IHOP 2008 Annual Report Download - page 72

Download and view the complete annual report

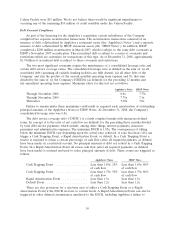

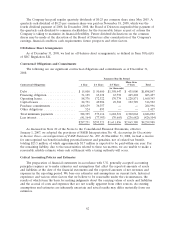

Please find page 72 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As described in Note 10 of Notes to the Consolidated Financial Statements, the Fixed Rate Notes

issued as part of the Applebee’s securitization transaction have a legal maturity of December 2037;

however, the Indenture under which the Notes were issued includes provisions which may accelerate

certain of the payment dates which, if not met, would require the Company to use operating funds to

begin to pay down the outstanding debt. The accelerated payment dates for the Applebee’s

securitization are as follows:

Class A-2-II-A Fixed Rate Term Senior Notes ...................... December 2012

Class A-2-II-X Fixed Rate Term Senior Notes ...................... December 2012

Class M-1 Fixed Rate Term Subordinated Notes ..................... December 2012

As of December 31, 2008, there was no acceleration of payment dates.

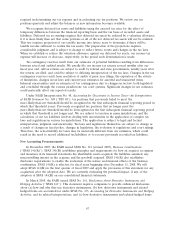

Another impact of the Applebee’s acquisition on our liquidity is the planned monetization of

certain Applebee’s assets. We are continuing to pursue a strategy which contemplates transitioning from

our current 80% franchised Applebee’s system to an approximately 98% franchised Applebee’s system,

similar to IHOP’s 99% franchised system. In order to accomplish this strategy, we plan to franchise

substantially all of the company-operated Applebee’s restaurants while retaining one company market

in Kansas City. This heavily franchised business model is expected to require less capital investment,

improve margins and reduce the volatility of cash flow performance over time, while also providing

cash proceeds from the franchising of the restaurants. If our strategy to transition to a 98% franchised

system is delayed or sales proceeds from franchising restaurants are less than anticipated, we believe

that the company-operated Applebee’s restaurants will continue to generate sufficient cash from

operations to meet our obligations, such that we will not be compelled to enter into refranchising

transactions at prices lower than we deem appropriate. Under the terms of the securitized debt

agreements, all of the proceeds of asset dispositions must be used to retire long-term debt.

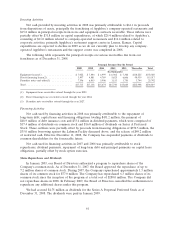

During 2008, we completed the following asset dispositions: a sale-leaseback transaction for the

real property on which 181 of the 199 fee-owned, company-operated Applebee’s restaurants are

situated, the sale of one additional fee-owned real estate parcel and a sale-leaseback transaction with

respect to Applebee’s corporate headquarters in Lenexa, Kansas. We received approximately

$378 million in proceeds from these transactions. During 2008, we also completed the franchising of

103 company-operated Applebee’s restaurants in the California, Nevada, Delaware and Texas markets.

We received after-tax proceeds of approximately $55.1 million from these transactions.

The proceeds from these transactions were used primarily to repay $350 million of Series 2007-1

Class A-2-I-X Fixed Rate Term Senior Notes, to repay portions of other long-term debt, to pay

transaction expenses (payment of which had been deferred) related to the acquisition of Applebee’s

and for general corporate purposes.

On February 24, 2009 we completed the franchising of five restaurants in the New Mexico market

and expect to recognize a gain of approximately $5.5 million on this transaction.

Applebee’s has a $100 million revolving credit facility, the Series 2007-1 Class A-1 Variable

Funding Senior Notes, committed to by Lehman Brothers Holdings Inc. (‘‘LBHI’’) (the ‘‘Lehman

Facility’’). LBHI filed for Chapter 11 bankruptcy protection on September 15, 2008. This bankruptcy

filing created uncertainty as to our ability to continue to access funds under the Lehman Facility. As a

result, in September 2008, the Company borrowed an additional $35 million under the Lehman Facility,

bringing our total borrowings to the maximum of $100 million, which amount was outstanding at

December 31, 2008. The $35 million has been used to purchase money market funds that are invested

in U.S. government securities. The money market funds are considered cash equivalents.

IHOP has a $25 million revolving credit facility, the Series 2007-2 Variable Funding Note,

committed to by Calyon Americas (the ‘‘Calyon Facility’’). At December 31, 2008, borrowings under the

58