IHOP 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

3. Business Acquisition (Continued)

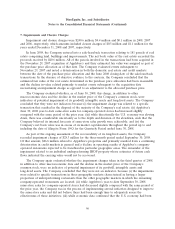

A significant portion of the fair value assigned to property and equipment in the preliminary

purchase price allocation was related to 510 Applebee’s company-operated restaurants. In the

preliminary purchase price allocation, the Company used assumptions as to rental data, capitalization

rates and obsolescence factors such as profitability, years in operation and lease holding period. The

assumptions used in the preliminary purchase price allocation were based on per-restaurant averages

that were applied to the entire portfolio of properties. Subsequently, the Company utilized these same

assumptions but with data specific to each individual restaurant and estimated a larger amount of

obsolescence. As a result, the fair value of property and equipment from the preliminary purchase price

valuation was revised downwards by approximately $133 million. Additionally, the data used to estimate

the capitalization rate in the preliminary allocation was based in part on industry data, the reporting of

which lagged the actual timing by several months. Once data on capitalization rates being utilized in

late November 2007 became available, the Company updated the capitalization rate assumptions

accordingly. As a result of this additional information on capitalization rates the estimated fair value of

property and equipment was revised downwards approximately $14 million. The corresponding offset to

these revisions was to goodwill, net of deferred taxes. The other adjustments to the preliminary

purchase price allocation were not significant, individually or in the aggregate.

The Company believes the fair value assigned to the assets acquired and liabilities assumed were

based on reasonable assumptions. Of the $811.5 million of goodwill, $124.8 million was assigned to

Applebee’s company-operated restaurant reporting unit and $686.7 million to Applebee’s franchise

reporting unit. The amount of goodwill allocated to the company unit was determined by comparing

the estimated sales value of the company restaurants with the carrying value (as of November 29, 2007)

of the company unit, with the excess allocated to the company unit as goodwill. The fair value was

based on a multiple of approximately six times the operating cash flow for the trailing twelve months of

the company unit. This multiple was supported by actual refranchising transactions negotiated within a

month after the acquisition. The remaining goodwill resulting from the final purchase price allocation

was assigned to the franchise unit. The goodwill resulting from this acquisition is not expected to be

deductible for tax purposes.

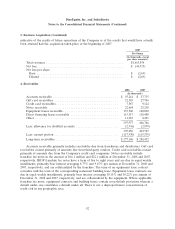

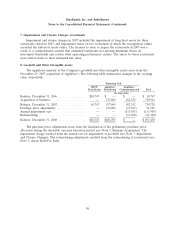

Pro Forma Results of Operations

The unaudited 2007 pro forma data of the Company set forth below gives effect to the Applebee’s

acquisition as if it had occurred at the beginning of 2007 and include (1) the amortization of other

comprehensive loss resulting from a swap the Company entered into in July 2007 to hedge the interest

payments on the securitization transactions which were entered into on November 29, 2007 to finance

the acquisition; (2) interest expense (including amortization) related to the securitization transactions

that took place during 2007; (3) additional depreciation and amortization expense related to the pro

forma stepped-up basis of assets acquired in the acquisition, and (4) reflects the tax effect resulting

from the pro forma adjustments based on an assumed effective annual tax rate of 39.5%. This pro

forma data is presented for informational comparison with 2008 only and does not purport to be

91