IHOP 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

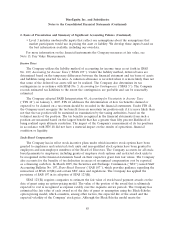

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Equipment under

capital leases is stated at the present value of the minimum lease payments. Depreciation is computed

using the straight-line method over the estimated useful lives of the assets or remaining useful lives.

Leasehold improvements and equipment under capital leases are amortized on a straight-line basis over

their estimated useful lives or the lease term, if less. The Company has capitalized certain costs

incurred in connection with the development of internal-use software which are included in property

and equipment and amortized over the expected useful life of the asset. The general ranges of

depreciable and amortizable lives are as follows:

Category Depreciable Life

Buildings and improvements . . . 25 - 40 years

Leaseholds and improvements . . Shorter of primary lease term or 3 - 25 years

Equipment and fixtures ....... 2 - 10 years

Properties under capital leases . . Primary lease term or remaining primary lease term

Property and equipment are identified as assets held for sale when they meet the held-for-sale

criteria of Statement of Financial Accounting Standards (‘‘SFAS’’) No. 144, Accounting for Impairment

or Disposal of Long-lived Assets (‘‘SFAS 144’’). The Company ceases recording depreciation on assets

that are classified as held for sale.

The Company capitalizes interest on borrowings during the active construction period of major

capital projects. Capitalized interest is added to the cost of qualified assets and is amortized over the

estimated useful lives of the assets.

Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets which includes amortizable

intangible and tangible assets in accordance with SFAS 144. The Company tests impairment using

historical cash flows and other relevant facts and circumstances as the primary basis for our estimates

of future cash flows. The Company considers factors such as the number of years the restaurant has

been in operation, sales trends, cash flow trends, remaining lease life, and other factors which apply on

a case-by-case basis. The analysis is performed at the individual restaurant level for indicators of

permanent impairment.

Recoverability of a restaurant’s assets is measured by comparing the assets’ carrying value to the

undiscounted future cash flows expected to be generated over the assets’ remaining useful life or

remaining lease term, whichever is less. If the total expected undiscounted future cash flows are less

than the carrying amount of the assets, this may be an indicator of impairment. If it is decided that

there has been an impairment, the carrying amount of the asset is written down to the estimated fair

value. The fair value is determined by discounting the future cash flows based on our cost of capital. A

loss resulting from impairment is recognized by a charge against operations.

The Company may decide to close certain company-operated restaurants. Typically such decisions

are based on operating performance or strategic considerations. In these instances, the Company

reserves, or writes off, the full carrying value of these restaurants as impaired.

79