IHOP 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

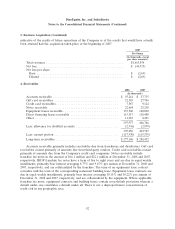

3. Business Acquisition (Continued)

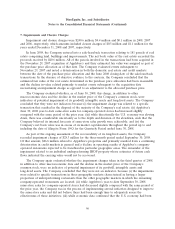

transaction value (including direct transaction costs and expenses) was approximately $2.0 billion. The

following table summarizes the components of the Applebee’s purchase price:

(In thousands)

Cash consideration ............................................. $1,948,093

Direct transaction costs ......................................... 16,444

Total purchase price ............................................ $1,964,537

The Company has accounted for the Applebee’s acquisition using the purchase method and,

accordingly, the results of operations related to this acquisition have been included in the consolidated

results of the Company since the acquisition date

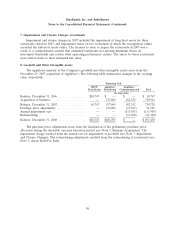

Purchase Price Allocation

The purchase price for this acquisition was allocated to tangible and intangible assets acquired and

liabilities assumed based on their estimated fair values at the acquisition date of November 29, 2007.

The following table presents the preliminary purchase allocation as estimated for the Company’s

Form 10-K for the Year ended December 31, 2007 and final purchase price allocation as adjusted

during the allowable allocation period:

Preliminary Final

Allocation Allocation

(In thousands)

Short term-investments ................................. $ 300 $ 300

Receivables .......................................... 47,117 46,922

Assets held for sale .................................... 15,192 4,084

Inventories .......................................... 13,396 13,311

Prepaid income taxes ................................... 2,184 2,184

Prepaid expenses ...................................... 40,790 40,844

Deferred income taxes (short-term) ........................ 11,648 20,128

Property and equipment ................................ 890,623 759,795

Tradename .......................................... 790,000 790,000

Franchise agreements .................................. 200,000 200,000

Goodwill ............................................ 719,961 811,508

Other intangible assets .................................. 22,589 21,267

Restricted assets related to captive insurance subsidiary .......... 10,863 10,863

Other assets ......................................... 11,889 4,812

Accounts payable ..................................... (30,165) (29,980)

Other accrued expenses ................................. (149,997) (143,963)

Capital lease obligations ................................ (3,747) (3,162)

Loss reserves related to captive insurance subsidiary ............ (4,422) (4,422)

Debt ............................................... (120,994) (120,994)

Deferred income taxes (long-term) ......................... (479,453) (432,966)

Other liabilities ....................................... (34,274) (37,031)

Net cash paid for acquisition ............................. $1,953,500 $1,953,500

90