IHOP 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Liabilities—Including an amendment of FASB Statement No. 115 (‘‘SFAS 159’’). SFAS 159 expands the

use of fair value accounting but does not affect existing standards which requires assets or liabilities to

be carried at fair value. The objective of SFAS 159 is to improve financial reporting by providing

companies with the opportunity to mitigate volatility in reported earnings caused by measuring related

assets and liabilities differently without having to apply complex hedge accounting provisions. Under

SFAS 159, a company may elect to use fair value to measure eligible items at specified election dates

and report unrealized gains and losses on items for which the fair value option has been elected in

earnings at each subsequent reporting date. Eligible items include, but are not limited to, accounts and

loans receivable, available-for-sale and held-to-maturity securities, equity method investments, accounts

payable, guarantees, issued debt and firm commitments. On January 1, 2008, the Company adopted

SFAS 159 and has not elected to use fair value measurement on any assets or liabilities under this

statement.

In May 2008, the FASB issued SFAS No. 162, Hierarchy of Generally Accepted Accounting

Principles (‘‘SFAS 162’’). This statement is intended to improve financial reporting by identifying a

consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial

statements of nongovernmental entities that are presented in conformity with U.S. GAAP. While this

statement formalizes the sources and hierarchy of U.S. GAAP within the authoritative accounting

literature, it does not change the accounting principles that are already in place. This statement was

effective on November 15, 2008 and did not have a material impact on our Consolidated Financial

Statements.

In June 2007, the EITF reached consensus on Issue No. 06-11, Accounting for Income Tax Benefits

of Dividends on Share-Based Payment Awards (‘‘EITF 06-11’’). EITF 06-11 requires that the tax benefit

related to dividend equivalents paid on restricted stock units which are expected to vest be recorded as

an increase to additional paid-in capital. The impact of adopting EITF 06-11 in 2008 did not have a

material impact on the consolidated financial statements.

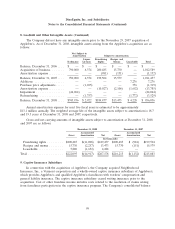

3. Business Acquisition

On November 29, 2007, the Company completed the acquisition of Applebee’s, a global dining

company that develops, franchises and operates restaurants under the Applebee’s Neighborhood

Grill & Bar brand. The Applebee’s acquisition was completed pursuant to the Agreement and Plan of

Merger, dated as of July 15, 2007 (the ‘‘Merger Agreement’’), among the Company, its wholly-owned

subsidiary CHLH Corp. (‘‘Merger Sub’’), and Applebee’s. Pursuant to the terms of the Merger

Agreement, Merger Sub merged with and into Applebee’s (the ‘‘Merger’’), with Applebee’s continuing

as the surviving corporation and becoming a wholly-owned subsidiary of the Company.

Pursuant to the Merger Agreement, each share of common stock of Applebee’s, par value $0.01

per share, issued and outstanding immediately prior to the effective time of the Merger (other than

treasury shares, shares held by IHOP, Merger Sub or any subsidiary of Applebee’s, and shares with

respect to which appraisal rights are perfected in accordance with Section 262 of the Delaware General

Corporation Law) was converted into the right to receive $25.50 in cash, without interest. The total

89