IHOP 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

18. Stock-Based Incentive Plans (Continued)

stock, or in shares of common stock subject to certain restrictions (‘‘Restricted Stock’’), or any

combination thereof. The terms and conditions of awards granted are established by the Compensation

Committee of the Company’s Board of Directors, but become immediately vested upon a change in

control of the Company, as defined in the 2005 Plan. Options are to be granted at an option price not

less than 100% of the fair market value of the stock on the date of grant. The 2005 Plan provides for

an initial grant of Restricted Stock (‘‘Initial Grant’’). At the end of a specified performance period, the

number of shares in the Initial Grant will be increased or decreased, based on the percentage increase

or decrease in the fair market value of the Company’s common stock during the performance period.

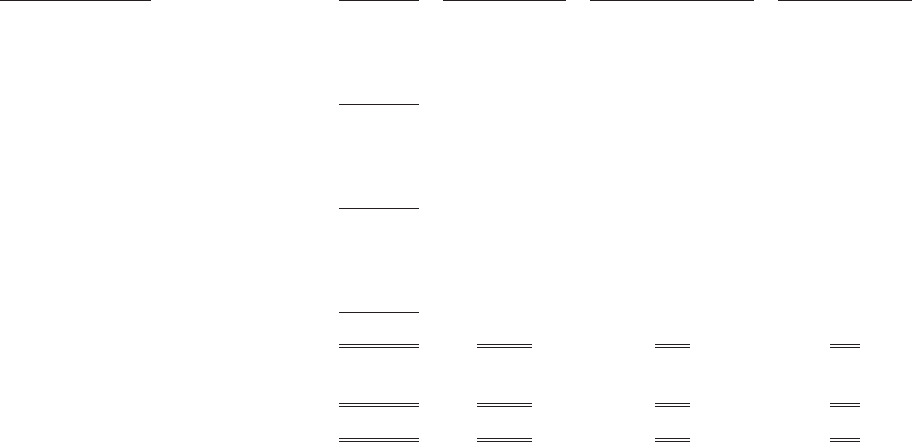

Stock Options

Stock option activity for the years ended December 31, 2008, 2007 and 2006 is summarized as

follows:

Weighted Average

Exercise Price Weighted Average

Number of Per Remaining Contractual Aggregate Intrinsic

Shares Under Option Shares Share Term (in Years) Value

Outstanding at December 31, 2005 . 1,078,833 $33.93

Granted .................... 10,850 50.96

Exercised ................... (204,447) 29.07

Terminated .................. (60,547) 42.71

Outstanding at December 31, 2006 . 824,689 34.71

Granted .................... 7,900 57.26

Exercised ................... (282,517) 31.69

Terminated .................. (8,316) 48.67

Outstanding at December 31, 2007 . 541,756 36.41

Granted .................... 576,000 36.05

Exercised ................... (41,500) 23.82

Terminated .................. (142,317) 38.86

Outstanding at December 31, 2008 . 933,939 $36.37 7.17 $—

Vested and Expected to Vest at

December 31, 2008 .......... 865,447 $36.43 7.00 $—

Exercisable at December 31, 2008 . 425,216 $37.36 4.64 $—

The per share weighted-average grant date fair value of options granted during the years 2008,

2007 and 2006 was $18.70, $14.21 and $13.81, respectively.

The total intrinsic value of options exercised during the years ended December 31, 2008, 2007 and

2006 was $1.8 million, $7.8 million and $4.5 million, respectively.

Cash received from options exercised under all stock-based payment arrangements for the years

ended December 31, 2008, 2007 and 2006 was $1.0 million, $8.9 million and $5.9 million, respectively.

The actual tax benefit realized for the tax deduction from option exercises under the stock- based

payment arrangements totaled $1.9 million, $3.0 million and $1.7 million, respectively, for the years

ended December 31, 2008, 2007 and 2006.

118