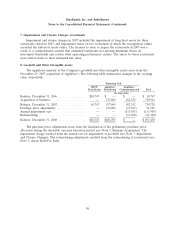

The following table summarizes the changes in the balance of assets held for sale during 2008:

(in millions)

Balance December 31, 2007 ................................. $66.1

Purchase price valuation adjustments .......................... (11.0)

Impairment charges ....................................... (5.6)

Assets sold ............................................. (62.7)

Assets reclassified to held for sale ............................ 24.0

Other ................................................. 1.1

Balance December 31, 2008 ................................. $11.9

94